Hospitality and leisure (H&L) dealmakers began 2025 with cautious optimism, but continued volatility in capital markets and trade policy has forced a reassessment of growth strategies. While the volume of large, transformative deals remains subdued, targeted M&A is providing operators with opportunities to adapt portfolios, sharpen strategic focus and scale digital capabilities. The current market conditions present an opportunity to acquire assets with favorable terms for buyers who are well-capitalized.

- Sector deal volumes are being tempered by high borrowing costs, valuation mismatches, and policy uncertainty. Market participants who have strong balance sheets, and a disciplined approach to capital allocation, however, will be well-positioned.

- Cross-border activities are complicated by trade and tariff uncertainty. Domestic-focused and service-oriented H&L operators remain better positioned for dealmaking.

- Shifting sentiment around global travel may prompt H&L operators to strengthen their US portfolios, with strategic dealmaking offering a potential fast track to stay ahead of emerging trends.

- After several years of investor excitement fueled by legalized online real-money gambling, traditional casinos and gaming operators reassess their long-term strategies. As the pace of new market growth slows and shareholder activism increases, the gaming industry may experience a wave accelerated consolidations and strategic divestitures.

- Divestments are becoming a more important tool for portfolio optimization, especially for brands that are reassessing their market exposure, demographic focus, and asset-light strategy. For H&L operators, this presents an opportunity to revisit which brands, geographies and customer segments offer the greatest potential — and to use M&A as a catalyst for accelerated realignment.

- Operators are doubling down on experience-driven growth, using M&A to enter luxury, lifestyle and bespoke travel segments catering to high-income consumers, particularly as the upper end of the income curve continues to drive overall consumer consumption growth in the United States.

- Technology is a priority. Acquisitions and partnerships have accelerated the shift from digital-first to AI-powered tech stacks.

- Three of the largest deals by value in H&L in 2024 were private equity (PE) buyers acquiring gaming operators at attractive valuations. While PE remains cautious in the first half of 2025, ongoing stock market volatility could present unique opportunities for financial buyers to re-enter the market and meaningfully move the needle on M&A activity across the H&L sector.

Note: The source used in the 2025 midyear outlook is S&P Global Market Intelligence.

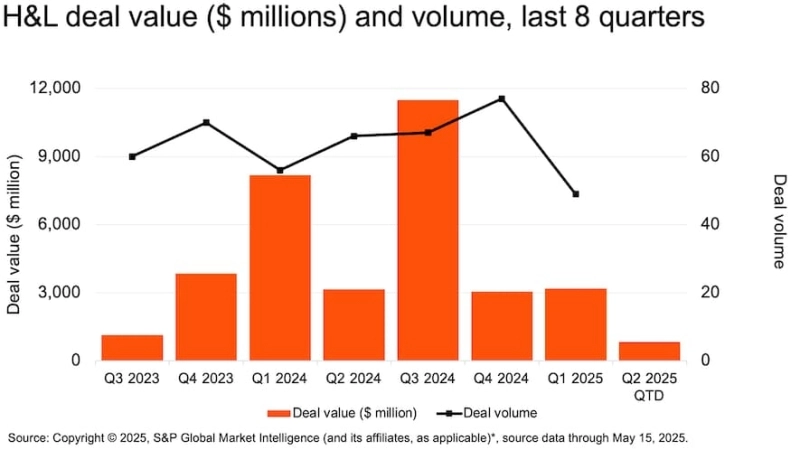

Year-to-date, PE-sponsored H&L deals have declined 85% YoY, from 43% of total deal value YTD 2024 to 7% YTD 2025, indicating that financial buyers have largely stayed on the sideline, while strategic players remained active for strong assets.

Looking forward

Despite persistent economic uncertainty, H&L operators and investors should remain alert to emerging value plays. As a result of prolonged volatility, distressed and underperforming assets could be brought to the market. At the same time, resilient demand for high-end travel and the imperative for digital transformation are reinforcing selective capital deployment priorities — particularly those aimed at driving operational efficiency and long-term value creation.

- Watch for clarity on interest rate policy and trade developments — both will shape valuation confidence, transaction pacing and ultimately consumer sentiment toward travel.

- Continue targeting experience-led assets that appeal to high-spending, digitally native consumers — customer segments that support long-term revenue durability and growth potential.

- Joint ventures and strategic partnerships can be leveraged to reduce the risk of tech innovation. This includes everything from AI-enabled engagement with customers to cybersecurity and automated operations.

- Use M&A as an active strategy to reshape the brand portfolio for resilience; scalability has the potential for higher long-term returns or profit enhancing strategies versus traditional footprint expansion.

“Forward-looking dealmakers are using this period to position for long-term value — not just through acquisitions, but through strategic focus and transformation.” Jonathan Shing,US Hospitality & Leisure Deals Leader

As the M&A landscape evolves in 2025, three priorities stand out for hospitality and leisure leaders: 1) staying agile amid uncertainty, 2) treating M&A and divestitures as strategic tools, and 3) building digital and experiential capabilities. Operators with a balanced sheet strategy that is disciplined and a portfolio thesis that is clear should be well positioned to capture the emerging value of a reshaped marketplace.