Since the COVID-19 outbreak, the Newark Airport Hotel market has undergone significant changes. The changes in the submarket hotel supply and the increase in passengers through Newark Airport have led to a slow, but steady, recovery in the hotel market. Newark Airport has recently completed and will soon complete expansion projects that support the positive outlook.

The changing hotel landscape

As passenger traffic levels at Newark Liberty International Airport The hotel demand in the airport submarket was also significantly reduced at the beginning of the COVID-19 epidemic. This allowed assets that were at a plateau in terms of ADR, or nearing the brand-mandated PIP (Property Improvement Program) renovations, to embark on significant renovation projects. The Hampton by Hilton on Spring Street directly west of U.S. Route 1-9 was renovated and converted into a Holiday Inn Express In April 2021. The former Holiday Inn was also located directly West of U.S. Route 1-9 and renovated into a Hampton by Hilton in May 2022. Lastly, the former Country Inn & Suites, located southeast of Newark Airport and adjacent to The Mills at Jersey GardensThe house was converted into a Hampton by Hilton In December 2022. Also, it is worth noting that the Home2 Suites by Hilton In January 2019, a new submarket opened, while an existing one remained closed. Comfort Inn & Suites Opened in November 20, 2023, the hotel will add almost 15% to the available rooms.

Hotel Submarket Recovery

The Newark Airport submarket has experienced a strong recovery despite the modest increase in hotel supply. Renovations of several assets, as well as the increased passenger traffic, have all contributed to the slow but steady growth. Hotel occupancy in the airport hotel market is expected to rebound to 78% by year-end 2023. STR. This is a slight drop from the peak of occupancy pre-pandemic, which was around 84%. The occupancy data for 2024 show further improvements, but still lag behind the pre-pandemic level. The market occupancy hasn’t fully recovered but the ADR trend has been very different. ADR in this Newark Airport submarket exceeded its pre-pandemic high in 2022, and then increased by almost 10% in 2023. ADR growth declined significantly in 2024. However, it remained positive. ADR growth was significant in 2024, resulting in RevPAR levels roughly $15 higher than the peak before the pandemic.

A number of factors are responsible for the slow recovery in occupancy, including an increase in hotel supply. Another issue is the permanent change in office dynamics, due to remote-work policies and trends. Moreover, due to this continuing of remote work policies, training groups of nearby companies, and other corporate-group sources have lagged behind in returning the market. New York City’s strong leisure tourism has compensated for the slow recovery in commercial and group travel.

Market RevPAR Analysis

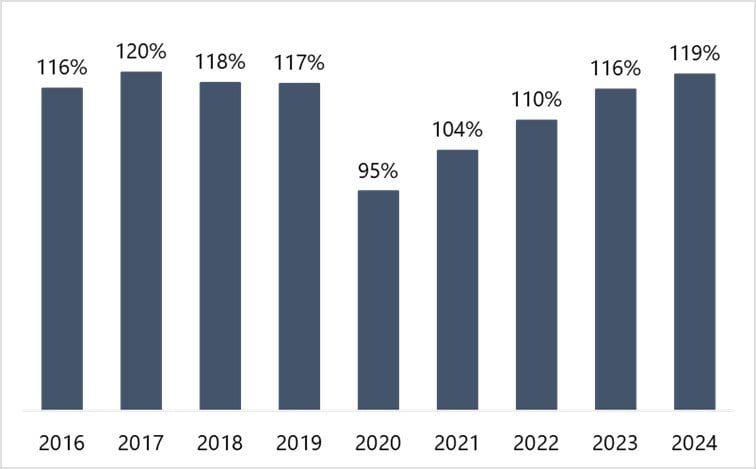

The comparison between the Newark RevPAR and the national average reveals the magnitude of the demand decline at the start of the COVID-19 epidemic, as well the current state of recovery of the airport’s submarket. Newark’s RevPAR was historically higher than the national average. However, the metro area has suffered more losses and is recovering slower. According to STR, despite demand growth and ADR gains, RevPAR has improved through 2024. It registered a 119% rate of penetration compared to national RevPAR. This level is just below the peak pre-pandemic of 120%. There is still room for improvement.

Newark Airport Upgrades

The performance of the Newark Airport hotel submarket is directly tied to the levels of passenger traffic through the airport, which surpassed pre-pandemic levels in 2023. According to airport officials, passenger traffic remained relatively stable in 2024 but decreased by 3.0% in February 2025 and 1.6% in March 2025. The recent minor decreases are a result of economic uncertainty regarding the tariffs instituted by the federal government, which has led to a decline in both international and domestic travel. The upgrading of the airport’s facilities is an important component in maintaining consistent growth in passenger traffic levels.

Newark Airport has undergone a variety of upgrades over the last decade. Most recently, the Terminal A Redevelopment Program The project was completed by early 2023, and the terminal became fully operational on August 20, 2023. The $2.7-billion, one-million-square-foot Terminal A is LEED Gold-certified and features 33 new gates, improved airside and landside infrastructure, and various state-of-the-art passenger amenities.

Projects that are ongoing as part of the EWR Vision Plan Included in the plans are the construction of the new AirTrain and the plans to renovate Terminal B and improve the existing Terminal C.

- After years of discussion and planning, the plans for the AirTrain Newark Replacement Program In August 2023, they were announced. The new AirTrain will connect the airport terminals, car rental facilities, hotel shuttle areas, and RailLink stations (where NJ Transit The following are some examples of how to get started: Amtrak Rail lines will be located. The AirTrain will be operational by 2029, at a cost of approximately $570 million.

- In October 2024, the Terminal B redevelopment project and Terminal C enhancement project were announced. A timeline has yet to be established. The Port Authority of New York and New Jersey These projects are expected to support the growth of passenger traffic for years to come.

The Terminal A expansion has allowed for increased passenger traffic. Terminal B, Terminal C and the anticipated Terminal B projects will also allow for more growth. AirTrain construction will improve travel efficiency to the airport as well access to the submarket hotels. The local hotels should benefit from the construction demand that will occur as these upgrades take place, and also increased visitor numbers once completed.

Market Outlook

Newark Airport’s occupancy hasn’t yet recovered to its pre-pandemic level, but ADR growth in recent years has been strong, leading to a RevPAR market in 2024 that is significantly higher than the peak before the pandemic. There are also no new hotels planned or under construction in the airport submarket. This should help to prevent any major disruptions.

The hotel supply has decreased significantly in the greater New York City area since the COVID-19 outbreak. Many hotels in Manhattan, the outer boroughs, and other areas have been closed permanently, or converted to temporary housing. This has created a greater potential for overflow demand, especially during times of high activity. The new federal policies are expected to lead to a decline in tourism and travel nationwide by 2025. However, it is still unclear how this will impact the Newark market. The outlook for the Newark Airport Hotel Market is positive at this time, given the high passenger traffic at Newark Liberty International Airport and the recent upgrades to the airport.

HVS transforms data into powerful insight that drives your success. Our unique method involves primary interviews in local markets to capture real-time data and insights. It gives you an edge in the market because we have a thorough understanding of it. HVS partners with you to provide you the most up-to-date data. This allows you to unlock the local dynamics, allowing you to make strategic, confident decisions. Contact us for comprehensive information on the Newark Market or to receive assistance in making investments that are aligned with your goals and risk tolerance. Cole Masler.

HVS

HVS is the world’s largest consulting and services organisation focusing on hotel, mixed use, shared ownership, gambling, and leisure. HVS was established in 1980. The company completes more than 4,500 assignments per year for hotel owners, real estate operators, investors and developers. HVS’s principals are considered the foremost experts in each region of the world. HVS offers a wide range of complementary services to the hospitality industry through a network of 60 offices with more than 300 professionals. hvs.com.

Cole Masler

Manager in New York

HVS