Germany is preparing to host the largest European sporting event biggest eventsHotels should adjust their strategies in order to maximize these revenue opportunities. Staying ahead of these changes is crucial for small and medium-sized independent hotels.

This article analyzes the impact of major events on four German cities in terms of hotel demand and occupancy trends. Does your strategy aim to maximize revenue?

About our data

Lighthouse’s hospitality data was used to analyze the demand and pricing information in this article. In order to better understand our findings, let’s add some context to the data.

- Demand: By combining hotel and flight searches, we can predict demand for a specific destination and stay date. As a result of high demand, hotel availability is decreasing. When we say unavailable hotels, it means properties that don’t show up as available for booking, either because they are already sold out or temporarily closed.

- Pricing: The data we have collected on hotel rates for future dates is based on the advertised price of a standard room at a certain destination. The data in this article represents the price of a standard hotel room as of 30th June 2025.

- Lead Time Pricing The average rate of a room for a specific night will change as the date of the stay approaches.

Oktoberfest Munich – 20 September until 5 October, 2025

Oktoberfest will be the largest Volksfest on earth and it is scheduled to take place in Munich between 20 September and 5 October, 2025. During this two-week celebration, visitors from around the world enjoy traditional music, games, contests and – perhaps most of all – beer. This year 6.7 millions people are expected.

The hotel demand around Oktoberfest Munich

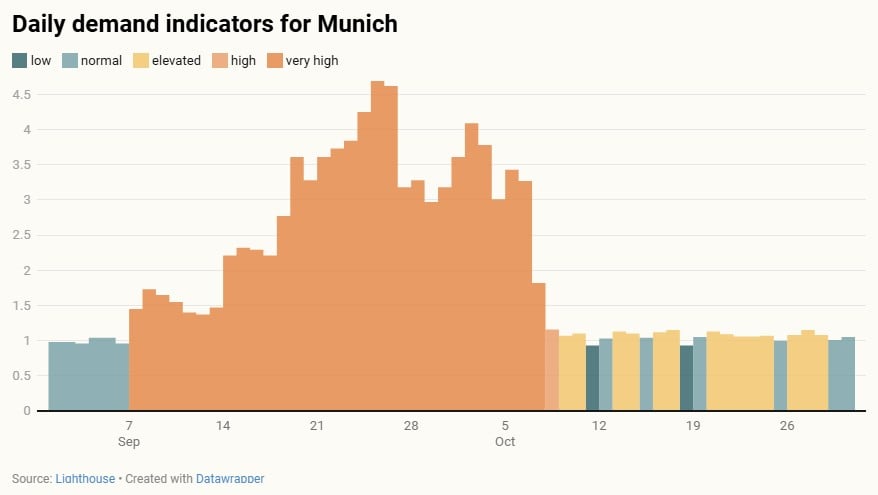

We need to understand how much interest is generated by the event. The analysis of daily indicators of demand for Munich shows a demand spike that occurred on the first night of the Oktoberfest, Friday 20 September. festival. While demand is strong throughout the event, the most interest is shown during the second weekend – from Saturday, 25 through Monday, 27 September. The demand then drops slightly, before peaking again at the last weekend of the event. It also coincides the Day of German Unity (3rd of October), a German public holiday, which adds to the peak demand on Friday. Demand returns to normal levels on 7 October.

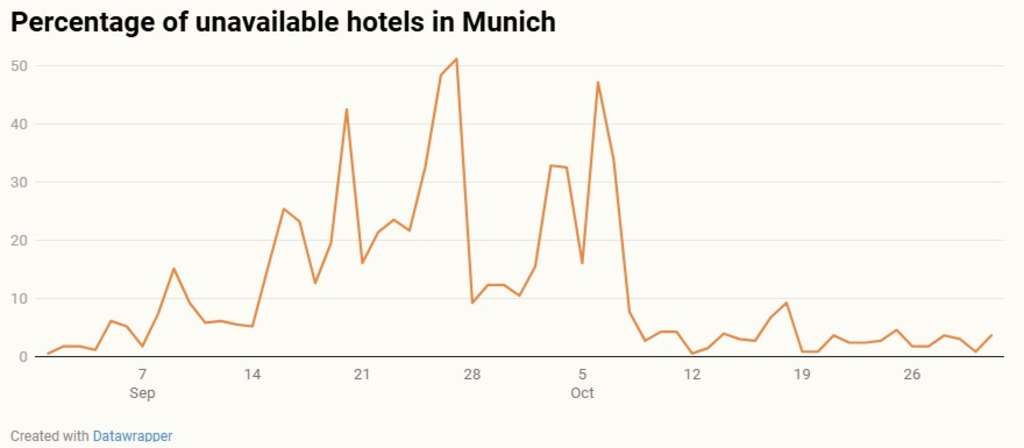

Next, let’s see if this increased demand has already materialized into bookings. The percentage of unavailable hotels in Munich during Oktoberfest shows clear spikes that correspond to the summits of demand across the event weekends. This means hotels are already booking out or applying minimum stay rules.

- On 20 September, 42.55% of hotels are already unavailable at the time of writing.

- On the two most popular nights – 26 and 27 September – around half of hotel rooms are unavailable for booking.

- The high-demand nights of 3 and 4 October during the closing weekend are almost 33% sold out.

- The Volbeat concert (6 October) and real estate fair EXPO REAL (6-8 October) could be responsible for the final spike in booked out rooms following Oktoberfest.

Hotel pricing trends during Oktoberfest Munich

When we look at advertised prices for stay dates during Oktoberfest, it is clear that hotels are raising their prices substantially to capitalize on the surge in demand. Branded and independent hotels show very similar trends, but independents demonstrate quite a bit more pricing power on most event dates.

The average room price on Friday 26 September (avg. €438.35) and Saturday, 27 September (avg. €442.91) – a staggering 118% and 121% price jump respectively, if we use the full week before the event as a baseline (Monday, 8 to Sunday, 14 October).

The highest priced stay dates during Oktoberfest are:

- Sat, 20 Sep: €401.28 independent, €390.72 branded

- Fri, 26 Sep: €457.05 independent, €419.65 branded

- Sat, 27 Sep: €445.11 independent, €440.71 branded

- Fri, 3 Oct: €429.44 independent, €381.13 branded

During Oktoberfest, hotel prices in Munich consistently soar to over €300 and often well over €400, a significant increase from Munich’s typical rates in surrounding weeks, indicating a rare opportunity to capture premium rates.

How hotel rates evolve closer to Oktoberfest Munich

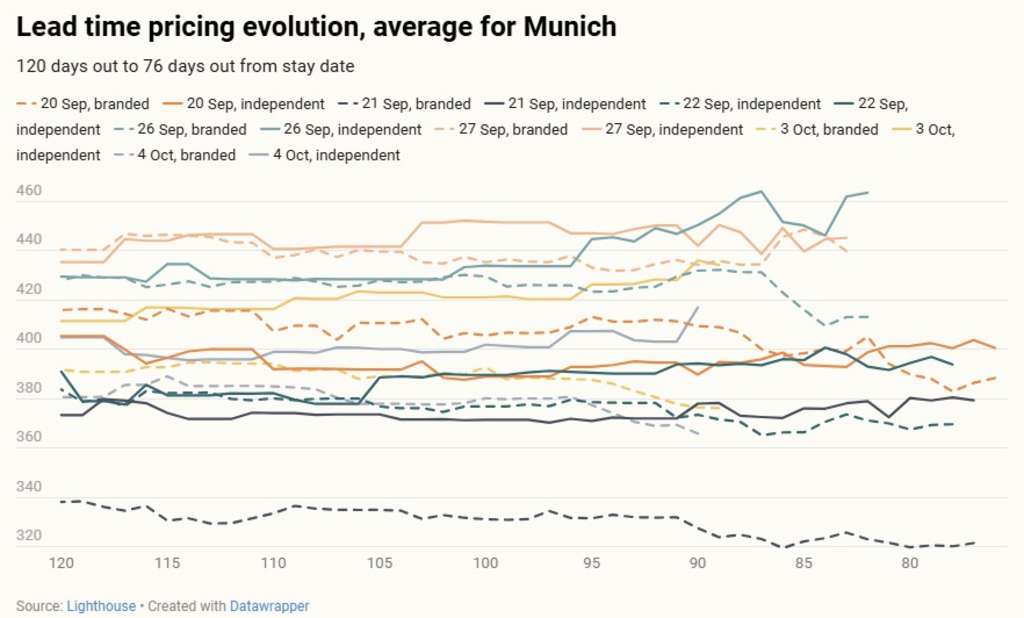

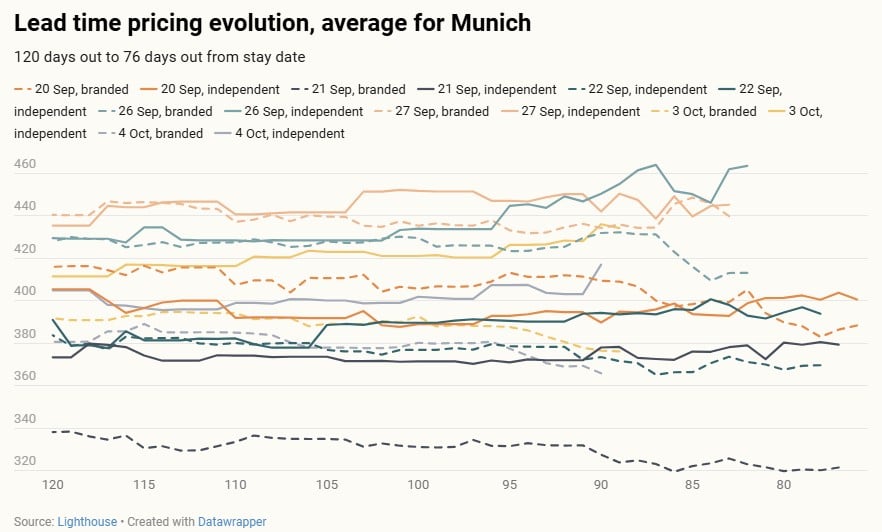

Analysis of lead time pricing data reveals similarities between branded and independent hotels’ pricing strategies, with a few important differences. Pricing stays relatively consistent until around 95 to 90 days out. After that, chain prices start a downward trend, while indie prices start to move upwards with sharper fluctuations.

The biggest uplift is seen for 26 October, the highest-demand night. These trends cause price gaps to widen in favor of independent properties as the event draws nearer. For the popular night of 20 September, branded hotels consistently advertised higher rates, until indies surpassed them at 80 days out.

Do you want to be the first to know about events coming to your destination? Check our free Market Alerts dashboard to discover nearby events and sign up for weekly notifications directly to your inbox. Stay two steps ahead of your competitors and raise your prices before guests book out all your rooms, ensuring you don’t leave any money on the table.

Berlin Marathon – 20 to 21 September, 2025

The Berlin Marathon is a major global running event that drew nearly 80,000 total participants last year. This year, it winds through the streets of central Berlin on the weekend of 20-21 September. Over the course of 2 days, the diverse event welcomes elite runners aiming for records, wheelchair athletes, inline skaters, handcyclists and tens of thousands of amateur runners from around the globe. Around 58,000 participants and a million spectators are expected to flock to the capital for this edition.

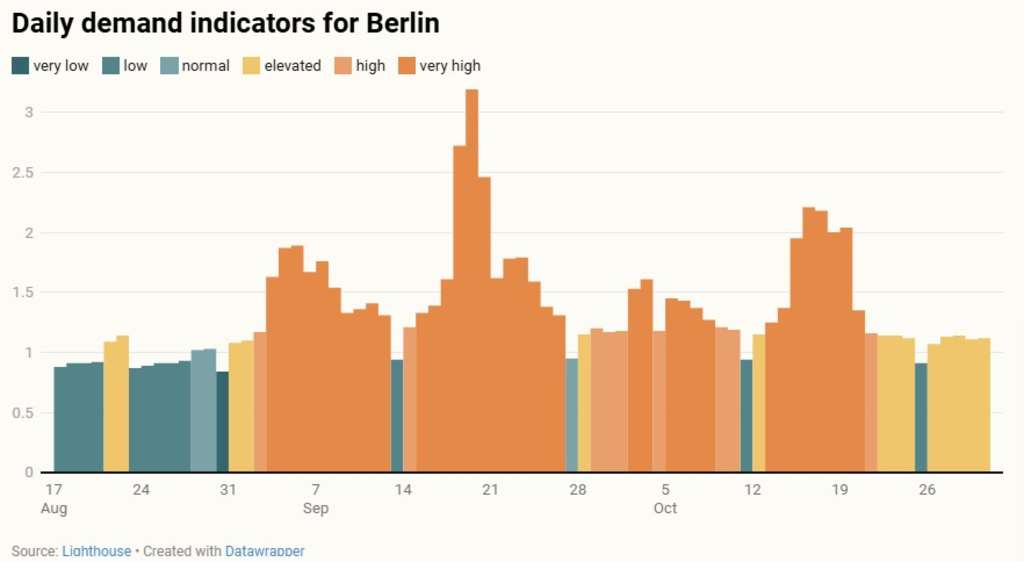

Hotel demand trends around the Berlin Marathon

Demand builds gradually in the days leading up to the event weekend and explodes on the 19th, the night before the event. It reaches its peak on the 20th and remains very high for the closing night of 21 September.

This year, the Berlin Marathon coincides with the start of Oktoberfest in the capital, which sends demand soaring even higher. That is possibly why demand remains very high in the following days and rises again for the second Oktoberfest weekend. However, this peak pales next to the incredible spike caused by the marathon.

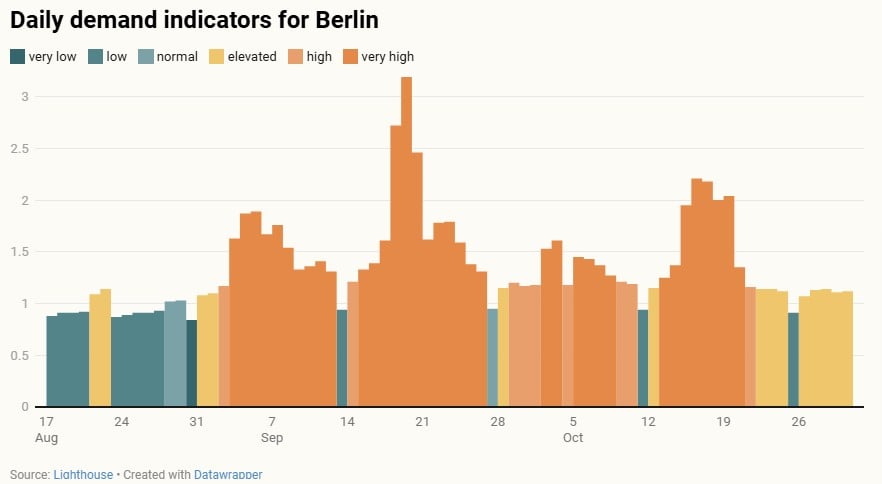

The demand surge becomes even more apparent when looking at the percentage of unavailable hotels. For 20 September, almost 64% of Berlin’s hotel rooms are already sold out at the time of writing. The nights of 19 and 21 September aren’t doing too bad either, with nearly 42% and 28% of hotels being unavailable respectively. These figures indicate that people want to make the most of their Berlin trip by staying multiple nights.

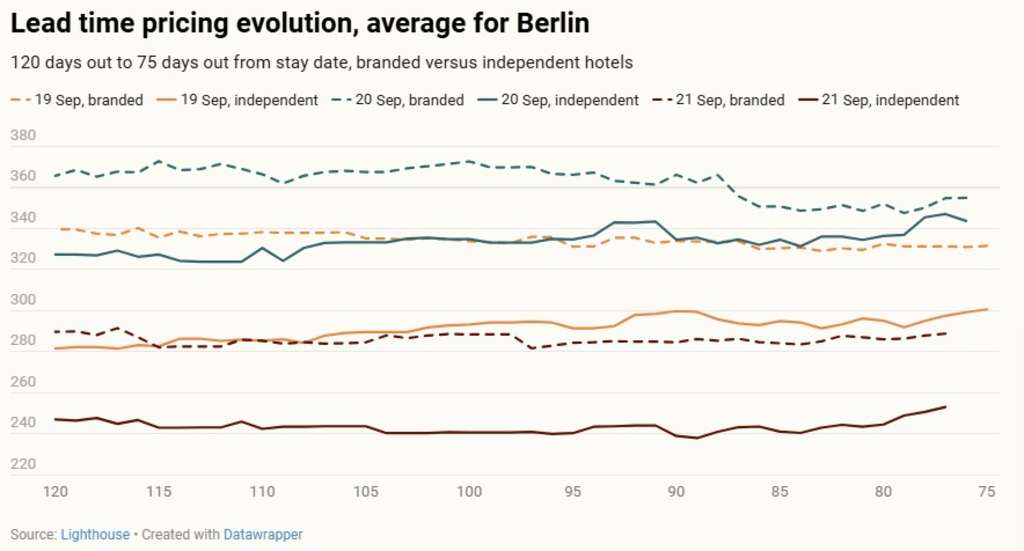

Hotel pricing trends during the Berlin Marathon

A look at average advertised prices tells us that Berlin hotels have increased their room rates significantly in anticipation of the marathon. Let’s compare them to the average rate during the weekend before (Friday 8 – Sunday 14 September) when demand was also very high but not extreme:

- Fri, 19 Sep: €313.87 – a 91.61% increase compared to our baseline

- Sat, 20 Sep: €345.69 – a sizeable price jump of 111.03% compared to baseline

- Sun, 21 Sep: €266.94 – still 62.96% higher than our baseline price

However, when digging a bit deeper, a significant distinction between indies’ and chains’ pricing becomes apparent. Independent properties charge consistently lower rates than their branded competitors during the marathon weekend, leaving a pricing gap of €28.74 on average.

- Fri, 19 Sep: €331.23 branded, €296.51 independent

- Sat, 20 Sep: €351.36 branded, €340.01 independent

- Sun, 21 Sep: €287.01 branded, €246.87 independent

The biggest divide manifests itself on Sunday, 21 September. Here, independent hotels have already lowered their prices again to €246.87, even though demand for this stay date remains very strong. Meanwhile, chain hotels are still reaping the revenue rewards, maintaining a strong average price of €287.01 a night. For independent hotels, that amounts to €40.14 of money left on the table per room per night.

These numbers also suggest that branded hotels might have implemented smarter length-of-stay restrictions for the marathon weekend than independents, allowing them to maximize revenue more effectively.

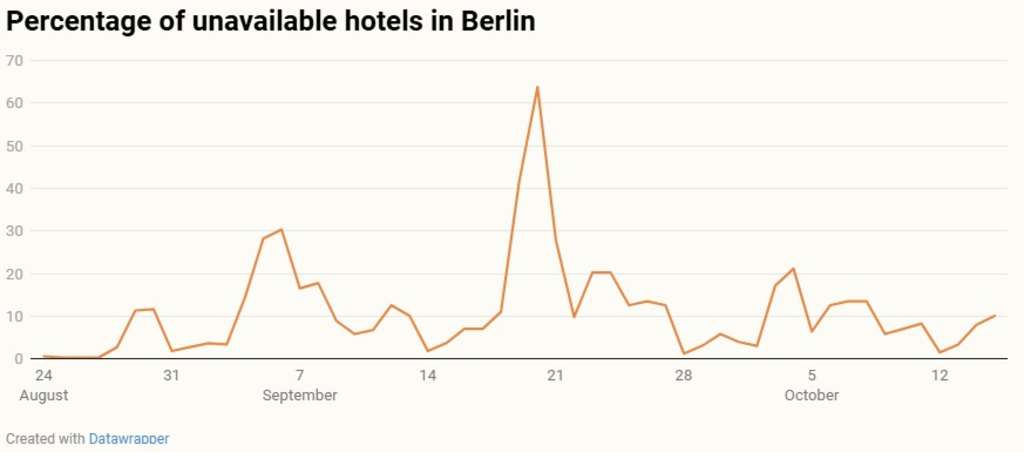

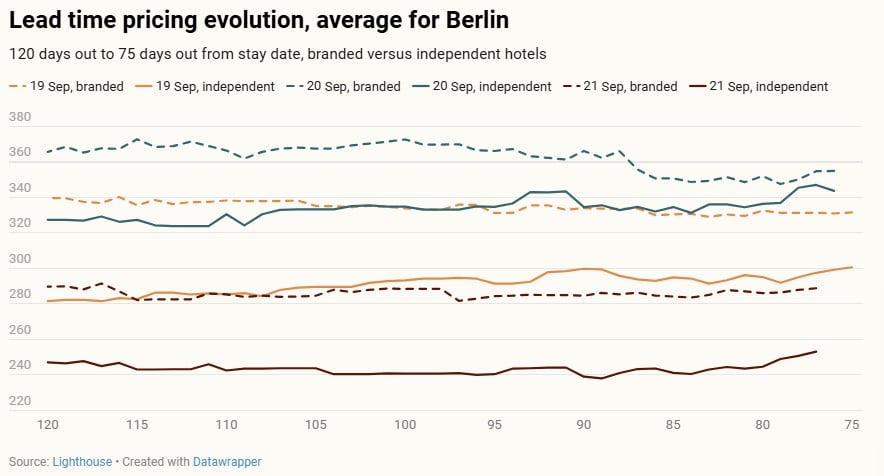

How hotel rates evolve closer to the Berlin Marathon

The divide between chains and indies becomes even clearer when analyzing lead time pricing data.

At 120 days before the stay date, independent prices were on average €46.34 below those of chains. This has likely caused independent properties to fill up more quickly, but at rates far below market value. Without strategic LOS restrictions, it can easily result in many one-night bookings that are more labor-intensive and less profitable, and leave rooms unsold on Sunday.

It seems that indies have struggled to close the price gap as stay dates approach. Only 40 days later, at 80 days out, it looks like indie hotels have started to increase their prices more substantially for all 3 stay dates, potentially a sign of high occupancy. In comparison, branded hotels show a stronger, steadier pricing strategy all throughout, only lowering prices for 20 September slightly from 100 days out and more significantly from 88 days out.

With demand this high, it’s safer to offer premium rates early and adjust down if needed. Plus, don’t forget to set rate restrictions well in advance or bundle Sunday night deals to protect high-value nights and encourage longer stays at elevated prices.

CPHI conference Frankfurt – 28 to 30 October, 2025

CPHI Frankfurt, the world’s premier pharmaceutical industry conference is scheduled to take place from 28 to 30 October 2025. It’s estimated to attract more than 60,000 visitors and exhibiting companies from over 160 countries to Messe Frankfurt. Expect a mix of global pharma stakeholders, gathering for three days of strategic networking and knowledge-sharing.

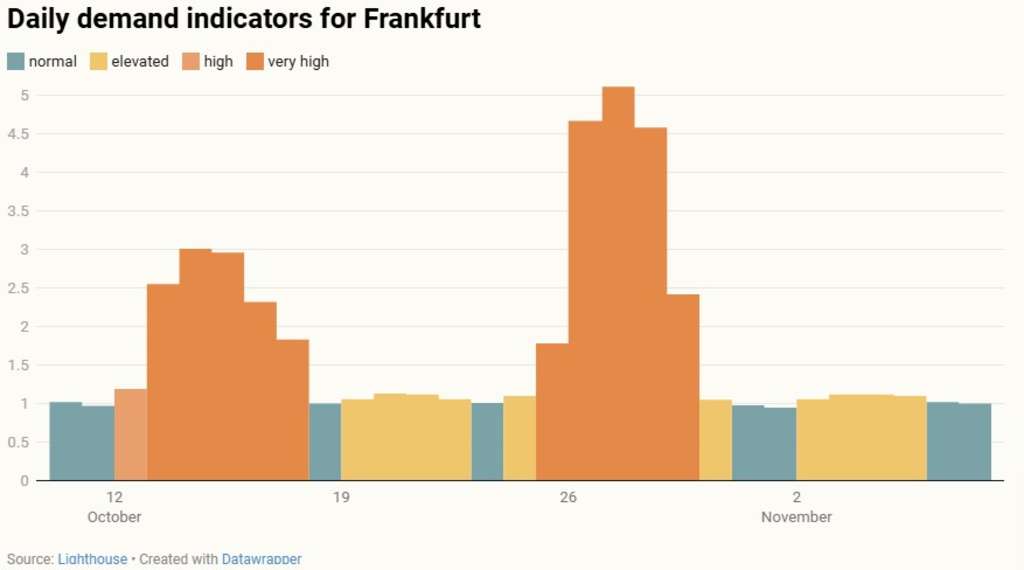

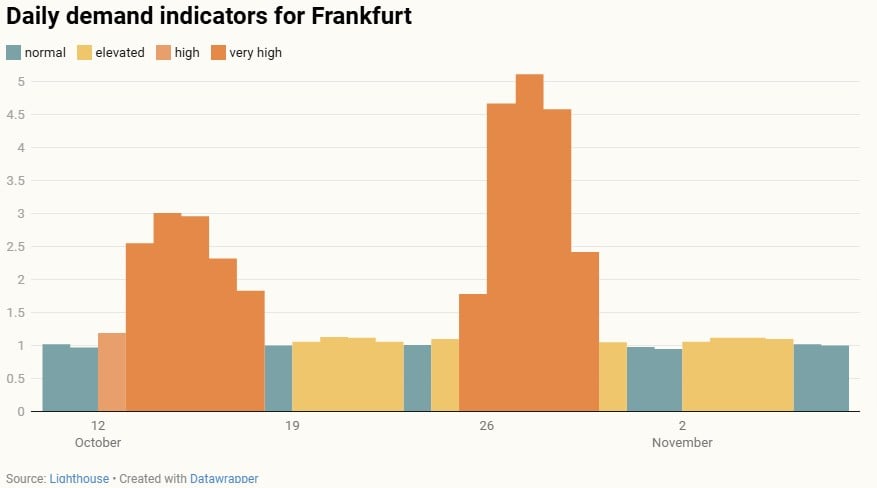

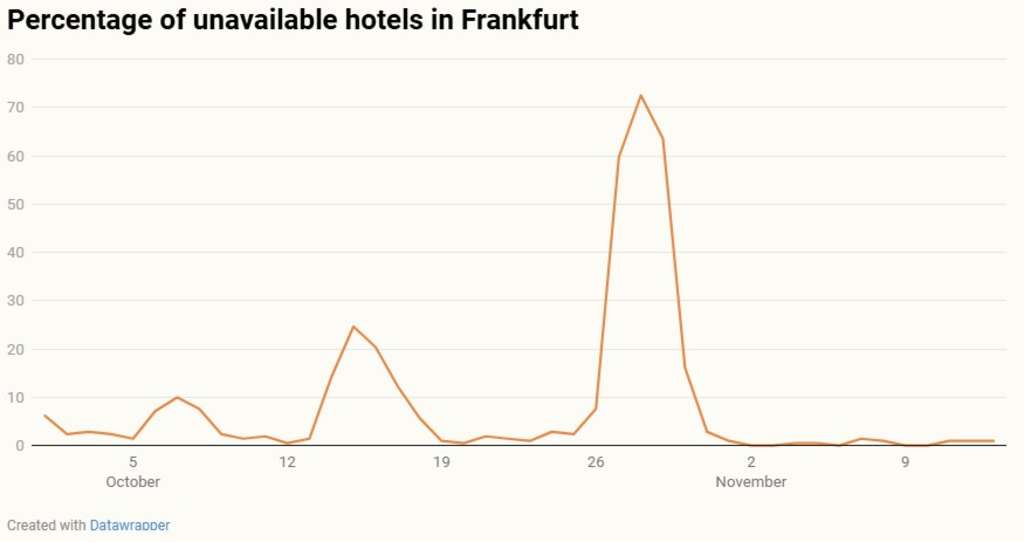

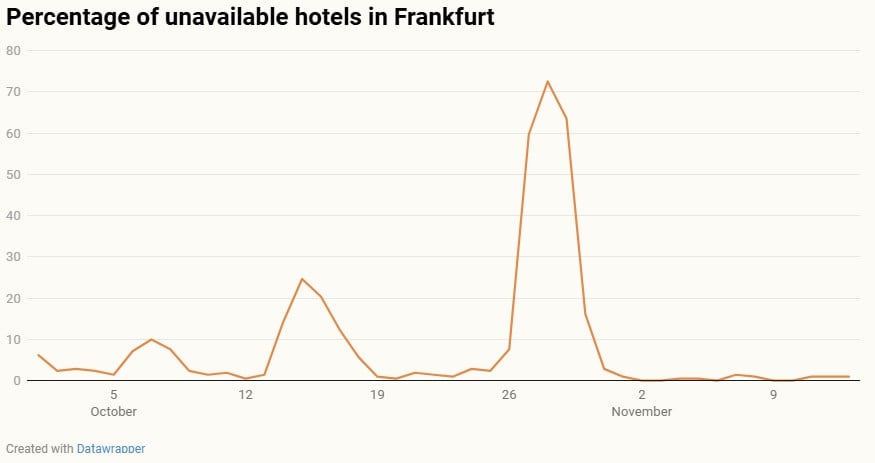

Hotel demand trends around CPHI Frankfurt

Frankfurt experiences a major spike in demand that directly corresponds to the CPHI conference dates. Demand shoots up the day before the event and peaks on October 28, the first day of the conference. It remains steady on the 29th as well, before starting to return to normal levels.

This strong demand clearly translates into high hotel unavailability levels. On the highest-demand date, 28 October, nearly 73% of hotel rooms are already booked out at the time of writing. Other immensely popular stay dates are 27 October (60% unavailable) and 29 October (64% of hotels unavailable).

Hotel pricing trends during CPHI Frankfurt

Are hotels in Frankfurt reaping the benefits of this heightened demand? Overall, hotels are charging much higher prices than usual during the conference. When we compare the average of 27-30 October (€315.23) to the same days the week prior when demand was elevated (€109.85), prices have increased by no less than 187%.

While average room rates have increased spectacularly for the duration of the conference, independent hotels didn’t dare to price quite as high as their branded competitors. It’s likely that many chain hotels have a more favorable location in this case and present the more obvious option for corporate clients.

Nevertheless, the pricing gap is striking. Branded hotels maintain significantly higher average prices than independent hotels for the highest-demand days:

- Mon, 27 Oct: €361.20 branded, €307.30 independent

- Tue, 28 Oct: €415.98 branded, €255.00 independent

- Wed, 29 Oct: €404.72 branded, €354.84 independent

- Thu, 30 Oct: €207.36 branded, €215.47 independent

Only for the final day of the conference, indie prices surpass those of brands, possibly indicating discounting by chains to fill remaining inventory.

Note: The event is too far out at the time of writing to draw any accurate conclusions from lead time pricing trends.

It’s important to remember that independent properties can attract business travelers. All you need is the right offering and distribution strategy – think corporate-focused OTAs, tailored packages, loyalty programs and special rates for companies.

Yungblud concert and K Trade Fair, Düsseldorf – 7 to 15 October

On 7 October, the wildly popular British artist Yungblud is coming to Düsseldorf to blow the roof off the Mitsubishi Electric Halle. The arena can hold up to 15,000 fans, a good chunk of which will be looking for a place to sleep after the concert.

In the following days, around 176,000 professionals from all over the world will flock to Messe Düsseldorf to attend K 2025 – the world’s leading trade fair for the plastics and rubber industry. More than 70% of the visitors are from outside Germany. This fair is held every three years, and this year will take place from 8 to 15.10.

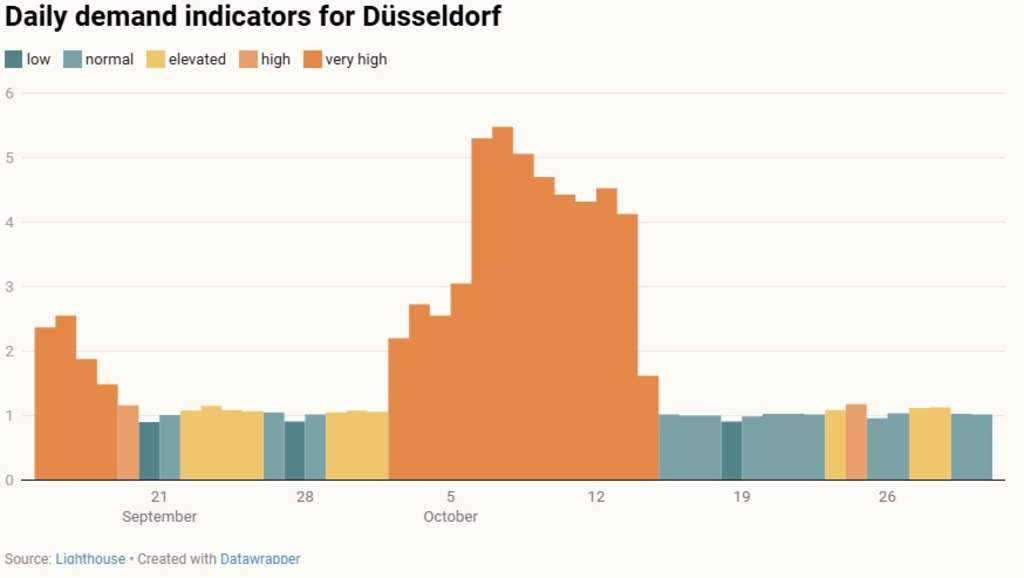

Hotel demand trends around the Yungblud concert and K Trade Fair in Düsseldorf

The number of searches for flights and hotels increases in the days preceding the event and peaks sharply on the 7th October. They reach their absolute maximum on the 8th October. The demand remains high until 14 October before dropping off on the last day of the K Trade Fair.

The dramatic demand surge is clearly reflected in the percentage of unavailable hotels during the event period. The highest unavailability is observed on 8 October at 76.67%, followed by 9 October at 71.67% and 7 October at 70.83%. Unavailability then drops but still remains substantial throughout the K Trade Fair.

Hotel pricing trends during the Yungblud concert and K 2025 in Düsseldorf

Hotel prices in Düsseldorf are soaring for the entire event period (7 to 14 October) in response to the heightened demand.

Average advertised prices reach their peak on Wednesday, 8 October (€498.20) – the highest-demand stay date. That’s a staggering 347% percent difference compared to the average rate on the same day the week after the event period (€111.49).

Both branded hotels and independent properties start raising their prices from 2 October, but independents show less aggressive spikes. Chain hotels generally maintain higher average prices for all of the core event dates – leaving a price gap of €42.25 on average. Indies only catch up from 14 October – when demand is fizzling out – after a steep price drop by brands.

- Tue, 7 Oct: €464.92 branded, €421.07 independent

- Wed, 8 Oct: €535.77 branded, €460.63 independent

- Thu, 9 Oct: €481.60 branded, €454.40 independent

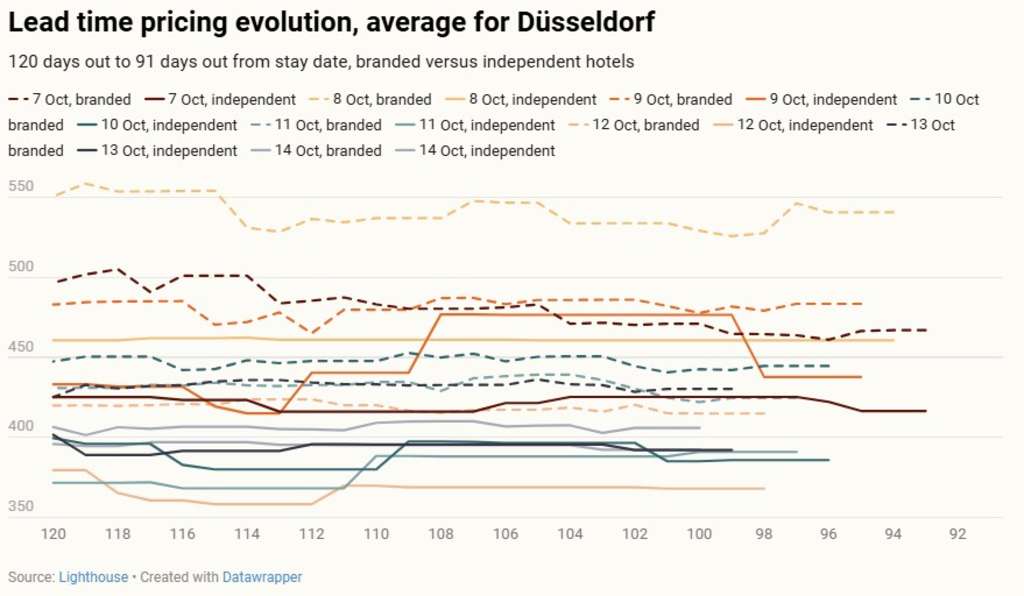

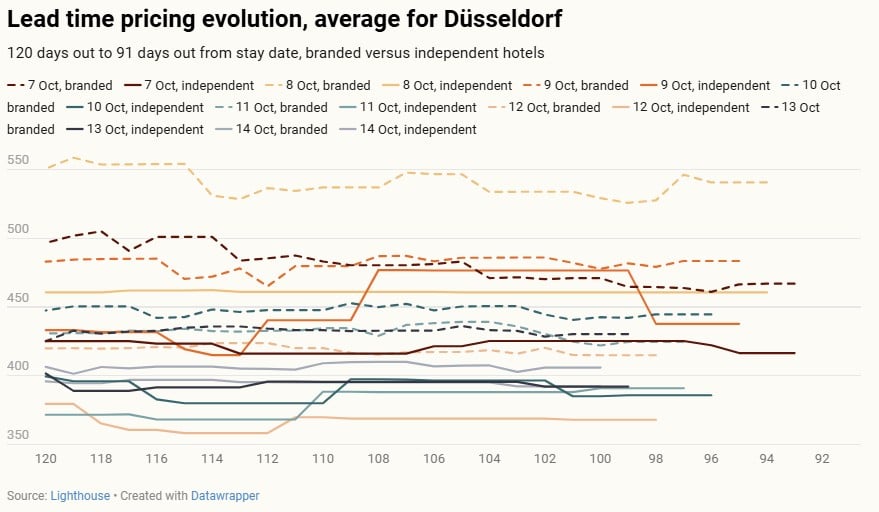

How hotel rates evolve closer to the Yungblud concert and K Trade Fair in Düsseldorf

Lead time pricing data shows that branded hotels price consistently higher than independent hotels for the key dates, with mild fluctuations and slight reductions closer to the stay date. It’s clear that they adopt a more dynamic yet robust pricing strategy, while indie prices remain unchanged for longer periods of time, after which they climb or fall more abruptly. Brands anticipated high demand and set premium rates early, only lowering their rates slightly when needed.

For 8 October, the most popular stay date, branded hotels were priced at €550.63 at 120 days out, compared to independent hotels that maintained flat pricing at €460.70 – a striking €90 difference. For most of the other stay dates, independent properties increase their rates again from 110 days out. This could indicate high occupancy and it’s possible that much of the initial demand has already materialized by that time.

As illustrated by brand strategies, it’s important to adjust prices regularly to respond to fluctuations in demand. Demand is not static, so neither should your rates be! With dynamic pricing, you avoid losing bookings due to overpricing and limit revenue loss from underpricing.

How to respond fast to future events in your area

These events show how quickly hotel demand and pricing can shift when large crowds are involved. Staying updated on events happening near you It is essential for success. Monitoring market trends and manually adjusting prices can be a time-consuming task for independent hoteliers. Chain hotels are often the winners.

What if you do not need a whole commercial department in order to beat your competitors’ prices?

You can stay ahead of the game and never miss a chance with the right tool. It will help you identify important changes and optimize your rates, restrictions and other factors. Enter Lighthouse for independents. This all-in solution acts as your revenue manager and works quietly in the background.

- Monitor the booking trend, competitors and demand 24/7

- You will be notified when there are major events in your destination.

- The ideal price for a room at any given moment

- Rates and restrictions are updated instantly on all channels

- Optimize your distribution channels using data-backed recommendations

Lighthouse helps you identify early opportunities and boost your prices to maximize revenue. No more guesswork. No more unfair competition. No more money on the table.

Want to save time while maximizing revenue? Ask for a demo to see how our solution can help independent hoteliers boost their revenue.

Lighthouse

Lighthouse is the leading commercial platform for the travel & hospitality industry.

We convert complexity into confidence with our actionable market insight, business intelligence and pricing tools to maximize revenue growth.

We are constantly innovating to provide the best platform to hospitality professionals so that they can price more effectively, measure their performance more efficiently and understand the market better.

Lighthouse is trusted by over 70,000 hoteliers in 185 different countries. It’s the only platform to provide real-time information on hotels and short-term rentals. Our goal is to provide an unmatched level of customer service. We consider our clients as true partners—their success is our success.

Lighthouse is a great source of information. https://www.mylighthouse.com.