INVESTMENT A ACTIVITY

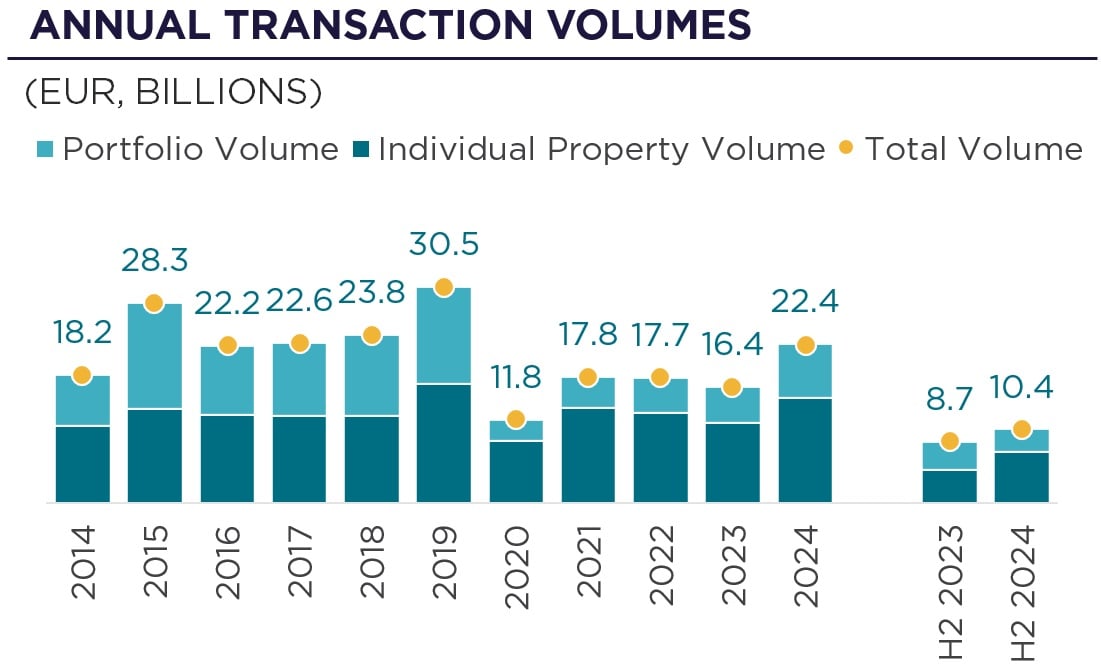

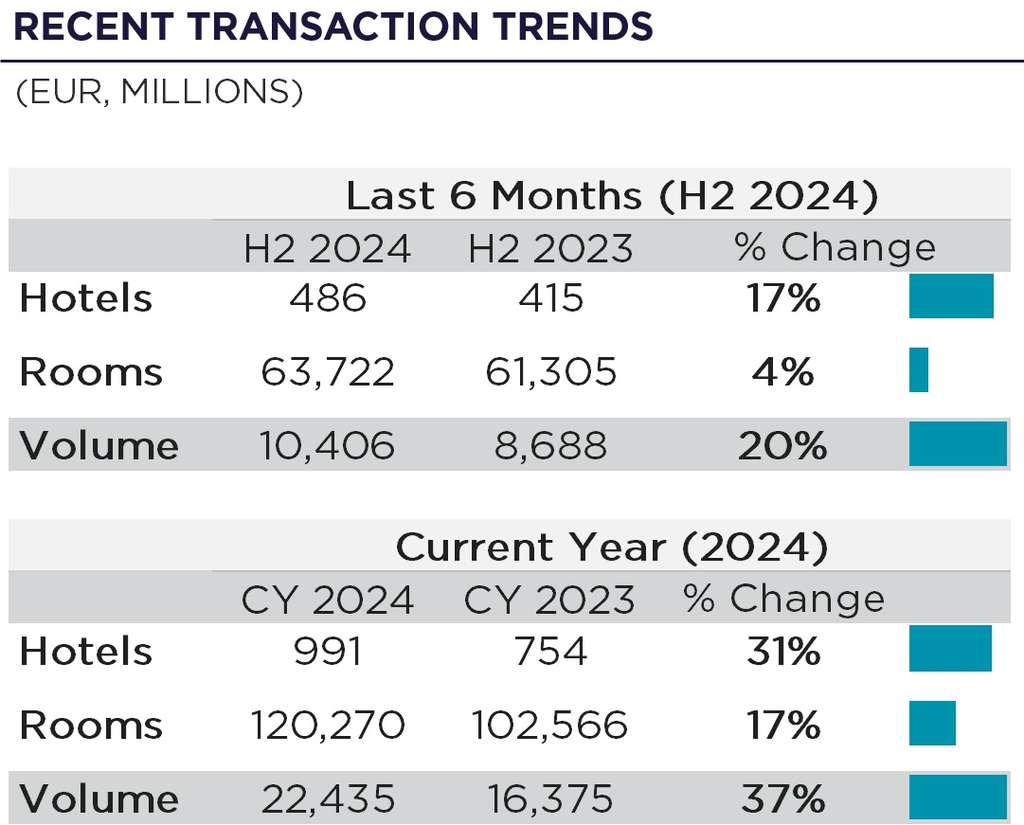

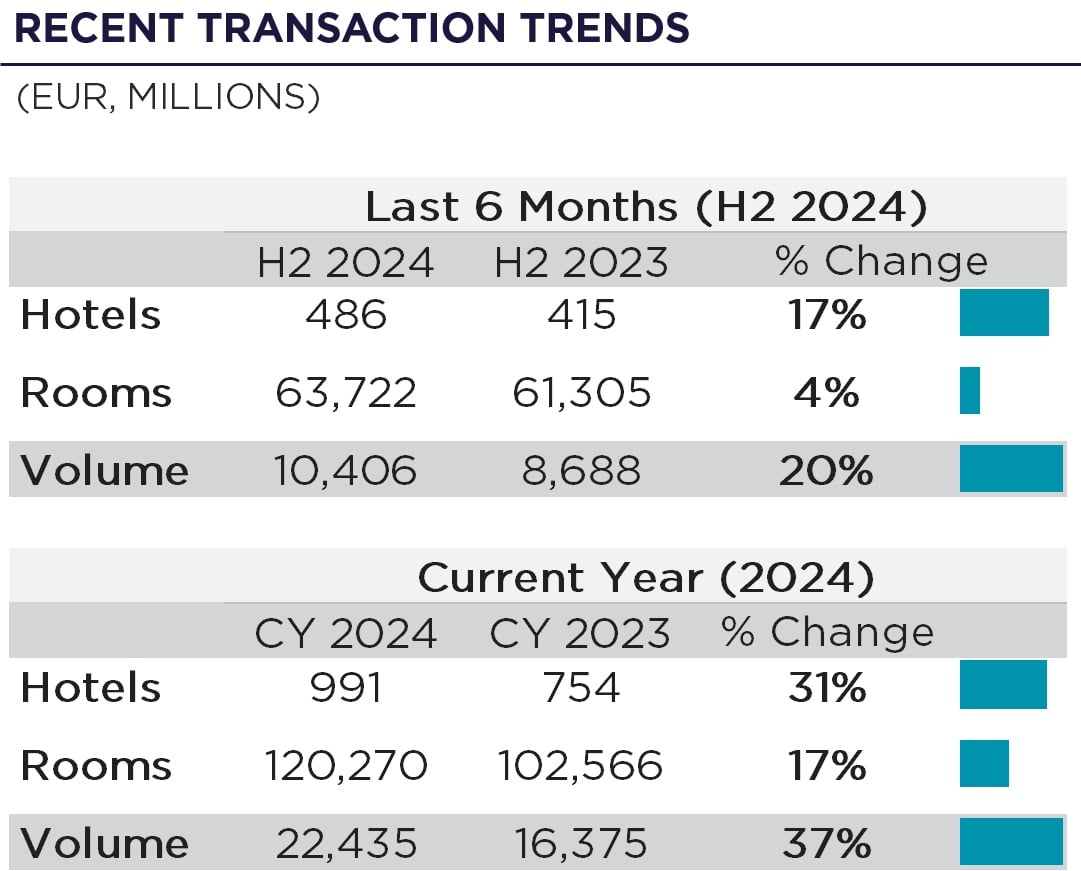

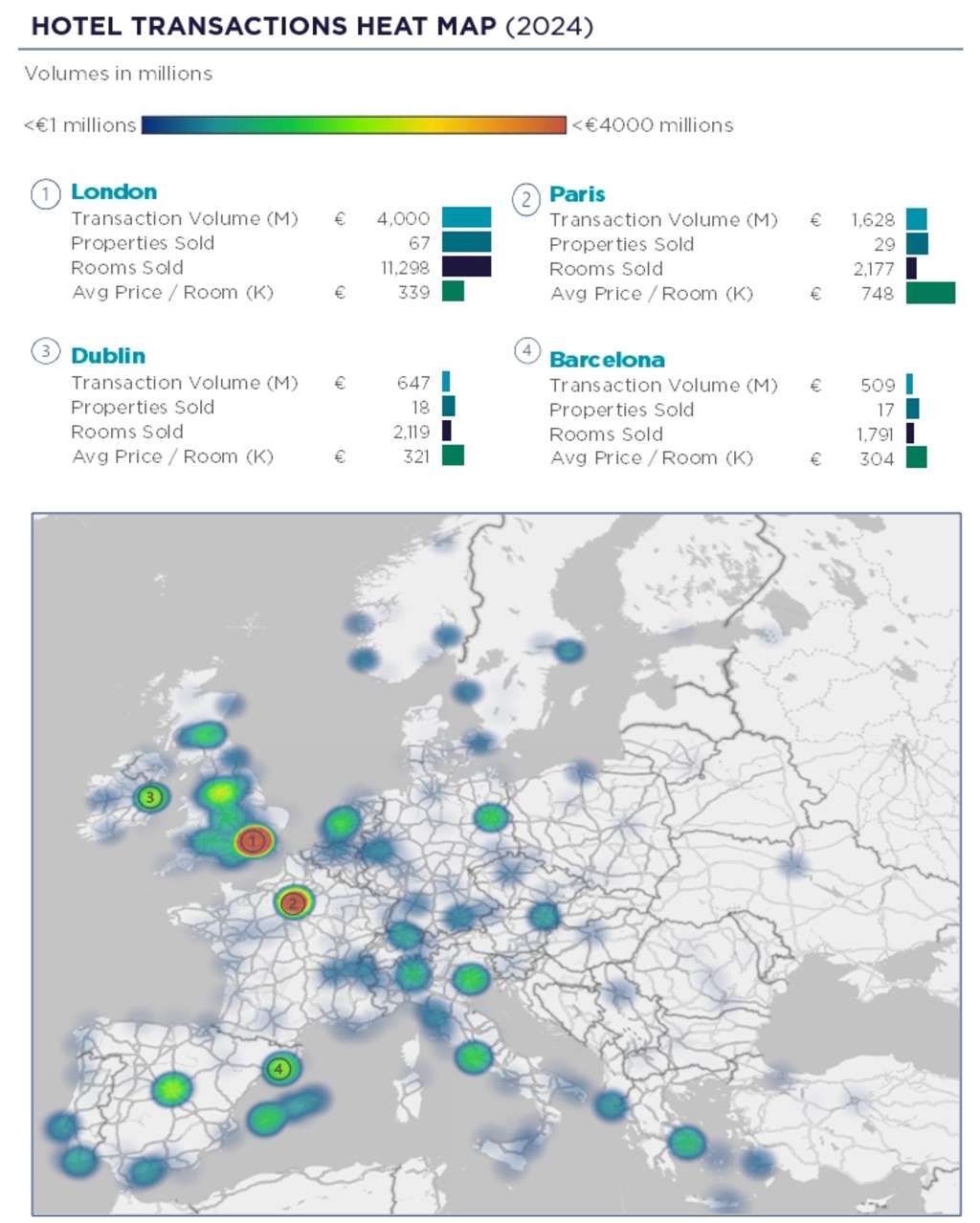

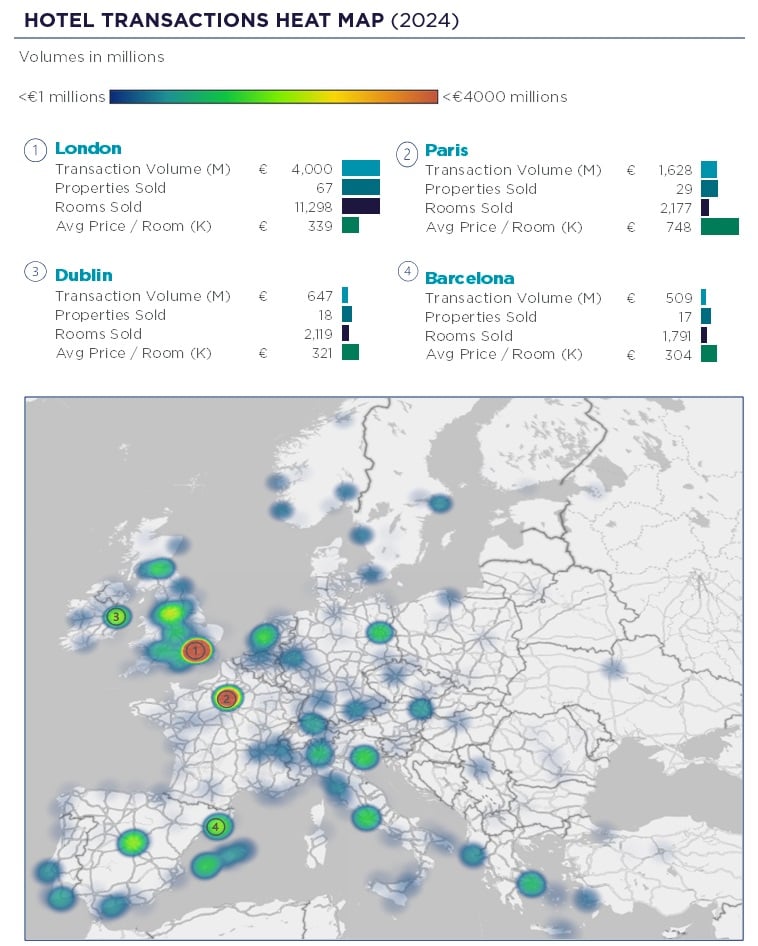

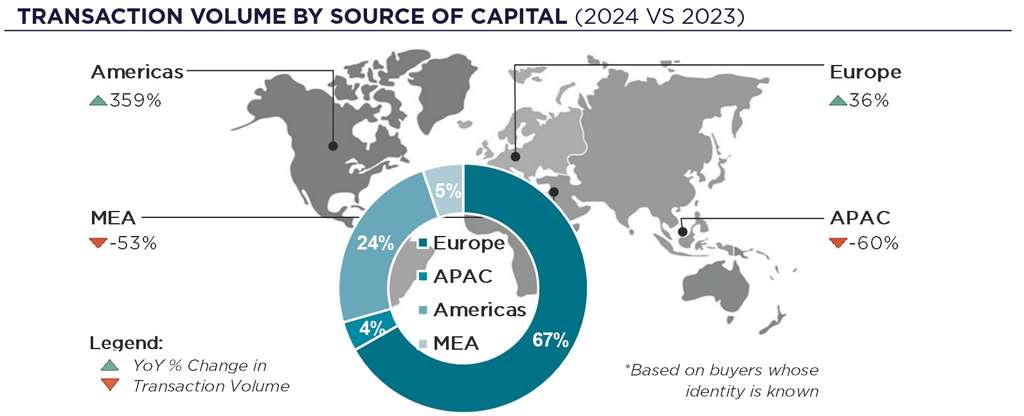

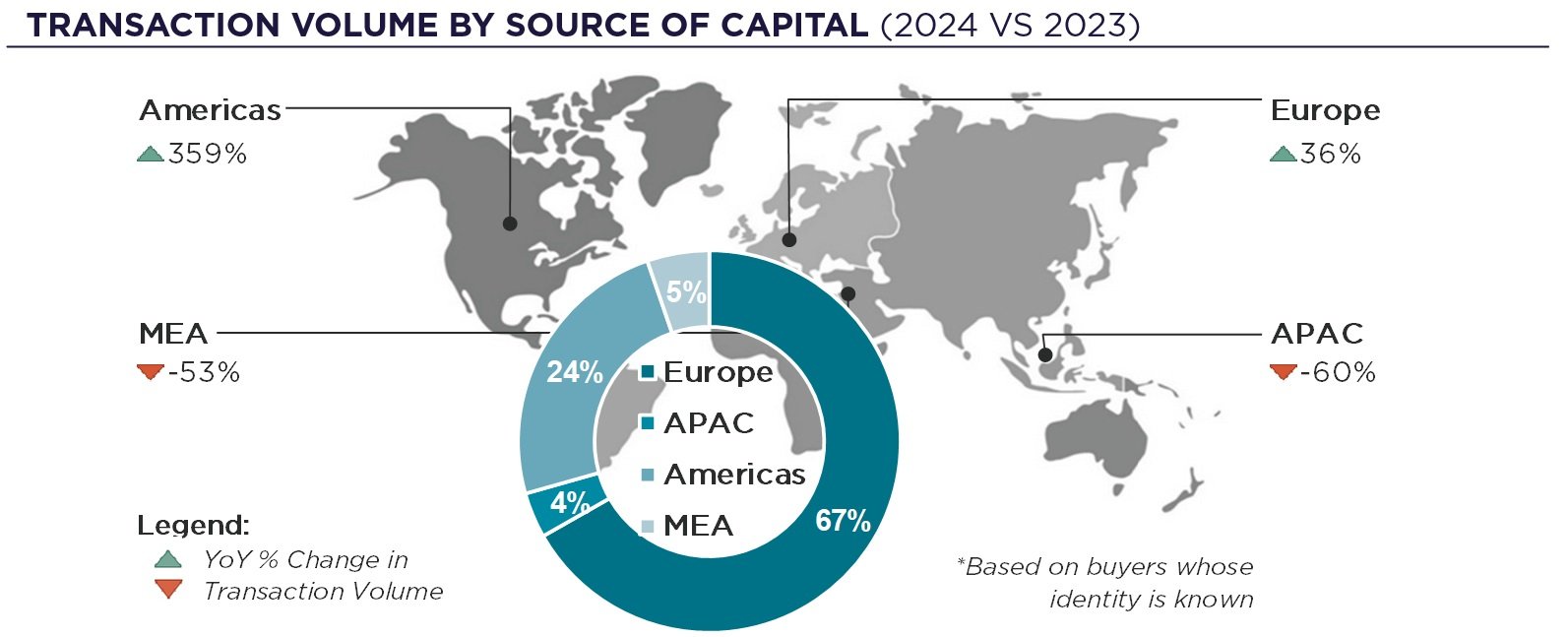

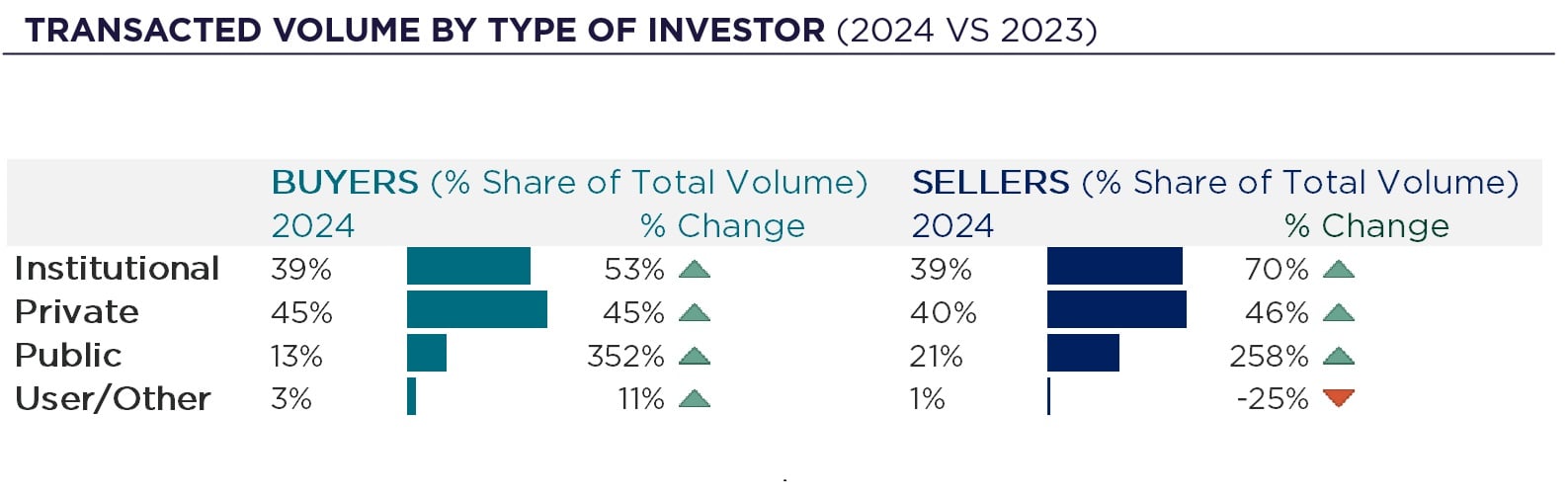

European hotel transactions exceeded €10.4Bn in H2 2024, involving 486 properties and close to 64K rooms. In 2024, European hotel transactions totaled EUR22.4Bn, the highest level since 2019. This is up 37% over 2023 (12% behind average for 2015-2019). The UK, Spain and France were the most active hotel investment markets, accounting for 59% of European volumes in 2024 with €13.2Bn (+38% vs 2023). Notably, the UK reclaimed its leading position in Europe, with €7.8 billion transacted in 2024 (+197% vs 2023). The top 10 markets saw the largest increases in investment relative to 2023 in Greece (+294%), Norway (+128%), Ireland (+218%), and the UK (+197%).

PRIME YIELDS

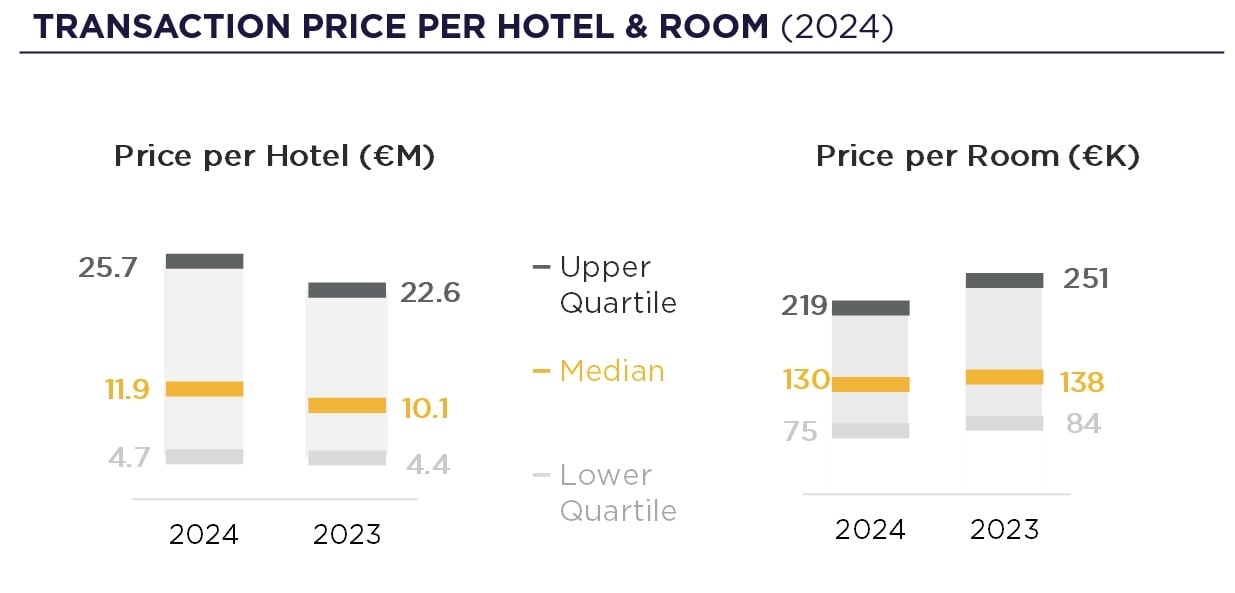

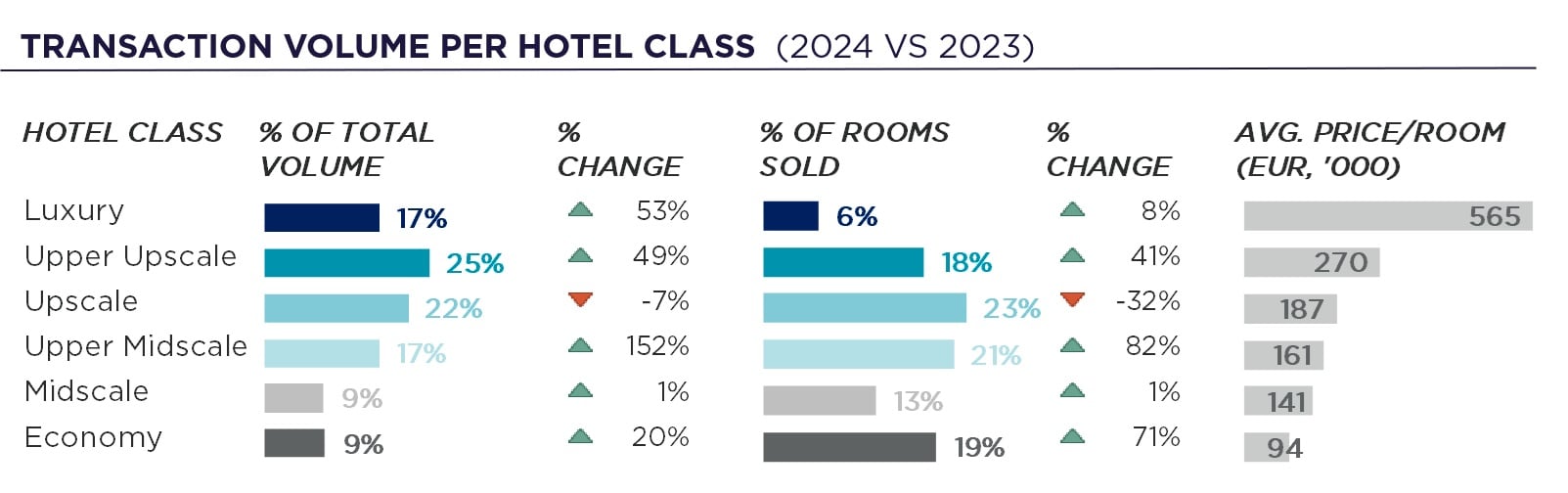

The average price per room in Europe was €201K in 2024, down from €216K in 2023. This decline reflects shifts in transaction composition (by class and location) rather than an indication of continued discounting in the hotel sector. On the contrary, following decompression in 2023, yields remained generally stable in 2024, with values further supported by growing income and minor compressions for the “best of the best” deals in markets with high entry barriers. According to MSCI, cap rates in Europe declined by 3.9bps between Q4 2023 and Q4 2024.

SUPPLY

Despite strong interest in the hospitality sector, new hotel development has slowed in recent years due to rising construction costs, reduced leverage and higher debt expenses. While converting underutilized office spaces into hotels has gained traction, especially in major cities like London, Paris, Rome, and Madrid, the pace of these conversions is expected to decelerate beyond 2025.

PERFORMANCE

In 2024, hotels benefited from strong performance, with RevPAR surpassing 2023 by 6% (+29% vs 2019). This was driven by a 4% increase in ADR and a 1.1 pp. gain in occupancy (-1.9 pp. vs 2019). The Eastern and Southern Europe regions led the RevPAR growth (+12% and +7% vs 2023, respectively). Among the key European markets, Athens, Madrid and Edinburgh saw the highest RevPAR increases (>18%).

Borivoj Vokrinek

Strategic Advisory & Head of Hospitality Research EMEA

Cushman & Wakefield