All figures are in U.S. dollars constant currency.

Highlights

- RevPAR in the United States has decreased for a fourth consecutive week.

- U.S. ADR is down as well as demand

- Global occupancy of rooms is up to a record high in 2025 but down for the fifth week running

- Japan, highlighted by Osaka as the leader in growth

- Canada’s momentum continues

RevPAR declines in three major markets are amplified

In the U.S., hoteliers reported a further significant decline in revenue per available room. This was only a small improvement over the previous week when revenue per available room (RevPAR) was down by 3.7%.

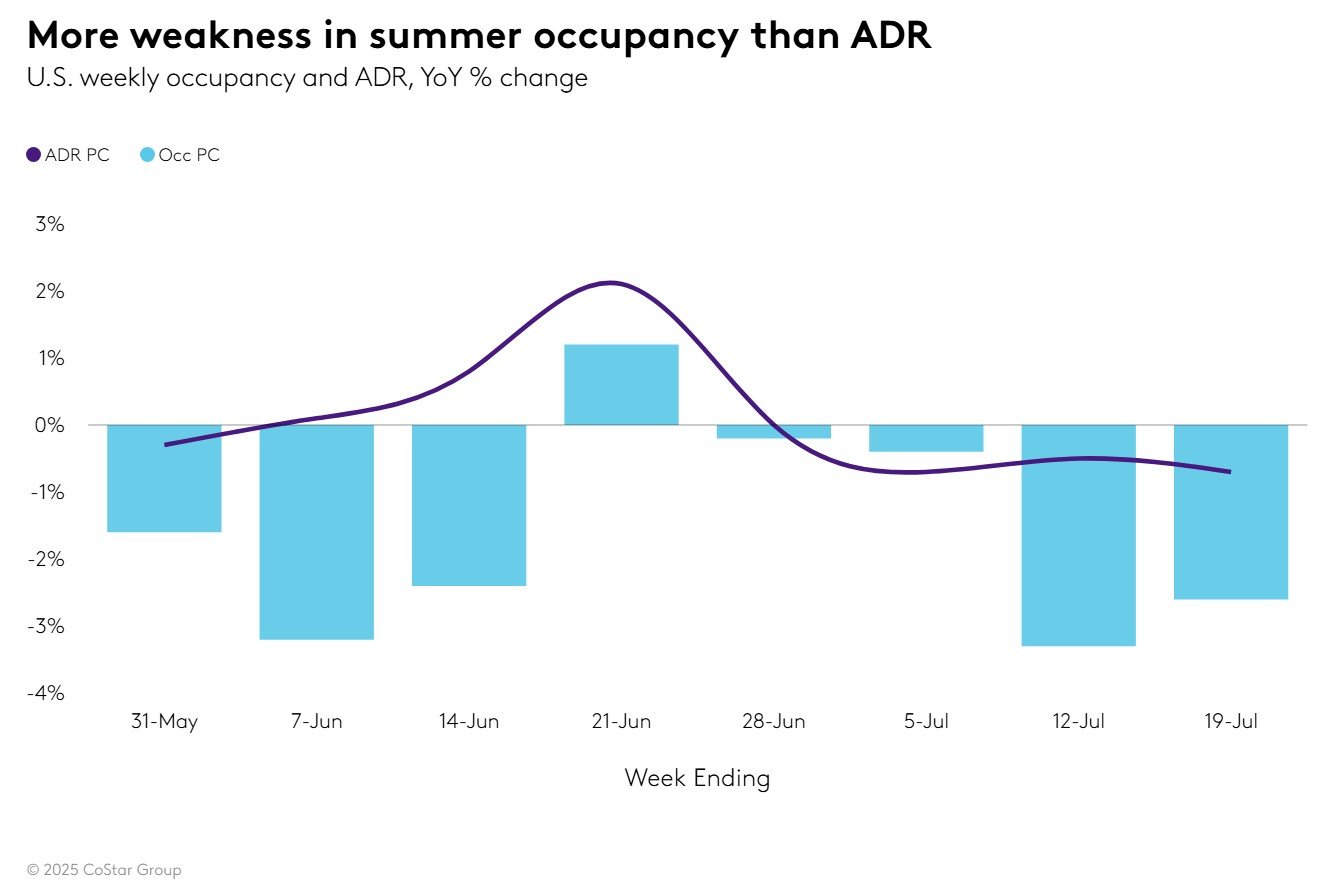

The RevPAR decreased primarily due to a decline in room demand (-1,8%), but the average daily rate (ADR), which was also down 0.7%. Weekly occupancy (71.6%) is 1.9 percentage points lower than last year, despite an increase in room supply of only 0.8%.

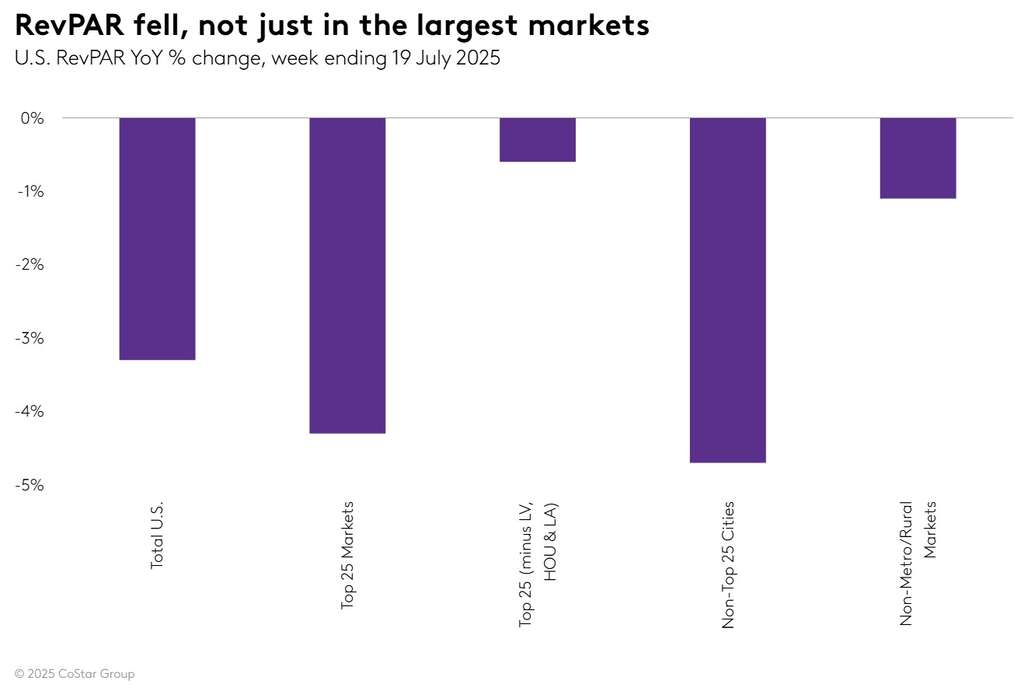

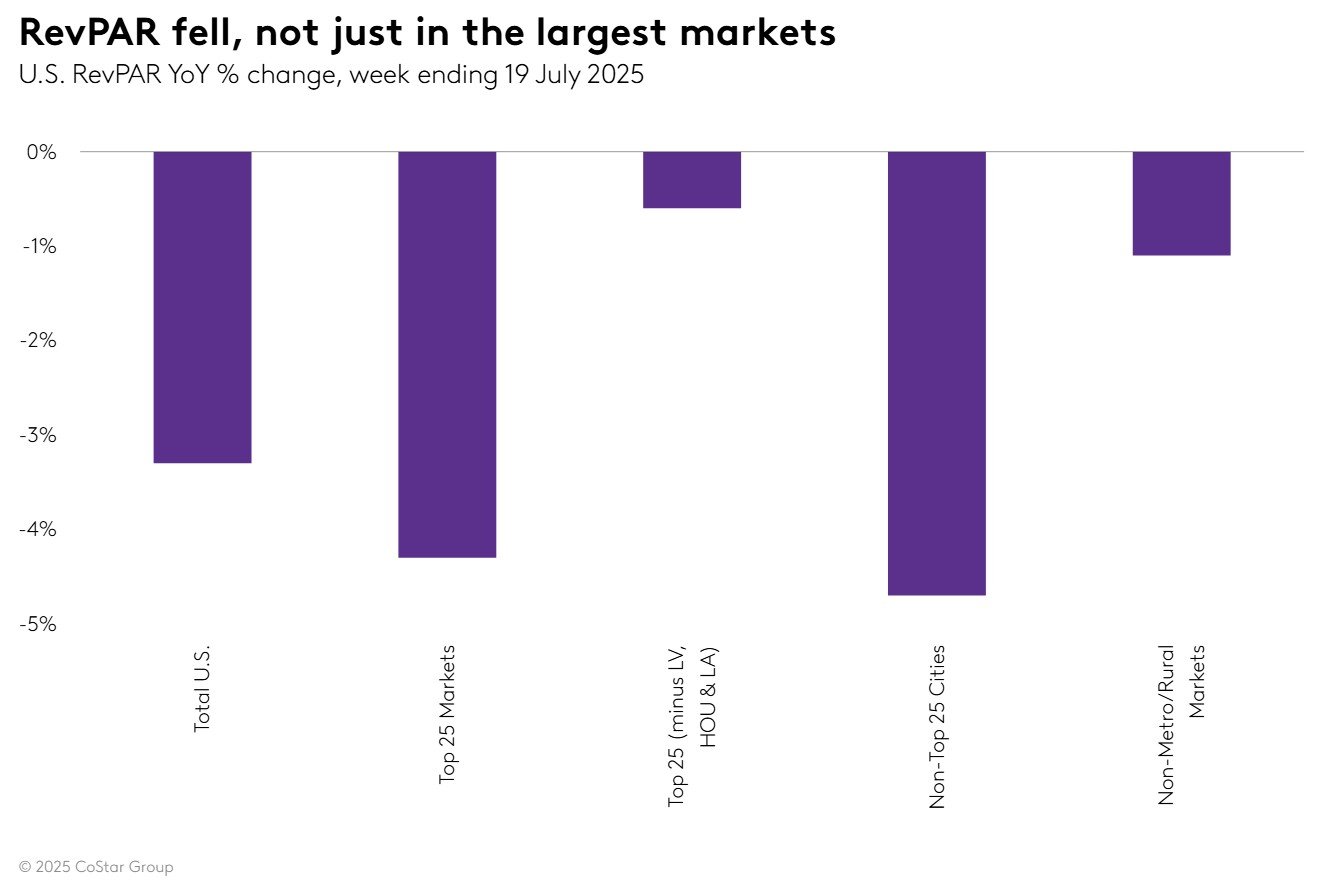

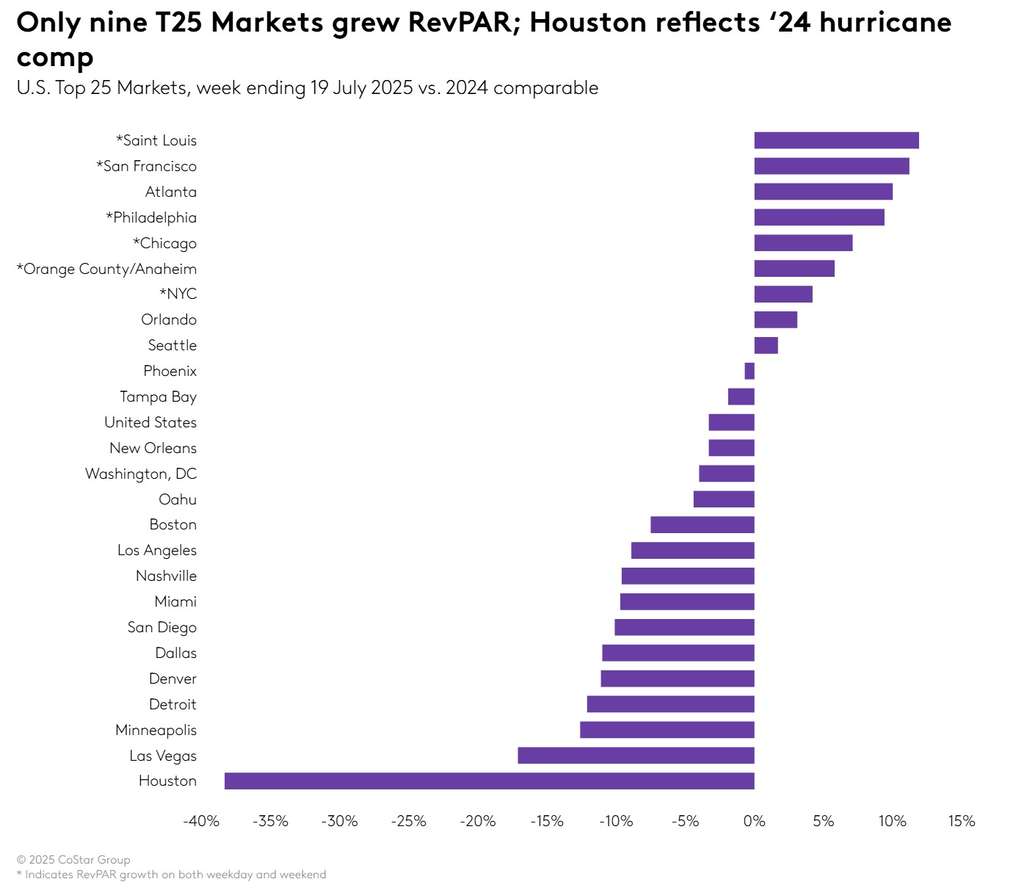

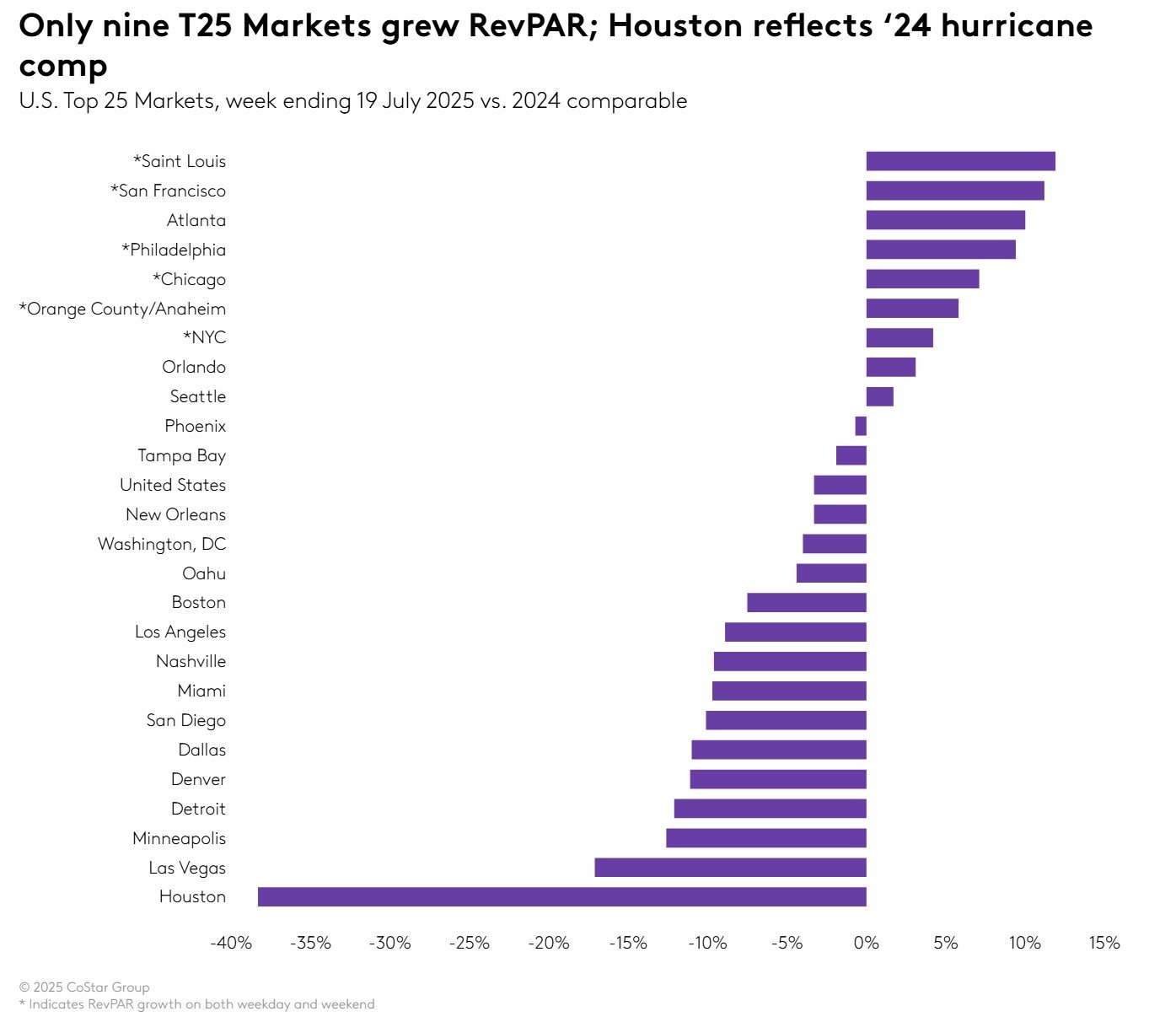

The largest RevPAR declines occurred in metro markets, both the Top 25 Markets (-4.3%) and metro markets outside the Top 25 (-4.7%). Three markets had a significant negative impact on the Top 25 Market results:

- Las Vegas RevPAR fell 17.1% on declining demand. As noted in previous weeks, we attribute Vegas’ performance to declining international arrivals, calendar shifts in groups and meetings, and economic impacts on middle to lower income households.

- Houston (-38.3%) saw tough comps because of the displacement demand from Hurricane Beryl last year and the “Derecho” earlier in that year.

- Los Angeles (-8.9%), and particularly Los Angeles CBD (-17.8%), saw both demand and ADR drop amid heightened tensions in the market.

Excluding these three markets, U.S. RevPAR would still have been down but by a lesser amount (-1.9%). Total U.S. ADR without Houston, Las Vegas and Los Angeles was still weak (-0.2%) and well below the rate of inflation. In the Top 25 Markets, RevPAR was somewhat flat (-0.6%) when excluding those markets and ADR was up 1.0%.

Metro markets (STR markets aligned with cities versus large rural areas) outside the Top 25 saw the largest RevPAR decline (-4.7%) with the largest ADR decrease (-2.8%). The more dispersed non-metro/rural markets also saw decreases (-1.1%) due almost entirely to occupancy (-1.0ppts).

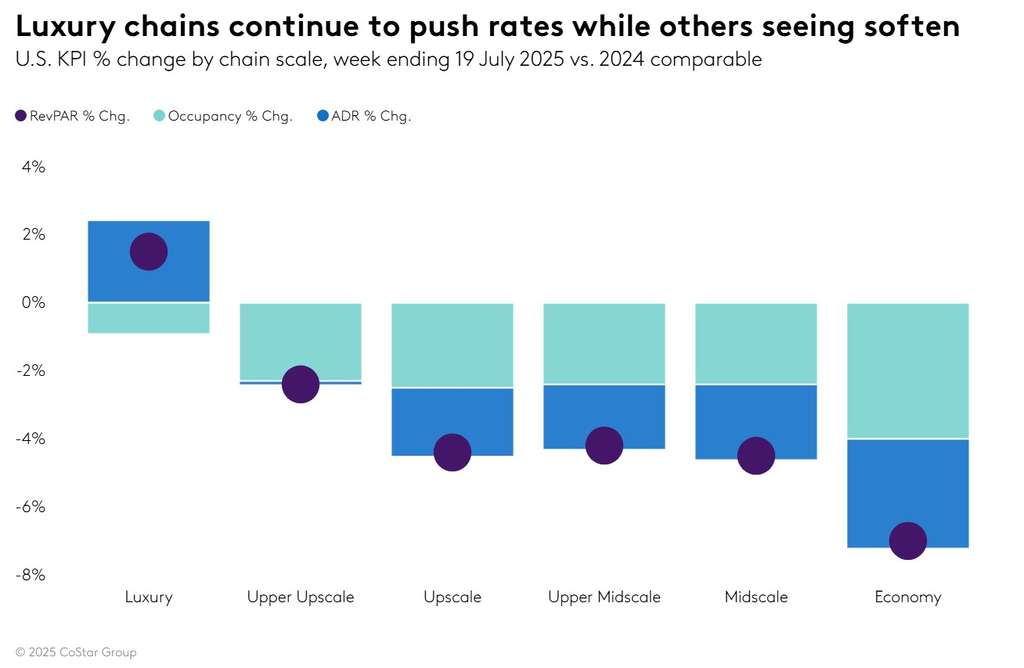

Since Memorial Day weekend, summer demand is down 1.6 million room nights (-0.7%) year over year and ADR is flat (+0.1%). Among the chain scales, only Luxury has seen RevPAR grow, but demand has been up in all scales except Economy and Independents. However, due to supply gains, summer occupancy is down in all chain scales.

The weekend was ‘less bad’ than the weekdays

Among the day parts, weekend RevPAR was down 2.5%, mostly because of the Top 25 markets. Outside of the Top 25, RevPAR was down 0.9%. Weekdays (Monday-Wednesday) and Shoulder days (Sunday & Thursday) saw RevPAR fall by more than 3%, mostly on falling occupancy with flat-to-down ADR, driven by the Top 25 Markets.

Excluding Houston, Las Vegas and Los Angeles, the remaining Top 25 Markets saw flat weekday RevPAR (+0.1%) on rising ADR. However, weekday RevPAR outside the Top 25 Markets was weak (-3.5%).

Luxury chains were again the bright spot

Luxury chains continued their positive trajectory with RevPAR increasing 1.5%, driven by a 2.2% ADR gain. The segment’s negative occupancy comp in recent weeks is best understood within the context of its rapidly increasing room supply, which has grown by a substantial 5.3% YOY. A healthy yet lower rate of Luxury room demand (+4.0%) also factors into the decreased occupancy. In other words, less than stellar occupancy growth within this segment is not a current concern.

The pendulum appears to have swung in an opposite direction for mid- to lower end chains and most acutely for Economy chains. As you may recall, Economy hotels weathered the pandemic with relative strength while Luxury saw sharp declines. On the flip side, this most recent week had Economy chains’ RevPAR dropping 7%. Declines are evenly spread between occupancy (-4.0%) and ADR (-3.2%). General conditions among Economy might be even less favorable than topline indicators given that the total supply to this scale has retracted by 0.9% year over year, which would typically be a catalyst for the core indicators.

Highest occupancy of the year with summer in full swing across most of the globe

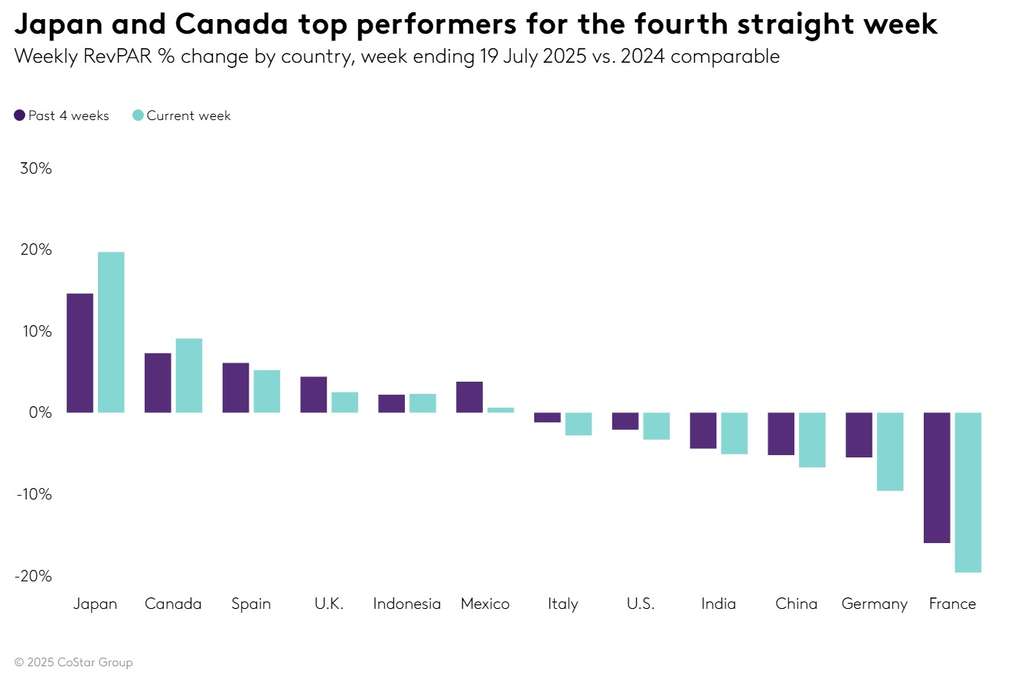

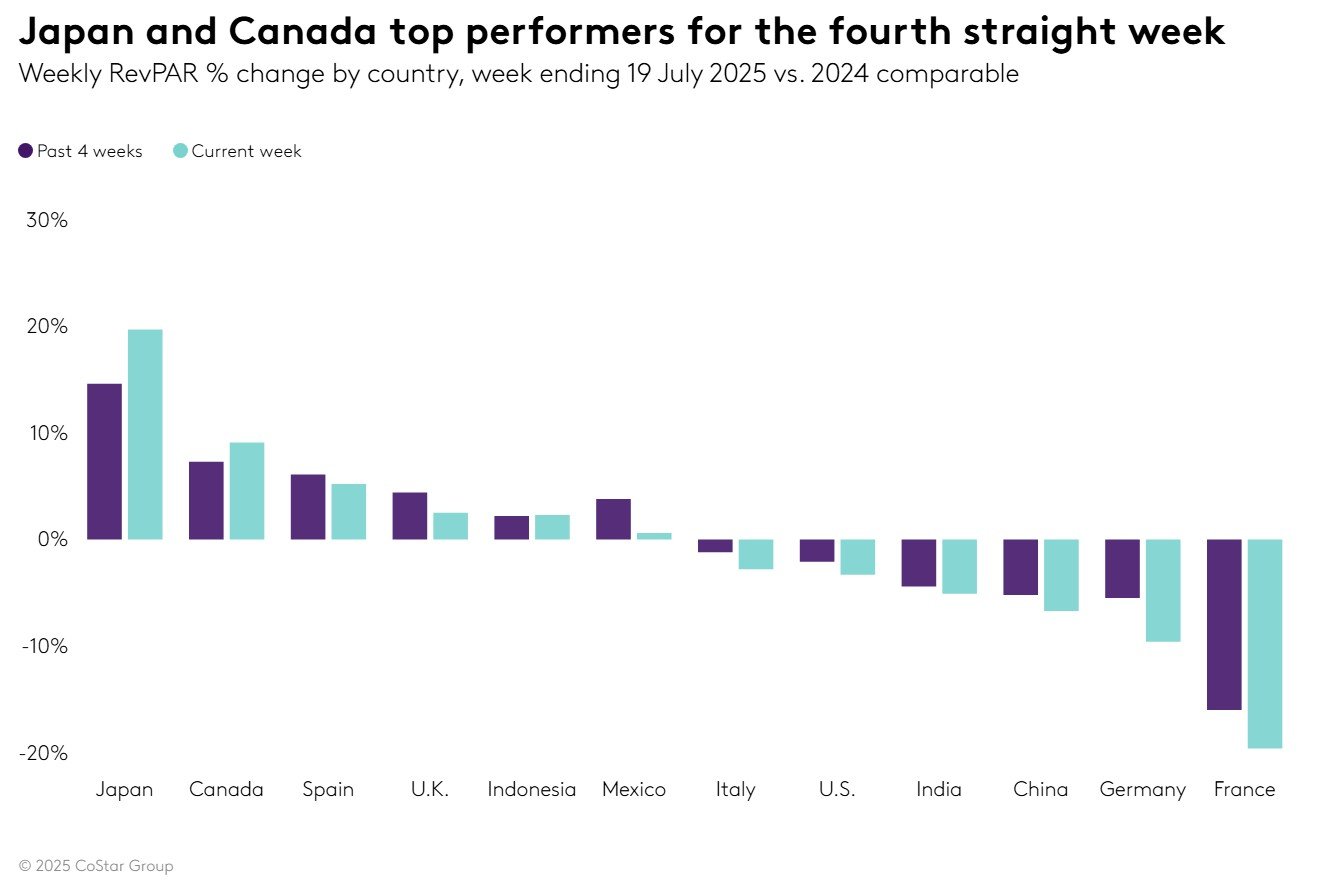

Global RevPAR (excluding the U.S.) has increased for the past three weeks with a 0.5% increase in the most recent week, lifted entirely by ADR. ADR has been the primary driver of RevPAR over most weeks this year. Occupancy fell 1.3 ppts below last year, but at 72.2%, it was the highest level recorded this year. Occupancy has decreased for the past five weeks. The top countries for the past four weeks include:

- Japan maintained its top RevPAR position, as it has all year. Occupancy has slowed over the past three weeks, but ADR continues to rise. Osaka, host of EXPO 2025, led Japan in RevPAR in the most recent week and has posted the greatest gains of any market in the country almost every week since the start of the mega event in mid-April. All markets in Japan experienced RevPAR gains.

- Canada posted the second highest RevPAR gain for the second consecutive week. Ten of Canada’s 22 markets posted double-digit RevPAR, lifted equally by both ADR and occupancy, reflecting a true increase in travel.

- RevPAR in Spain advanced over 5% for the third consecutive week with the greatest lift coming from the Canary Islands in the south and the Balearic Islands in the northeast. Barcelona and Madrid, Spain’s largest urban markets, have seen negative RevPAR comps over the past two weeks.

- The U.K. experienced another strong week with RevPAR rising in markets across the country. Four of the five largest markets increased RevPAR, led by Manchester, which increased 25.8%. Northern Ireland was the top performing market across the country as host of the 153rd Open Championship golf tournament.

France and Germany have experienced declines over the past four weeks due to sporting event calendar shifts from last year. China’s RevPAR declined 6.7%. Among the four top-tier cities, Beijing and Guangzhou saw double-digit declines while dips in Shanghai and Shenzhen were more modest (less than 3%).

Looking Ahead

U.S. hotels over these past weeks demonstrated softer than expected performance. We are seeing a mix of both positive/negative signals. As we have recently seen with Houston, interpretations of national/market-level performance against prior year will become a bit more nuanced now through the end of year, especially in September (Hurricane Helene) and October (Hurricane Milton) as we recognize that YOY indicators will run into tough comparisons as those disasters impacted multiple markets. We also recognize the occurrence of sociopolitical headwinds that have recently reduced demand to select markets for the short term.

Along those lines, we cannot find any reason to disagree with American airlines CEO Robert B. Isom’s recent statement that July will be the low point and that performance will improve sequentially each month in the quarter …and demand strengthens.

About CoStar Group, Inc.

CoStar Group (NASDAQ: CSGP) is a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar Group conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of real estate information. CoStar is the global leader in commercial real estate information, analytics, and news, enabling clients to analyze, interpret and gain unmatched insight on property values, market conditions and availabilities. Apartments.com is the leading online marketplace for renters seeking great apartment homes, providing property managers and owners a proven platform for marketing their properties. LoopNet is the most heavily trafficked online commercial real estate marketplace with thirteen million average monthly global unique visitors. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X offers a leading platform for conducting commercial real estate online auctions and negotiated bids. Homes.com is the fastest growing online residential marketplace that connects agents, buyers, and sellers. OnTheMarket is a leading residential property portal in the United Kingdom. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. Thomas Daily is Germany’s largest online data pool in the real estate industry. Belbex is the premier source of commercial space available to let and for sale in Spain. CoStar Group’s websites attracted over 163 million average monthly unique visitors in the third quarter of 2024. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information. For more information, visit CoStarGroup.com.

This news release contains “forward-looking” statements, including statements about CoStar’s beliefs or expectations regarding the future. These statements are made based on current opinions and are subjected to many uncertainties and risks that could cause the actual results to be materially different from these statements. These differences could be caused or contributed to by a number of factors including the possibility that future media events may not result in an increase in occupancy rates. CoStar has provided additional information regarding potential factors which could lead to results differing materially from the ones anticipated in the forward looking statements. This includes, but is not limited to the filings that CoStar makes with the Securities and Exchange Commission from time to time, such as the Annual Report on Form 10K for the year ending December 31, 2023 and in Forms 10Q for the quarters ended March 31, 2020, June 30, 2030, and September 30 2023. CoStar’s forward-looking statement are based solely on information that was available at the time of this publication. CoStar is not obligated to update any forward-looking statement, whether in response to new information, future events, or otherwise.