In 2025, hotel operating costs will be a major concern due to the slow growth of projected revenue and increasing inflation concerns. This article focuses on certain operating expenses which were rising in 2024, and provides guidance on how you can monitor and control these in 2025.

The hotel profit margin is a measure of profitability as a percentage of revenue. It’s considered to be a good indicator for the efficiency of hotel operations. Hotel profit margins have decreased in 2023 and 2024 at the Gross Operating Profit level (GOP) as well as Earnings Before Taxes Depreciation and Amortization. This indicates that operating and ownership costs have increased faster than revenues. CBRE’s forecast for February 2025 Hotel Horizons® Forecast Investment Performance, this trend should continue until 2025. It may even extend a couple of years beyond.

Fears of inflation and a slowdown in revenue growth are on the rise.[1]In 2025, the focus will be on operating expenses for hotels. In this article, we provide advice on how to monitor them and control them for 2025. The analysis is based a pre-sample of 2,600 U.S. Hotels that provided us with data for 2025 Trends® The Hotel Industry survey.

Before and After the Election

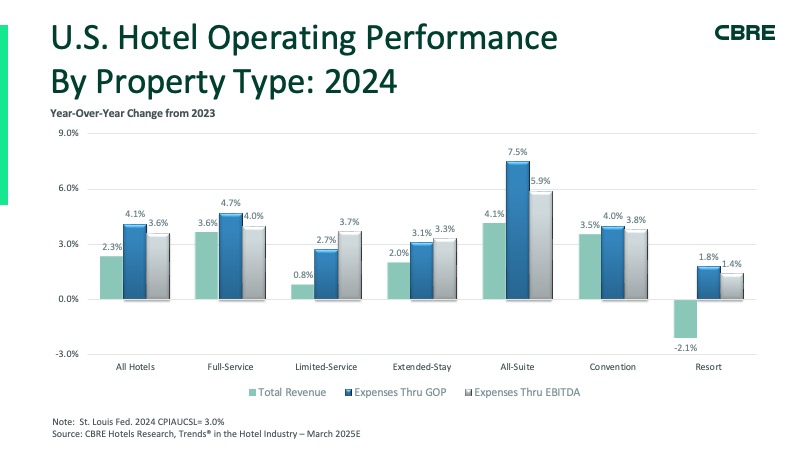

In 2024, expenses above GOP increased by 4.1% over the previous year, outpacing the 3.6% growth in expenses under GOP. Both metrics are higher than 2.3% growth in hotel revenue for the entire year. The trend is consistent across all property types, except for extended-stay and limited-service hotels. Property managers are in general more in control of expenses above GOP than those below GOP. These expenses tend to be fixed and controlled by the owner.

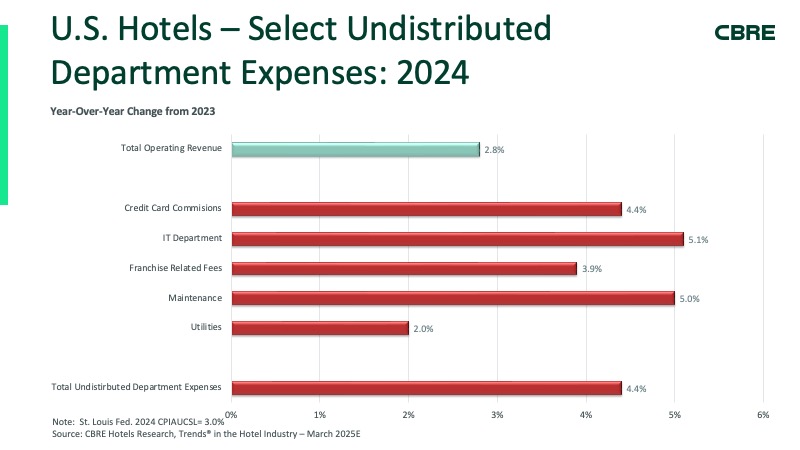

We have highlighted below the percentage increases in 2024 for departmental expenses that are not distributed or operated (above GOP). Although some of these costs may not be large in dollar terms, the growth of a department’s expenses on a per available room (PAR), or percentage basis is a good indicator of relative volatility and can help you identify expenses that need to be controlled.

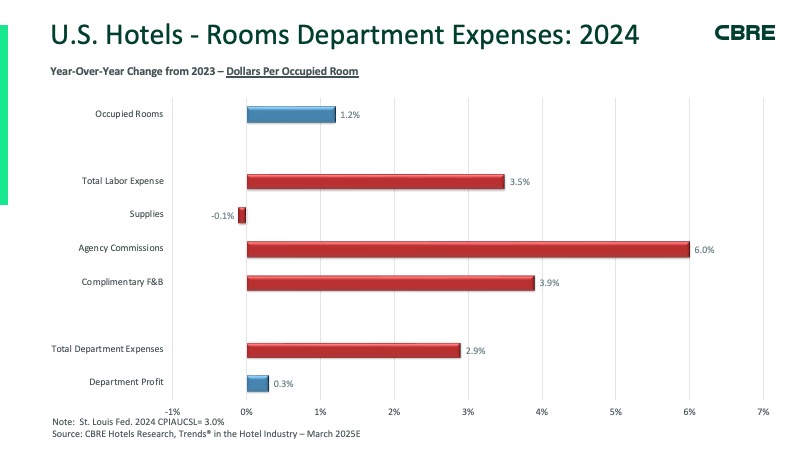

Rooms: 2.2% increase in revenue

Rooms Department expenditures are highly volatile and should be analyzed in terms of dollars per occupied room (POR). The greatest cost increases within the Rooms Department in 2024 were agency commissions (6.0%) and complimentary food and beverage (F&B) (3.9%). Agency commissions are associated with the channels used by guests to book their rooms, while complimentary F&B is influenced by brand standards and loyalty programs, and the cost of the food and beverages purchased.

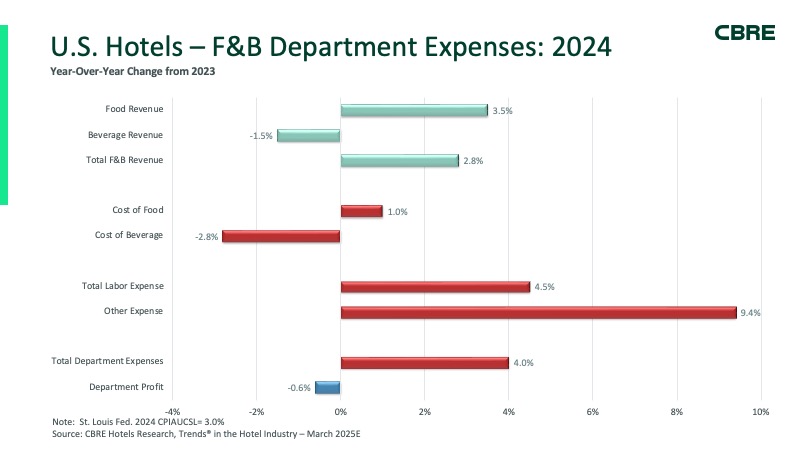

Food and Beverage (an increase of 2.8% in departmental revenue)

Food and beverage prices at hotels are rising in tandem with grocery store prices. Unexpectedly, in 2024 the total purchases of food and beverage were 2.3% less than they were in 2023. The decline in food and beverage costs was more influenced by the changes in revenue sources than the changes in cost control. Hotels have reduced service levels and restaurant offerings, while group bookings are returning. The result has been a higher contribution from banquets and buffets. Both of these provide a lower ratio of food costs. In addition, we saw a drop in beverage revenue in 2024. That led to hotels buying less alcohol.

Labor costs and operating supplies increased in this department by 9.4% and 4.5% respectively.

Undistributed (2.3% hotel revenue increase total)

The majority of the expenses in these departments are fixed. These expenses can severely impact profits when they grow at a faster rate than revenue. Four costs are rising at a pace that is significantly higher than the revenue growth rate in 2024.

Since the credit card commissions accounted for a large percentage of hotel revenue, this increase in expense is quite surprising. Total hotel revenues increased only 2.8%.

– The cost to implement new technology has helped increase the Information and Telecommunications Department’s expenses by 5.1%.

– Fees related to franchises, as well as fees charged in percent of revenue, have increased by 3,9%. Costs associated with the guest loyalty programs increased the highest among this expense category.

Costs of the maintenance department increased by 5.0%. This is due to rising labor costs and supply prices, along with deferred projects.

Utility costs were a bright spot for 2024. In 2024, the combined cost of water, gas, electricity and sewer increased only by 2.0%.

Hotel Revenues Increase by 2.3%

The labor expenses are allocated between the various departments, both those that are operated and those not. (Except for Utilities), however since this is the hotel’s largest expense it should be analysed separately.

In 2024, salaries, wages, employee benefits, and their combined costs will rise by 4,8% for the sample. According to the Bureau of Labor Statistics the average hourly pay for an employee in the hospitality industry increased by 4.0% over the course of the year. This implies that the average number of hours worked in a hotel sample has increased by 0.8%.

We use the same methodology to analyze trends over the last six years in the hotel labor efficiency. The number of hours worked in the typical hotel sample has decreased by 7.4%, while compensation dollars have increased by 22.1%. Summary: Hotels are paying more per hour worked. This reflects the difficulty operators have faced in filling open positions as well as the cuts made to the amenities and services they provide to their guests.

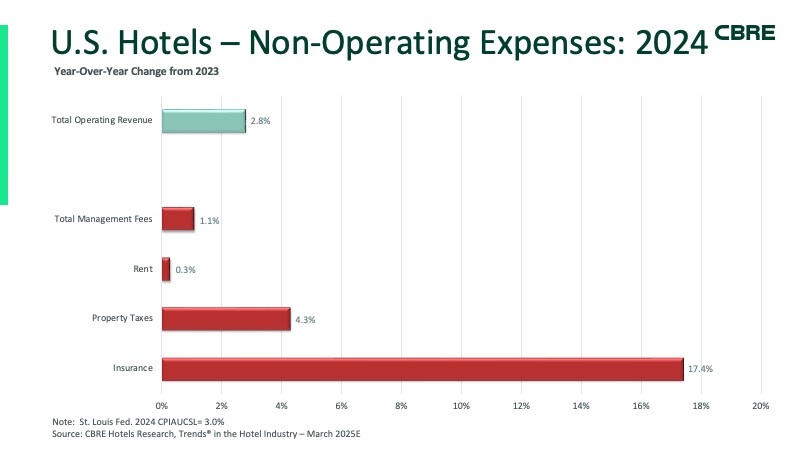

Non-Operating expenses (2.3% increase in total hotel revenue)

Hotel owners can negotiate and appeal new contracts, even though they have little control over the expenses that fall below GOP.

The survey sample’s management fees in 2024 increased only by 1.1%, less than revenue growth of 2.3%. In 2024, we observed a decrease in the number operators who earned a management incentive fee compared to those in 2023.

In 2024, property tax payments will increase by 4,3% as municipalities try to fill their coffers.

In 2024, insurance premiums are expected to continue growing at a double-digit rate.

Cost Containment

CBRE Hotels Asset Management oversees 45 hotels in the world. We monitor hotel performance on behalf of owners as asset managers. Owners and operators are encouraged to follow our advice as they strive to control costs by 2025.

Labor

The ever-increasing trend in labor costs is alarming, and continues to emphasize the need for a critical review of labor productivity. This is because the incentives and processes used by hotel management companies are not evaluated for efficiency.

The return of group business has led hotels to use more contract labor. This additional help comes with a high price. Asset managers must micromanage labor and evaluate each department by position. They also require hotels to utilize staff in multiple departments whenever possible.

By reducing unnecessary positions, and ensuring that the right number of employees are assigned to each supervisor or manager in the company, an operator can increase their productivity and profit margins.

Guest Service Costs

Commissions are growing almost three times revenue-per-available room. Hotels are increasingly relying on third-party revenue to offset the softness in their top line. Bookings are becoming more expensive, whether it’s through online travel agencies or convention housing intermediaries.

Asset managers need to scrutinize bookings in order to maximize profitability. They must consider the type of booking, the cost per booking, and where the bookings are placed. Other costs associated with serving the needs to loyalty members can be found in the complementary gifts and services, complementary F&B, service recovery, and guest amenities expense categories found in each department. Add up the costs for an entire hotel and you can easily reach hundreds of thousands in terms of brand standards or service. To win the loyalty of our guests, we must focus on service excellence rather than the size and number of gifts and free services.

Corporate Resources

We can compare the negotiating power of each hotel brand or manager within our portfolio. This gives us a better understanding of which hotels leverage corporate resources in order to negotiate contracts and purchase.

Technology

Information Systems and Technology should be treated as capital investments. Hotel managers need to prove a return-on-investment, and new technology must replace old systems. This line item saw some of its highest increases during the 2025 budget period, and therefore requires more scrutiny.

Striking the Balance

Right-sizing is more than just cost-cutting. It is also about adopting prudent business practices, eliminating unnecessary costs and services, cutting waste, improving productivity in the workplace, and restoring acceptable and sustainable profitability.

Robert Mandelbaum (robert.mandelbaum@cbre.comCBRE Hotels Research is headed by Andrea Grigg. Andrea Grigg (Andrea.Grigg@cbre.comCBRE has a Senior Managing director, the Global Head for Hotel Asset Management. For benchmarking your property’s operational costs, visit pip.cbrehotels.com/benchmarkerContact us websales@cbre.com. This article was originally published in Lodging’s April 2025 issue.

[1] University of Michigan March 2025