Imagine the following: An international guest arrives on your site, ready to make a reservation. They’re looking at the total in local currency and don’t know what it means. Confused, the customers hesitate. Others proceed with the booking only to be surprised by unexpected conversion fees from their bank. This is a bad experience for guests and can cost hotels money in the form of conversion fees or lost business.

There’s another way.

Mews Payments’ multicurrency feature transforms the way hotels manage international transactions. The feature allows hotels to provide seamless, transparent pricing for guests in their preferred currencies. And it doesn’t just give your guests more payment satisfaction – it allows you to make money on the conversion, creating a whole new revenue stream that previously belonged to the banks.

This is how it works

Multicurrency: More options, more experience

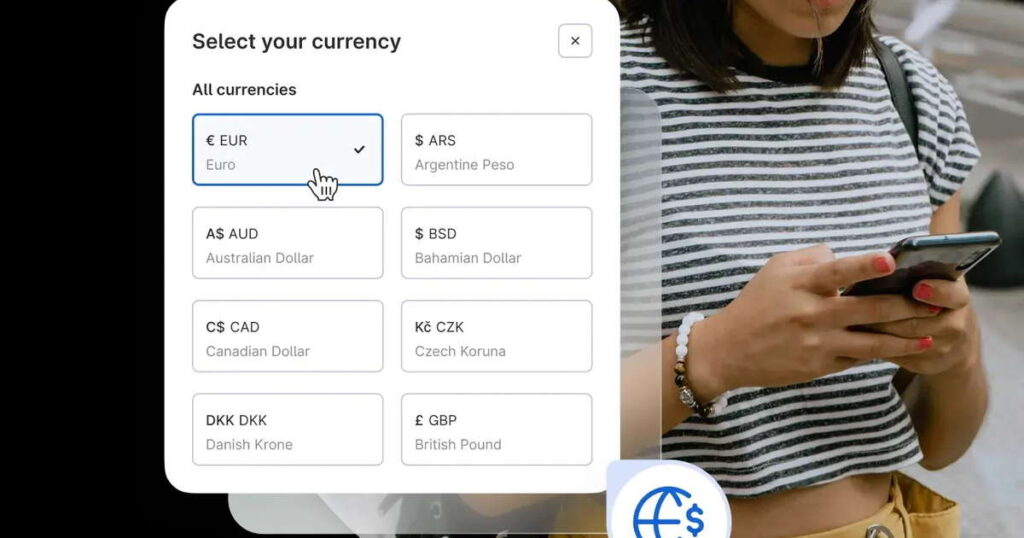

Multicurrency This new dynamic currency conversion option allows international guests to pay in their own currency. Home currency Or in the local currency used by the hotel. They can do this at any stage of the journey, including at booking, arrival, and departure.

This provides guests with clarity, transparency and confidence. Guests can easily understand the price they pay without having to convert currencies mentally or searching “USD to EUR” in the middle of a booking. The bank won’t surprise them with unexpected foreign exchange charges days later.

It’s also about driving more revenue. It’s about increasing revenue.

Multicurrency is a revenue driver

When guests choose to pay in their home currency through the Mews platform, the hotel keeps a portion of the conversion fee – revenue that would otherwise go straight to the guest’s issuing bank. It’s a double win: The hotel gets to unlock a new revenue stream and the guest can see the rate in full transparency.

This extra clarity can also have a significant impact on conversion. According to a recent study, offering local currency as a payment option can boost conversion rates of bookings by up 10%. The price is more easily understood by guests, who are more likely to make a booking. Real-time FX disclosures at the time of payment also help build trust. Happier guests, happier hoteliers.

Multicurrency offers a lot of benefits to hotels that have international guests. It is hard to capture Multicurrency revenues without a modern payment system. Let’s step back to look at your hotel’s payment processes in general.

Uber and hospitality payments

Mews doesn’t consider payments to be a simple back-office operation. They are fully equipped. You can embed the embedded code into your website The journey of the customer is integrated. Payments can be woven throughout the entire guest experience from check-in through to check out, including in the case of a no show.

Mews is similar to Uber, which eliminated the awkward exchanges of cash and cards at the conclusion of taxi rides. Once guests provide their payment information, they are tokenized and securely stored. You don’t need to ask. No friction. No friction. Just smooth transactions that enhance a modern, seamless guest experience.

The real change is happening behind the scenes. Embedded payments don’t just streamline guest interactions – they Drive operational efficiency, Improve cash flow. Reduce revenue leakage Due to unpaid bills and no-shows. Below is more information.

Why embedded is better than integrated

Integration solutions are a way to connect your PMS with external systems, but still they create silos. Embedded payment, on the contrary, are made within the system. From card tokenization through to reconciliation, everything happens in one place. It’s a major win for front-office teams, as they no longer have to hunt down unpaid bills and manually input payment information. The staff can spend more time helping customers and less time checking payments.

And benefits go beyond the front-desk. Embedded payments, which automate and use intelligent workflows to reduce back-office tasks can free up time for staff members to concentrate on strategic and growth initiatives.

It is a waste of time for your team to chase down declined or unpaid payments. This can also cause stress by making uncomfortable follow-up phone calls. These days are long gone. The system securely stores the card information, and allows hotels charge cards after leaving if necessary. It is much safer for hotel guests and efficient for them.

When hotels use embedded payments, they can charge a guest’s card automatically after the cancellation period closes. That’s not just added convenience – it’s reduced revenue leakage and improved cash flow.

Hotel payments are set to have a bright future

No matter if you are a revenue manager or general manager of a hotel, the message to all is that embedded payments have become a strategic element. Multicurrency, for example, shows how much revenue can be generated when payments are fully integrated in the guest journey.

Hotels with embedded payment systems that are automated and user-friendly will run more efficiently. They will also improve guest satisfaction and create new revenue opportunities.

Is your hotel prepared to make payments an asset?

Watch the entire episode of Matt Talks to learn about embedded payments and currency conversion. Matt Welle is joined by Susanne Sanders, Mews’ General Manager of Fintech.

About Mews

Mews The leading platform in the new age of hospitality. Mews Hospitality Cloud, which powers over 12,500 clients in more than 85 different countries, is designed to streamline hotel operations, transform guest experiences, and create profitable businesses. BWH Hotels and Strawberry are among the customers. Hotel Tech Report named Mews Best PMS (2020, 2025), and among the Best Places To Work in Hotel Tech (2020, 2022), 2024, and 2025. Mews raised $410m from investors such as Growth Equity at Goldman Sachs Alternatives and Kinnevik to transform hospitality.