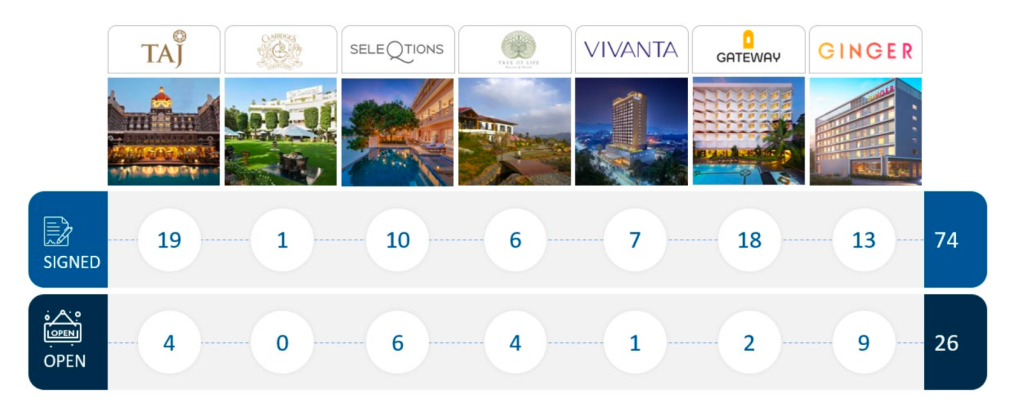

Indian Hotels Company Limited, the parent company of Taj Hotels, announced on Tuesday it had increased its hotel portfolio by 100 hotels. These include 74 new signings and 26 new openings.

According to its Accelerate 2030 plan, the company plans to increase its portfolio of hotels to 700 by 2030.

Last week’s spate of announcements, including from Accor, Radisson, IHG, Hyatt, Ascott and Marriott, are the latest illustration of the race for global hotel brands to stake their claim in India.

IHCL signed a record number of 74 contracts in its last fiscal year (ending March 31) (2024-2025). This resulted in a leading pipeline of 137 hotels, said Suma Venkatesh, executive vice president — real estate and development, IHCL.

A significant share of the signings were in Gateway Venkatesh explained that Ginger and Vivanta brands were a reflection of India’s rapidly growing midscale and upscale segments. Vivanta and Ginger both grew their portfolios to more than 50 hotels during this period.

The company has also increased its presence internationally by adding more than 800 keys to the Middle Eastern market of Bahrain and Ras Al-Khaimah in the UAE.

Last Quarter Reported for IHCL

Its quarterly results for the period The company’s EBITDA will surpass 10 billion INR ($117 million) by the end of December 2024 for the very first time. This performance was fueled by a 29% increase in revenue, and a record profit of INR 5,8 billion ($68 millions).

The company noted that RevPAR was 78% more expensive than the average for the Indian hospitality industry.

IHCL CEO, Puneet Chhatwal, said during the last earnings call that he expects the fourth quarter to show similar growth in top-line numbers and other metrics: “We are confident of definitely delivering on the double-digit growth that we have promised and guided the market on from the previous year,” Chhatwal said in January.

The results of the fourth quarter will be released later this month.

The Re-invention of Ginger Hotels

IHCL has a transformation plan that includes the reinvention and repositioning of its Ginger brand. Ginger, formerly known as a budget brand, has been upgraded to target more premium customers.

Service upgrades, a brand-new all-day dining concept and renovations at its properties are part of the evolution. These changes have increased occupancy rates and management views Ginger as the key driver for future growth.

Chhatwal stated that Ginger, in its new form, has only existed for a couple of years. He remembered that Covid was a hit eight to nine months after the opening of the first Ginger hotel.

Chhatwal is expecting Ginger to continue performing well, even though the properties are in different stages of renovation.

“Definitely after Taj, our second most important brand in the next few years to watch… will be the Ginger brand,” he said.

Building Loyalty and Repeat Business

IHCL also places importance on customer retention and loyalty as part of its growth strategy. Tata’s Neu loyalty platform is a great benefit to IHCL.

Loyalty now accounts for 40% of enterprise revenue.

This focus on loyalty for a brand such as Ginger is important, since it generates a lot more repeat business.

Chhatwal stated that it took 17 years for the Taj Inner Circle loyalty program to reach 2,000,000 members. However, after joining Tata Neu the loyalty base increased by four times in just four years.

IHCL’s digital initiative has allowed it to better use customer data in order to attract large events and increase repeat business, such as Delhi or Mumbai. IHCL is expecting the loyalty program to exceed 10 million members, Chhatwal stated.

Accommodations Stock Index Performance from Year to Date

What am i looking at? The performance and stock prices of the hotels and short term rental sector within the ST200. The index includes publicly traded companies across global markets. This includes international and regional hotel brands as well as hotel REITs and hotel management companies.

The Skift Travel 200 Combining the financial performance from nearly 200 travel agencies worth more than one trillion dollars in a single number. See more hotels and short-term rental financial sector performance.

Read the full methodology behind the Skift Travel 200.

Bangkok hosts the top travel event.

May 14-15 2025 BANGKOK