CoStar You can also find out more about the following: Tourism Economics Further downgraded growth forecasts were released in the revised U.S. Hotel Forecast for 2025-2026 at the 17th annual Hotel Data Conference.

Due to the continued poor performance and increased macroeconomic concerns, growth rates have been lowered for all top-line metrics. These include demand (-0.6ppts), average daily revenue (ADR) (-0.5ppts) as well as RevPAR(-1.1ppts).

Similar adjustments have been made for 2026. These include: ADR (-0.3ppts), RevPAR (0.7ppts), Demand (-0.5ppts).

Amanda Hite is the president of STR. She said that “unrelenting inflation and uncertainty, combined with difficult calendar comps and changes in travel patterns have led to lower demand.” As the year progressed, rate growth has converged closer to demand. In the next 18-months, we expect little to change in the economy, but are confident that hotel performance will improve once the trade negotiations have been concluded and the effects of the budget reconciliation act become apparent.

“The slowing U.S. economy should absorb the effects of tariffs without tipping into a recession,” said Aran Ryan, director, industry studies, Tourism Economics. “The current environment—characterized by slowing consumer spending, reduced business capital spending and declining international visitation—will transition to one boosted moderately by tax cuts and less policy uncertainty as we look to 2026.”

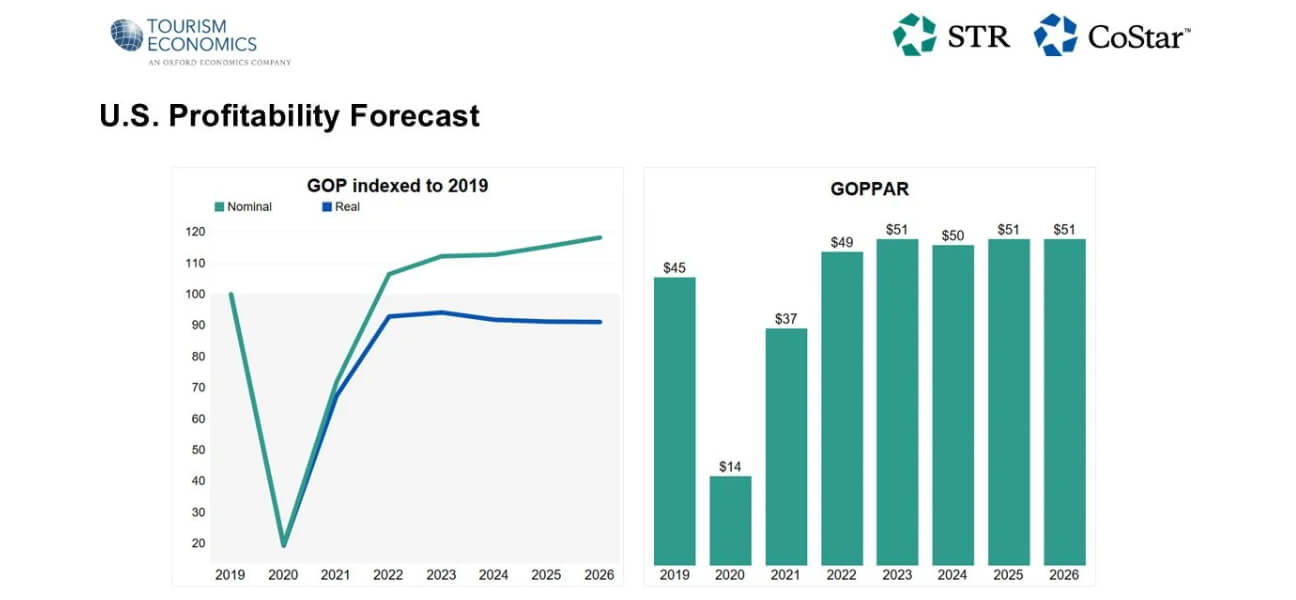

“While our GOPPAR forecast remains unchanged from the previous revision, GOP margins were revised down 0.3ppts for 2025 and 2.3ppts for 2026, mainly due to a potential increase in expenses, particularly F&B,” Hite said.

The Post U.S. hotel growth forecast downgraded The first time that appeared on hotelbusiness.com.