Travel trends are a result of a variety of factors. As a result, it is difficult to predict the future when it comes down to traveler confidence or the impact that this will have on hotel performance. STR conducted a project to evaluate the impact that a potential drop in international inbound arrivals could have on U.S. Hotel demand.

The most likely scenario would have a limited impact

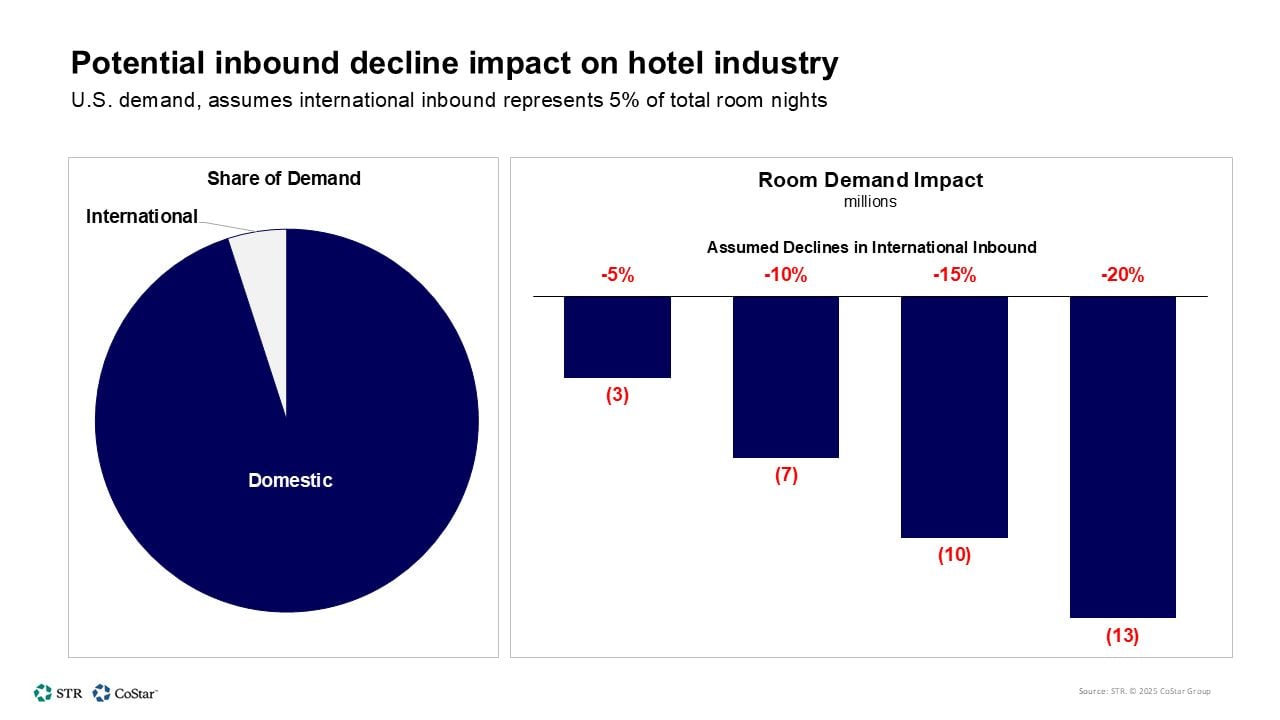

The January 2025 forecast of STR and Tourism Economics is based on an assumption that inbound international travel will account for 5% in total U.S. demand for hotel rooms, measured by room nights. According to recent economic shocks and an 11.6% drop in overseas visitor arrivals in MarchTourism Economics has now projected a decline of 9% in international inbound arrivals in 2025. (- 20% from Canada).

STR created four scenarios based on this projection to demonstrate the impact of a possible decline in U.S. demand for hotels. If inbound international travel falls by 5%, the hotel industry could lose up to 3 million nights. To put this in context, U.S. Hotels sold 1.3 Billion Room Nights last year.

The impact of a steeper decline in international arrivals on the demand for hotels will be more noticeable. Our analysis shows that even a 1% decrease in international arrivals would result in a 5 basis point reduction in hotel demand.

Recent performance

Q1 2025 included several major demand influencers that impacted the industry. Three were built into the calendar – the presidential inauguration in January; Super Bowl shift from the largest U.S. hotel market (Las Vegas) in 2024 to the 38th largest market (New Orleans) in 2025; and the College Football Playoff Championship shift from Houston (2024) to Atlanta (2025). Two were not built into the calendar—the Los Angeles wildfires and continued impact from the fall 2024 hurricanes.

Those demand influencers, along with a later Easter, made for a messy calendar when analyzing potential performance impacts from the geopolitical environment.

March rounded out Q1 with a whisper following two stronger months. RevPAR increased a modest 0.8% in March following gains of 2.1% and 4.3% in February and January, respectively.

RevPAR for the quarter advanced 2.2%, and ADR was the primary driver of that growth all three months. Among day types, weekdays produced the largest increases in occupancy and ADR.

April preliminary data through the 26th showed expected fluctuations, mostly negative, given the Total Eclipse comp from last year then the Easter and Passover holidays. Easter week demand, specifically, was higher than the holiday week the last two years. Overall, for 1-26 April, RevPAR was down 0.3% YoY on a 2.1% drop in occupancy.

Demand in U.S. hotels within proximity to the Canada and Mexico borders has wavered the last two months with no conclusive evidence of a trend.

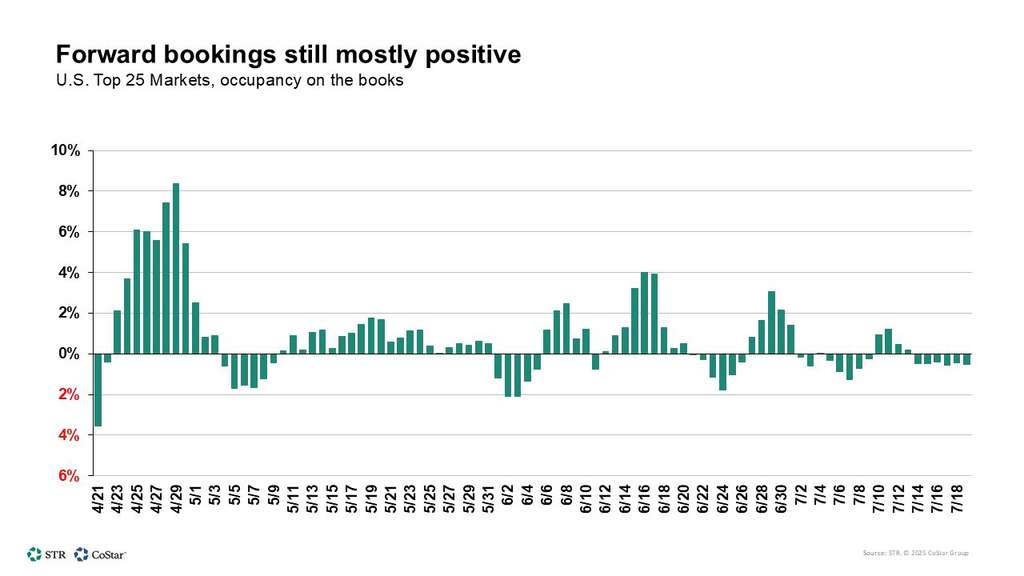

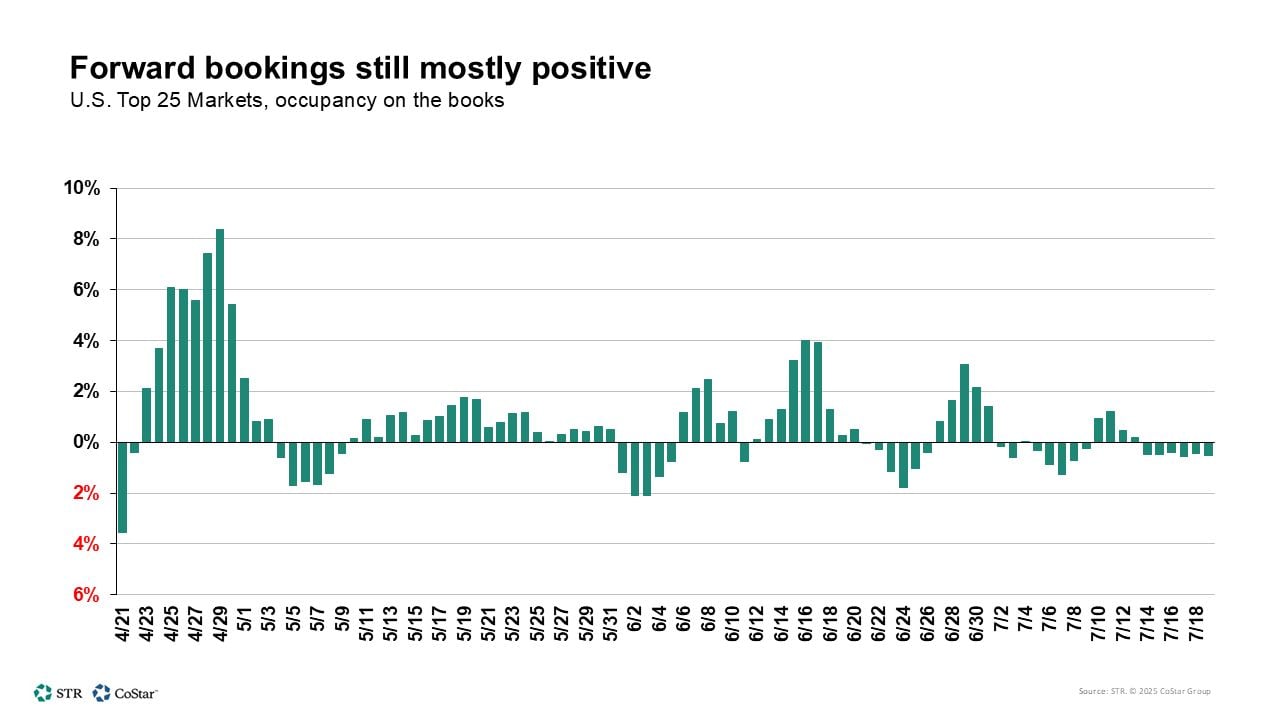

Future bookings

Forward bookings among major U.S. markets in aggregate look mostly steady for the coming months. Of course, the story is not the same in every market. For example, D.C. is down around 3 percentage points on average through June, while San Diego is up around 6 ppts.

Other metrics/indicators we are watching

- ADR growth has been the primary driver of RevPAR in our forecasts this year. However, it will be important to monitor for any slowdown to gauge if properties are discounting rates to gain market share.

- There has been some discussion about potential softening in long-term Group bookings. This could reflect shorter booking windows as planners wait for more market certainty, or it could signal a longer-term decline. Group demand has been resilient in recent years, so any sustained downturn would warrant a reevaluation of the overall demand outlook.

- TSA screenings were up the past three weeks, which aligns with the holiday and spring break travel. In the week ending 26 April, screenings grew 2.7% YoY.

- As shown by data from the U.S. Department of Labor, layoffs have remained mostly stable, and new unemployment claims have seen a slight rise since last year.

- According to the Bureau of Economic Analysis, consumer spending held in Q1 with 3.1% YoY growth.

Looking ahead

In a recent episode Isaac Collazo, STR, and Jan Freitag, CoStar Group (formerly CoStar Group), warned the hospitality industry not to be influenced by recent events and avoid overreacting in their decisions. As expected, the data is noisy and there are many conflicting signals.

Trust the data, and rely on a complete analysis. In the future, there will be a cleaner calendar for comparing year-over-year comparisons. This part of your process should be easier to navigate.

NYU IHIF, in early June, will feature a new forecast from STR & Tourism Economics.

CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP), is a leading online provider of real estate information and analytics. CoStar Group was founded in 1987 and conducts ongoing, extensive research to create and maintain the most comprehensive and largest database of real-estate information. CoStar is a global leader in information and analytics about commercial real estate. Its clients can analyze and interpret the data to get a unique insight into market conditions, property values and available properties. Apartments.com provides property owners and managers with a platform that is proven to help them market their apartments. LoopNet has thirteen million monthly unique visitors on average. STR provides benchmarking data, analytics and market insights to the global hospitality industry. Ten-X is a leading platform to conduct commercial real estate auctions online and negotiated bidding. Homes.com connects agents, buyers and sellers in the fastest-growing residential online marketplace. OnTheMarket is the leading residential property portal for the United Kingdom. BureauxLocaux has become one of France’s most popular property portals to buy and lease commercial real estate. Business Immo, France’s most popular commercial real estate news source. Thomas Daily is Germany’s largest online real estate data pool. Belbex offers the largest selection of commercial spaces for rent or sale in Spain. CoStar Group websites had over 163,000,000 unique monthly visitors on average in the third quarter 2024. CoStar Group, headquartered in Washington, DC, has offices across the U.S., Europe, Canada, Asia, and Canada. We plan to use our corporate website CoStarGroup.com as a distribution channel for company material information from time to time. Visit https://www.costargroup.com/ for more information. CoStarGroup.com.

This news release contains “forward-looking” statements, including statements about CoStar’s beliefs or expectations regarding the future. These statements are based on current beliefs, and they are subject to many uncertainties and risks that could cause the actual results to be materially different from these statements. These differences could be caused or contributed to by a number of factors including the possibility that future media events may not result in an increase in occupancy rates. For more information on potential factors that may cause results to be materially different from those predicted in forward-looking statements, please refer to CoStar’s filings made with the Securities and Exchange Commission. These include CoStar’s Annual Report Form 10-K for year ended December 31 2023 and the Forms 10-Q filed for quarterly periods ending March 31, 2024 and June 30, 2024 and September 30, 202023. CoStar has made all forward-looking claims based on information that was available at the time of this publication. CoStar does not assume any obligation to revise or update these statements as a result new information or future events.