Due to conflict, climate changes and US tariffs, the rate of global economic growth is expected to decline from 3.1% in 2020 to 2.9% in 2030.

- US real GDP expected to grow by 1.6% as inflation reaches 3%

- In a worst-case scenario, US tariffs may cost businesses up to USD1.2 billion.

- India and Southeast Asian countries to remain world’s fastest growing economies

Lan Ha, Head of Insights for Economies and Consumers, Euromonitor International The pace of global disruptions has increased due to ongoing conflicts, extreme climate conditions and uncertain future trade conditions. Volatility in the global market is no longer an exception. It’s now the norm.

Euromonitor recently published its report. Market Volatility: Risks and Opportunities Ahead, In a worst-case situation, the global GDP could fall by USD 3.4 billion.

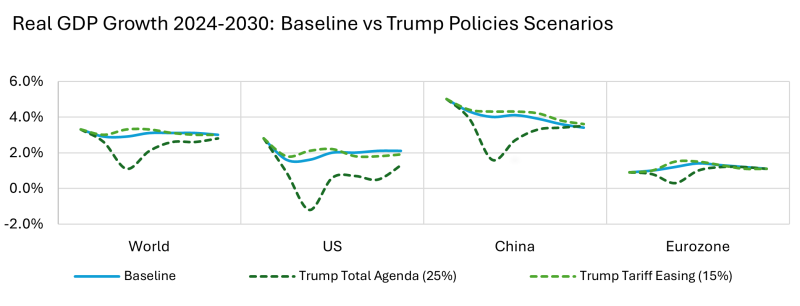

Total Trump’s scenario could see global inflation surge to 5.7% by 2025, and the US enter recession in 2026.

Source: Euromonitor International Macro Model

Note: The data from 2025 and beyond is updated. 7 July 2025

Trump’s return to protectionist US policies has reignited concerns about a global trade war. According to Euromonitor’s Trump Total Agenda scenarioAs supply chain disruptions, and rising import prices ripple throughout the global economy, inflation could rise to 5,3% in 2025.

The economic outlook in the US is becoming more fragile. By 2026, the country is at a greater risk of experiencing a policy-induced economic recession. This could end a decade of resilience. Euromonitor International has revised its forecast of US real GDP growth to 1.6% from 2.1% earlier in the year. Inflation is expected to rise from 2.3%.

Supply chains and commodities are still struggling due to climate events and ongoing conflict.

As geopolitical tensions and extreme weather continue to disrupt global supply chain, manufacturers are turning their attention toward resilience amid uncertainty. This includes nearshoring production and creating future-proofed products. According to Euromonitor’s Macro Model, a 20–40% surge in commodity prices could push global inflation up by 1 percentage point in 2025, adding further pressure on businesses.

If the “Liberation Day’ scenario is taken into consideration, it becomes even more difficult for businesses. Tariffs can cost US importers up to USD 1 trillion. Manufacturers will also see their component costs increase by 20 percent.

Ha said: “Uncertainty has become the norm” Businesses must be able to respond quickly and make decisions based on data, scenario planning and diversifying supply chains. “Innovation and growth can only be achieved when businesses have a thorough understanding of their consumers and the markets in which they operate.”

Asia Pacific remains the key region for growth-oriented companies

Southeast Asian nations and India still offer great opportunities, despite an uncertain environment. India’s strong growth in the domestic market is being driven by an expanding middle-class, an expanding domestic market and a projected GDP of around 6.5% annually over the next 3 years.

In fact, leveraging on India’s economic resilience has proven to be a successful strategy for global FMCG leaders like Unilever and Nestlé, with acquisitions and new product launches happening in 2024 and expected to increase in 2025.

Visit Euromonitor Trump policies insights page For more information, please click here.