This report compares the cost of construction for hotels across different classes. The research includes a compilation, which shows actual hotel budgets and development costs, as well as a total cost per product/room.

INTRODUCTION

The lodging industry has shown resilience by maintaining high average daily rates (ADRs) and revenue per room (RevPARs) in 2025 despite flat occupancy. ADR and RevPAR remained at near-record levels compared to 2023 and 20, despite some leisure markets stabilizing or softening. The national occupancy rate remained the same as in 2023. However, hotel revenues grew modestly from year to year. These trends indicate a market which has stabilised following the pandemic disruptions. The high cost of capital and debt, combined with the elevated costs of construction, continue to be a major factor in new hotel development. The underlying performance climate remains favorable in theory but actual construction is subdued. In fact, the growth of supply forecast for 2025 is well below the pre-pandemic levels.

Developers continue to encounter barriers to bring new projects to the market, despite strong performance in top-line hotels. Construction costs have increased and financing has become more expensive, which has slowed down the number of projects. Lenders are cautious about new construction. They often require more equity, and apply conservative underwriting standards. In the end, even though operational fundamentals are in favor of new supply, development activity has remained muted because stakeholders have been waiting for more clarity in the economic and capital markets.

HVS has been tracking hotel development costs since the 1970s, when we began collecting data on actual hotel budgets. HVS compiled data from projects that were proposed or in construction for the calendar year 2024 to calculate hotel development costs per room. The data reflects six product categories including: full-service and luxury hotels.

You can also find out more about the following: HVS U.S. Hotel Development Cost Survey The survey provides average costs of each lodging product. The survey does not aim to provide a comparison tool to determine year-toyear changes. Instead, it represents the cost to build hotels in America by 2024. As we will discuss, the medians & averages of this survey are heavily affected by the type and location of hotels that are being developed in this phase of the economic cycle. This publication was created to help developers, investors and consultants evaluate hotel projects. As the development costs for hotels depend on many factors that are unique to each project and location, you should not rely on this report to determine actual hotel projects’ cost or to value them. It is designed to support preliminary cost estimates and to compare the different hotel categories.

The impact of supply-and-demand dynamics on hotel development

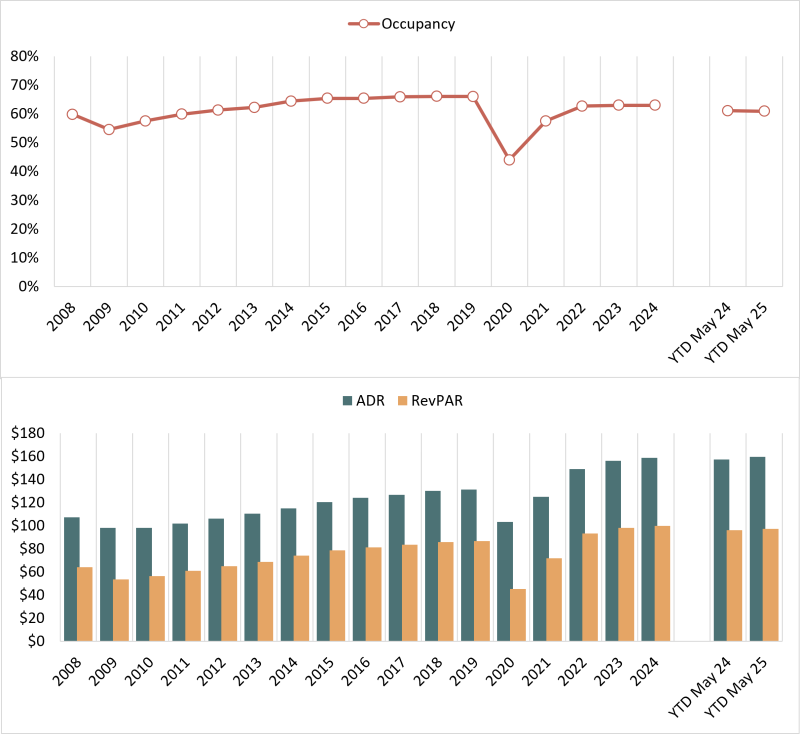

The occupancy rate of U.S. hotels in 2024 will be the same as it was in 2023, but ADR will exceed previous levels. STR reported 2023 national year-end occupancy of 63.0% with ADR of $158.67. The metrics reported for the period from January to May 2025 were 60.9% occupancy and $159.58, which is a decline of 0.4% in occupancy, and an increase of 1.6% in ADR, when compared with the same period in the previous year. RevPAR increased by 1.2% in comparison to the same period of 2024. This shows a slow, but steady, growth trend.

EXHIBIT 1: U.S. ADR & REVPAR REACH ALL-TIME HIGHS IN RECENT YEARS, BUT OCCUPANCY STILL RECOVERING

Source:

In 2024 the national market continued the trend from 2023 where many leisure-oriented destinations, which were among the first markets to recover following the pandemic had a correction. Some resort destinations also showed a flat or decreasing performance, as initial demand waned. Urban destinations have continued to recover at a faster pace than the national average. This is illustrated by the fact that the primary markets (which are the top 25 US cities) saw an increase in RevPAR of 2.7% from 2023 to 2024. Meanwhile, the RevPAR growth in all other markets was only 0.9%. The gap between the two markets decreased in the first half of 2025, when primary markets saw a RevPAR growth of 1.4% compared to all other markets’ growth rate at 1.1%. This suggests that the shift from leisure destinations to urban destinations is complete.

The lodging industry as a whole has been and continues to be navigating a complicated economic and political environment. In addition, the uncertainty around the U.S. elections in 2024 and rising inflation (albeit slower than prior years) contributed to caution from both investors and travelers. By 2025’s first half, the market had begun to adjust to a new administration with its changing policy directions. Like in previous cycles, changes in spending priorities, regulation and macroeconomic sentiments can cause changes in the lodging demand. This is often true in markets or sectors that were not previously in focus. The underlying volatility is continuing to influence investor and developer expectations for the rest of the year.

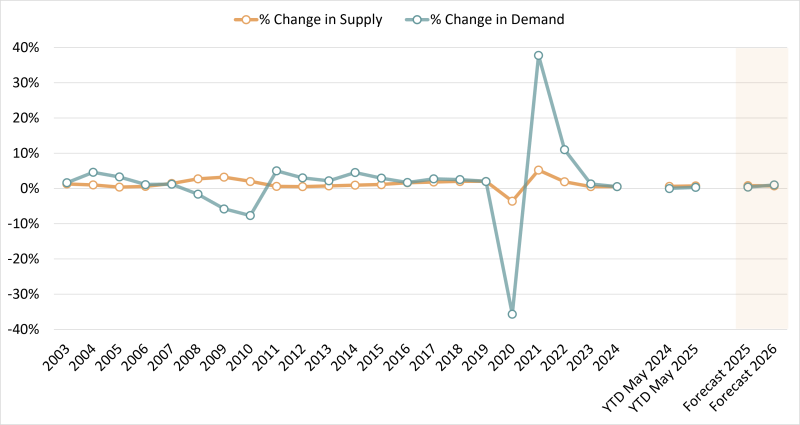

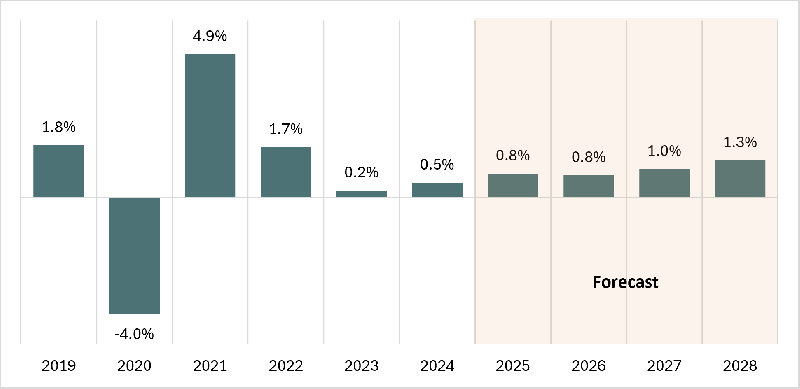

Supply growth is typically slower than the market due to the time required for projects, financing and development. The following graph shows that total supply in 2020 decreased by 4.0%, due largely to hotel closures caused by travel restrictions during the pandemic. In 2021-2022, national hotel supply grew dramatically. This was due to a number of reopened hotels and the completion of most hotel construction projects that were planned or completed before 2019/20. In 2023 and 2024 the rate of addition to new supply was 0.2% and then 0.5%. The combination of rising construction costs, and rising debt costs has slowed down new hotel development over the past few years. These factors will continue to limit future supply growth, as shown in the forecast for 2025 and 2026, which predicts a 0.8% increase.

The growth of the national supply has slowed in recent years.

Source: STR, HVS

Based on the data provided by STR, we have created a table that shows historic data of supply-growth, as well as our predictions for 2025-2028.

EXHIBIT 3. The U.S. hotel supply is expected to grow at a faster pace through 2028.

Source: STR, HVS

Hotel development is not only hindered by high construction costs and capital expenditures, but also presents opportunities for strategic growth. Many projects have been slowed down by the tightening of lending criteria and reduced returns. This is especially true for those at an early conceptual stage or in marginal markets. Developers with a long-term view and capital access may be able to take advantage of this situation to begin pre-development activities, including market/feasibility analysis, entitlements and design, as well as brand/operator and site selection at an early stage. The fact that fewer companies are moving ahead means those who do the groundwork can be better positioned for a more streamlined pipeline of hotels when capital markets start to relax. Developers who act now, when construction costs are beginning to fall and land is becoming more available in certain markets, could have an advantage as the next cycle of growth begins.

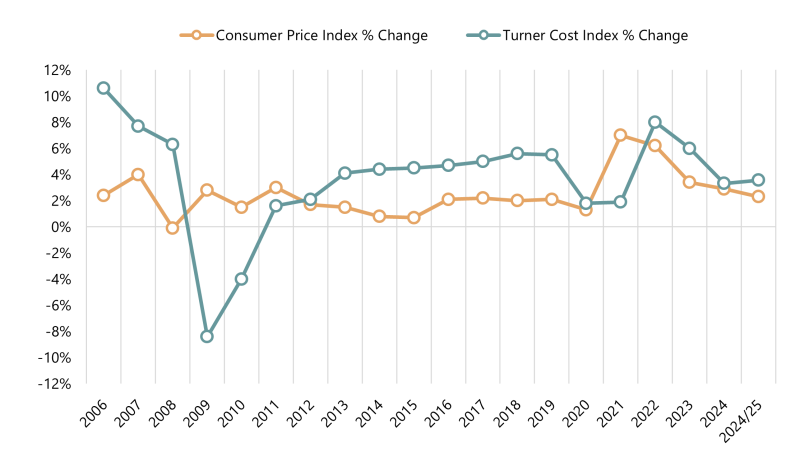

CONSTRUCTION COST INCREASE

Below, we provide historical data on inflation in relation to development costs. The Turner Building Cost Index has tracked the costs of non-residential buildings construction in the United States market since 1967. Turner Building Cost Index factors are determined on a national basis by labor rates and productivity as well as material prices and the competitiveness of a marketplace. The cost index increased by 8.0% between 2022 and 2023, but then slowed to 1.8% in 2020, 1.9% in 2021, before accelerating again in 2024. Growth of the index fell again to 3.32% in 2024, then rose slightly to 3.57% trailing-twelve-month (TTM) period ending March 2025.

Rider Levett Bucknall, which compiles quarterly construction cost reports, also reported an increase in construction costs index of 4.69% by year-end 2024.

In the graph below, the changes in the Consumer Price Index (CPI), as well as the changes in the Turner Construction Cost Index (TCCI) for each year are shown.

EXHIBIT 4: COMPARATIVE VIEW OF CONSUMER PRICE INDEX VS. TURNER COST INDEX CHANGES

Source: U.S. Bureau of Labor Statistics. Turner Building Cost Index

Source: U.S. Bureau of Labor Statistics. Turner Building Cost Index

As we head into 2025, the construction cost inflation will continue to decrease, creating an environment more favorable for hotel development. This trend is primarily driven by two factors. The broader economy has seen a significant reduction in inflation, which eases upward pressure on materials, wages and services. The hotel construction industry has seen a significant slowdown in the last few years. In fact, pipelines are down dramatically from their previous peaks. Due to a decrease in the number of projects competing for subcontractors and labor, pricing power has been shifted back towards developers. This results in more competitive bidding and less volatility when estimating costs. New tariffs introduced by Trump’s administration, however, are causing uncertainty to the cost structure. These measures may reintroduce cost pressures later in the year. This is especially true for materials that are dependent on global supply chain. However, the current climate is generally more favorable to advance feasible developments.

HOTEL DEVELOPMENT CATEGORIES OF COST

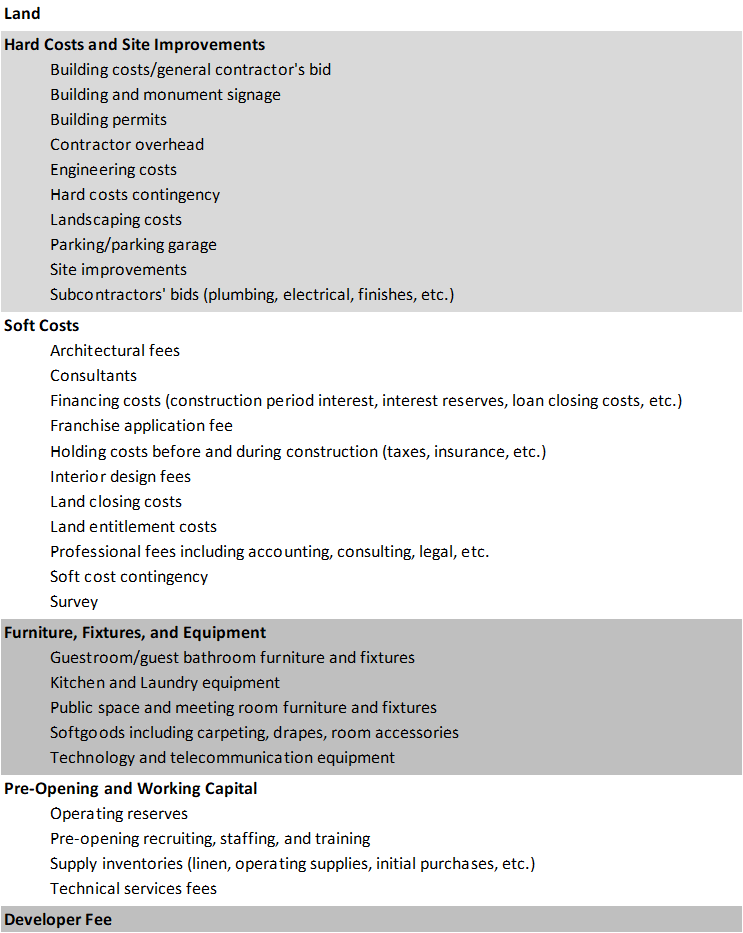

The evaluation of the budget’s comprehensiveness can be difficult, since different line items are often used, while some components are unintentionally left out. HVS was the first to present hotel development costs in a consistent manner, which helped developers and other industry participants understand them. We have developed the following summary format based on our review of actual developers’ budgets and the HVS U.S. Hotel Development Cost Survey. This is the basis for all the cost categories. These categories are useful to hotel professionals who want to conduct an analysis of hotel feasibility. They also provide a base for evaluating proposed projects. The six HVS categories are illustrated in the following diagram, along with the typical items for each category.

EXHIBIT 6: HVS HOTEL CATEGORIES FOR COSTS

Source: HVS

These categories do not represent all items that are included in a budget for development. However, they do show the most common ones. Construction accounting presents development budgets in much greater detail than general investment analysis. DATA COLLECTION & SAMPLE SIZE HVS gathered actual hotel construction data in 2024. Although not all construction budgets were captured (for various reasons including incomplete data or skewed information, or development attributes), we selected complete and reliable budgets to form the basis of this year’s study. Budgets were included for ground-up developments in the United States. In this survey, Florida, California Texas and Georgia were among the top states represented. These are the places where most hotel developments occur in the US. In this year’s study, it is notable that the total cost of luxury projects in these states exceeds $2 million for each room.

Our data was also analyzed to identify the top brands and types of hotels in 2024. In the category of limited-service hotels, Hampton by Hilton is the leading brand. Holiday Inn Express comes in second, Fairfield Marriott third, and Tru Hilton fourth. The most popular category was extended-stay, which included brands such as Home2 Suites, TownePlace Suites, Hyatt House and Residence Inn. Marriott and Hilton are the two most popular hotel brands.

Costs of developing a hotel room

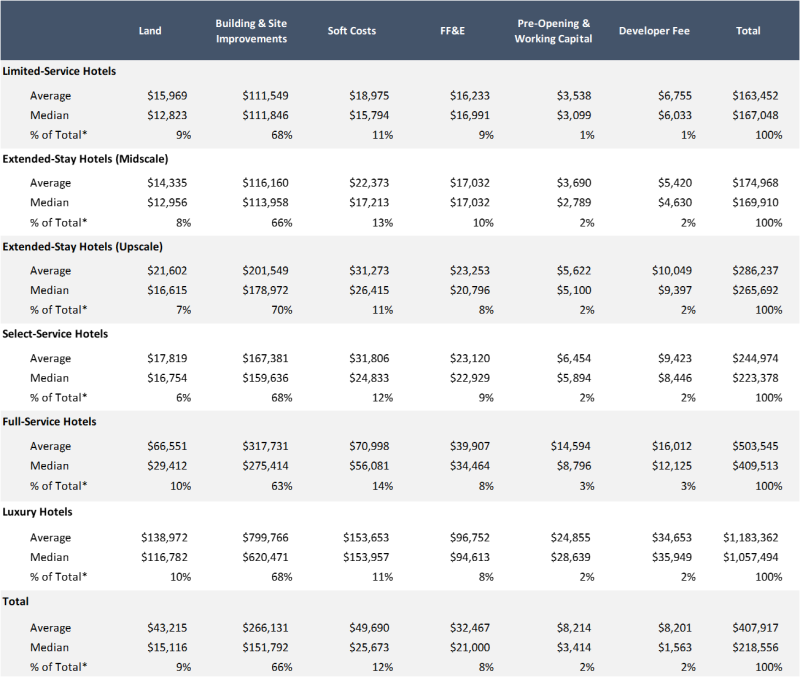

The averages and medians below represent a wide variety of development projects throughout the United States. This includes projects in areas where there are low entry barriers and projects in highly-priced resort and urban destinations.

EXHIBIT: MEDIAN COSTS FOR HOTEL DEVELOPMENT STABILIZES AFTER OUR LAST RESEARCH

*The percentage of total is calculated based on the total sample of all budgets.

Source: HVS

The popular brands were included in the range of $167,000-$169,000 for the median cost per room. The median costs for hotels in the select-service and upscale extended-stay categories were around $223,000 and $265,000, respectively. Costs to build full-service hotel projects are higher than those for select-service, with a $409,000 median cost per room. The median cost for luxury hotels was over $1,057,000. The median cost of hotel development across all properties surveyed was $219,000 per bedroom, which is similar to the survey last year, indicating that construction costs have stabilized.

A CONCLUSION

The budgets analysed in this study were provided directly by developers, lenders, and owners on both conversion and new hotel construction projects during the time period illustrated. The survey results combine data from real construction budgets, organized by product type. The results include unique hotel developments that are not replicable due to the nature and complexity of hotel development. We caution developers not to rely on this information when estimating costs for a particular project. A variety of factors can affect the hotel’s budget. The HVS US Hotel Development Cost survey recommends that users only use the cost per room in each of the cost categories as a guide.

Construction and FF&E design and procurement firms are the best sources for obtaining hard costs and FF&E costs for a specific hotel project. Developers should consult multiple sources during the hotel development process in order to accurately estimate the cost. The cost of development should also be adjusted to account for inflation, given that the average hotel development can take three to five year. Lastly, it is recommended that the projected performance for the hotel should be reviewed at regular intervals during the development phase.

HVS can assist hotel owners in every aspect of their development and ownership, from the initial idea to opening and beyond. Contact Luigi Major by calling (310) 270-3240. lmajor@HVS.com.

Luigi Major is Managing director, Advisory, HVS Americas. He is a trusted advisor who works with clients in the Americas, providing tailored solutions that meet their specific needs. He has worked on thousands of projects in the United States, Latin America and the Caribbean. Luigi graduated from the Conrad N. Hilton College of Global Hospitality Leadership at the University of Houston in 2007 and joined HVS. Luigi can also be reached by phone at (310) 271-3240. lmajor@hvs.com.