This sponsored content was developed in collaboration between Skift and a partner.

Hotel performance in the world was strong throughout 2024. In fact, it averaged 7% growth over 2023. The momentum began to slow in 2025 and by May the sector was down 7%. Skift Travel Health Index Hotel performance was down by 2 percentages points from the year before, the first easing of the overall performance since 2020.

Every revenue stream is important in the face of continued volatility and uncertainty. The most recent Data SnapSkift and Onyx CenterSource examined why the GDS model of agency remains one hospitality’s most stable revenue engines. OnyxInsights data indicates that $2.1billion in commissions were paid in these channels between 2024 and 2025. This article defines the GDS commission share as the percentage of hotel business that is attributed to GDS transactions.

Part 2 of this analysis explores even more factors that influence this critical input for hotel bookings: whether a hotel is branded or independent, where it’s located, and when it was built. Although it may not come as a surprise that each of these characteristics plays a significant role in a hotels revenue potential, their contributions show how important it is for travel management companies and operators to pay attention to the underlying commission dynamics.

Branded hotels lead in GDS commission share

Flying the flag of a major hotel group appears to be a good way to maximize your share of GDS commissions.

Independent hotels that are not affiliated with major brands, but managed by global hotel chains or franchised, perform consistently worse than branded hotels. In North America, the average commission for branded hotels is 5.6% compared to 2.6% for independents. There are also significant gaps in Asia-Pacific (4.8% to 2.7% vs. 4.8%) and Europe (4.5% to 2.9%).

Why is that? Global chains use their extensive distribution networks, loyalty programmes, and marketing resources to boost bookings. Independent properties rely heavily on their niche positioning, local experiences or specialized partnerships in order to compete.

To ensure that they can predict and increase their returns, agencies often give priority to properties who are part of larger programs. To increase their attractiveness for agencies, independent hotels can strategically join global or loyalty programs.

Property Location and Commission Shares

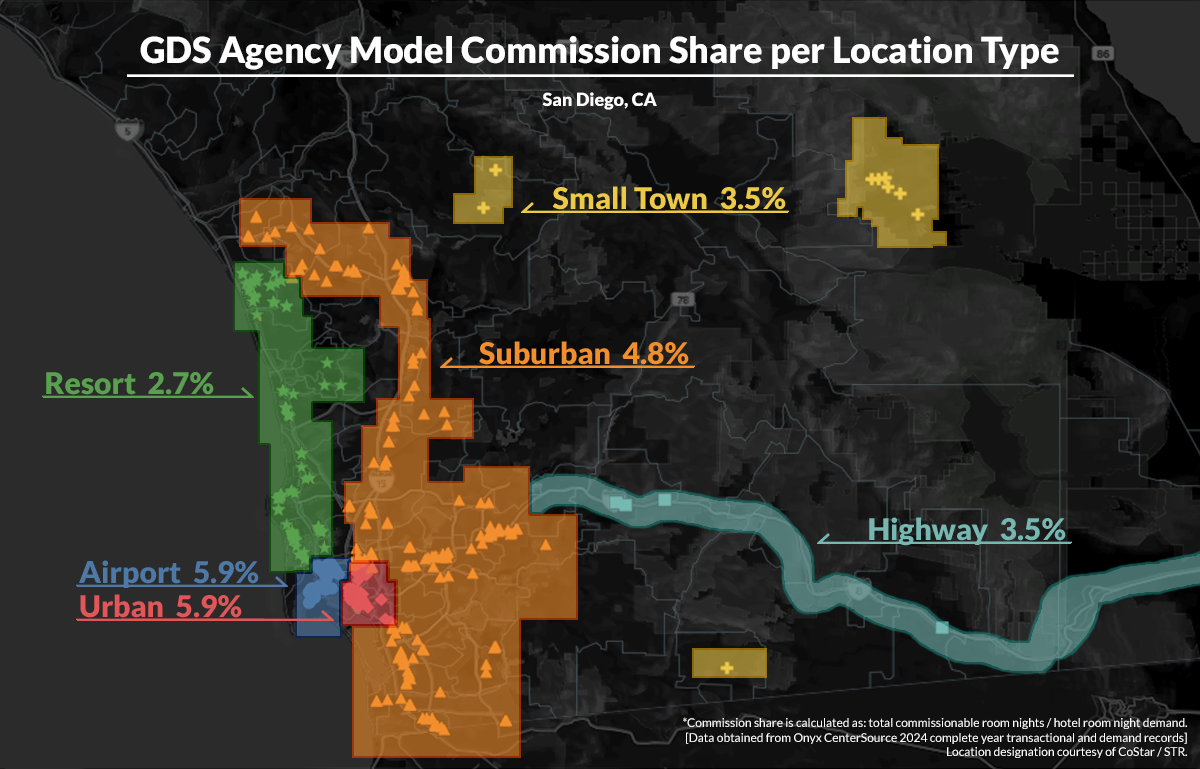

GDS commissions can be influenced by more than just affiliation with major brands. Hotels located in proximity to competitive properties in urban, airport, and suburban markets in the U.S. also see significantly higher GDS commission shares — 5.9%, 5.9%, and 4.8% respectively — in comparison to highway and small-town locations (3.5%) and resorts (2.7%).

This map shows the different submarket types in San Diego, Calif.

The advantage of urban and airport hotels is due to the high frequency of business travel, transient stays and strategic corporate agreements, rates and agreements, which are all highly visible in GDS.

To increase demand for their properties, agencies prioritize airport and urban properties. This allows them to enjoy consistent bookings at higher volumes. Hotels outside of these environments should strategically position themselves by focusing on specialized events, local attractions or unique experiences.

The impact of hotel openings on commission growth

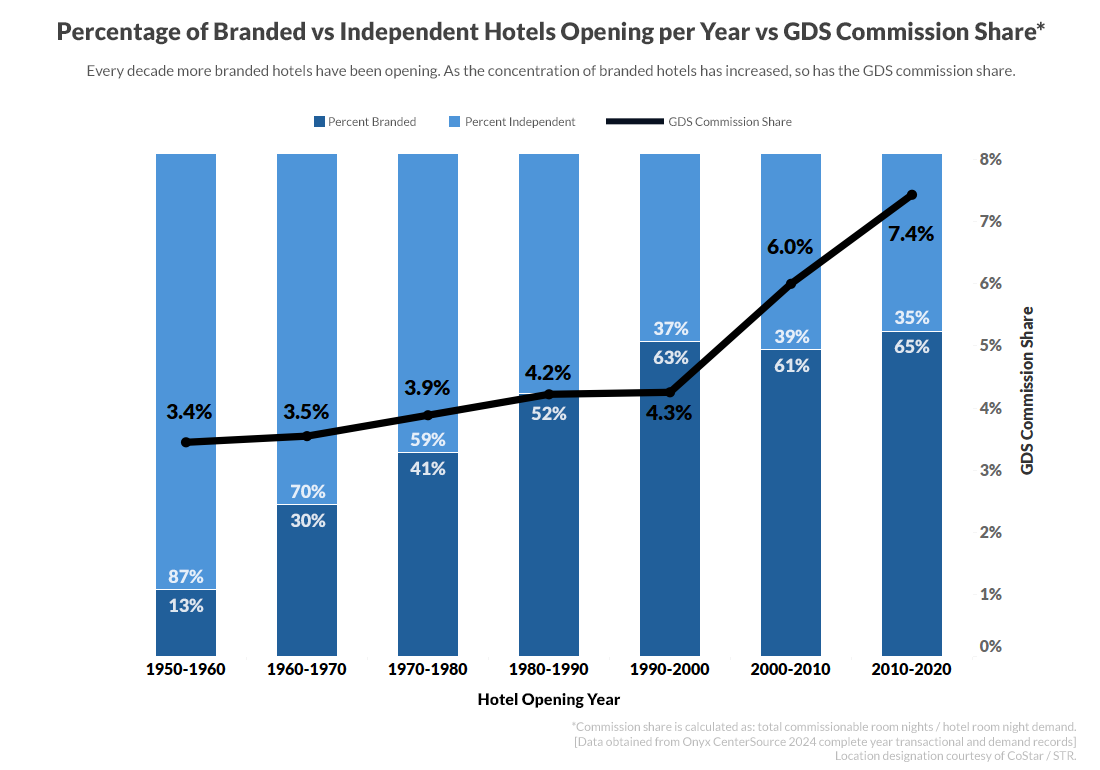

These two factors are strategic and deliberate. The golden rule in real estate is “location,location,location” and the question “branded or independent?” is a constant concern for hotel investors. The date of construction is a more random but equally important factor.

The historical data shows that the growth in the overall industry commission share correlates with the increasing dominance of brand hotels. The GDS agency’s commission share for hotels opened between 2010 and 2021 was 7.4%, a significant increase from earlier periods. This period coincides with a significant expansion of major mergers and franchising growth.

It is possible that the correlation between a shift in industry to branded hotel chains in 1990s and higher GDS commission shares in 2000s was due to the adoption of centralized distribution strategies by large hotels, which gave hotels better positioning and visibility in the GDS. This trend also reflects the changing preferences of travellers, especially business and leisure travelers. They are more interested in consistency, trusting brands, and rewarding loyalty programmes. Bookings of high volume are often directed to branded hotels that have a reputation for quality and reliability.

To compete effectively, independent hotels need to recognize the competitive landscape, and invest proactively in brand management, enhanced partnership frameworks, and reputation management.

Hotel and Agency Takeaways on Strategic Relevance of GDS Channels

Understanding the dynamics of commissions gives hotels and agencies a powerful strategic advantage. It allows them to make better decisions, improve their competitive position, and increase profitability, in a complex and ever-changing global hospitality environment.

Hotels can evaluate their operational and strategy positioning by using the following methods:

- To increase distribution, enhance loyalty programs, partnerships and affiliations in branded networks.

- Strategically position offerings based upon geographic strengths and unique markets appeal.

- Prioritizing differentiation and modernization to increase ADR and Commission appeal.

Meanwhile, agencies can sharpen the strategic focus of their agency by:

- Prioritizing hotels that are branded, centrally-located, and newer, as they consistently deliver reliability and client satisfaction, and can deliver higher commissions.

- Marketing campaigns that are targeted at high-value segments of travelers.

- Utilizing historical and persona-driven insight to optimize hotel partnerships, and negotiate favorable compensation structures.

“The Data Snap” This is a series of articles that will continue to be published. It will provide a more accurate picture of the hotel booking landscape. Hotels and agencies can then make better decisions based on data, which in turn helps them create productive relationships with their partners and increase revenue.

OnyxInsights gives hotels and TMCs a complete view of the landscape in order to better serve clients and partners. Onyx CenterSource handles over 100 millions transactions per year on behalf of 150,000 hotels and 200,000 agencies around the world, which amounts to nearly $2.1 billion. Visit onyxcentersource.com to learn more.

This content was developed collaboratively. Onyx CenterSource Skift’s brand content studio. SkiftX.