Hotel Profits Reach a Ceiling. Forecasting is now essential.

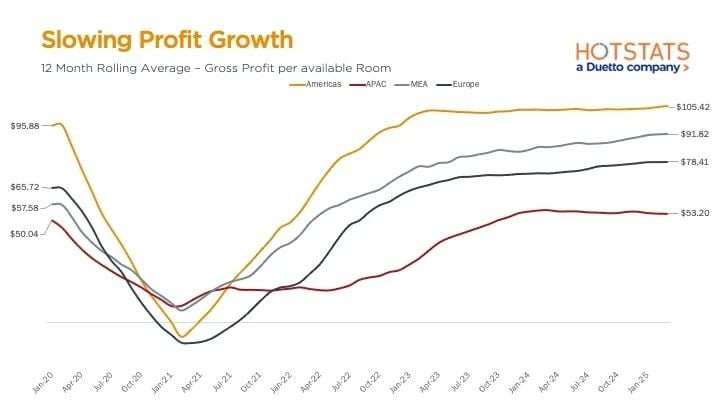

After two years of post-pandemic rebound, hotel operators are now facing a harder truth: revenues are still growing in some regions, but costs are rising faster—and profits are hitting a ceiling.

In key European markets, labour cost increases of 4–6% year-on-year are outpacing revenue growth, eroding GOPPAR and putting pressure on operators to rethink what drives performance.

We are going into a much more difficult time where labor costs are growing more than the revenues in the UK. Michael Grove, Chief Operating Officer at HotStats, during a recent HOSPA webinar

The picture is clearest in the UK, where year-to-date total revenue per available room (TRevPAR) dipped slightly—just under 1%—but labour costs climbed over 4%. The result: a 6.6% drop in profit per available room. Even in London, where performance has outpaced the rest of the country, profit margins remain below 2019 levels when adjusted for inflation.

Across Europe, the story is similar. In Portugal, Belgium, and Austria, flat or marginal revenue gains have translated into negative profit territory. In contrast, markets that grew revenue by more than 3.5% are the only ones showing meaningful margin expansion.

If your market is growing more than 3 to 3.5%, that’s the point where you start seeing margin growth to offset these cost increases

, Grove added.

That 3.5% figure is more than a trend—it’s emerging as a tipping point in GOPPAR trends for 2025.

From Backward Metrics to Hotel Profit Forecasting Tools and Real-Time Margin Control

This divergence between revenue and profitability has brought a new imperative into focus: forecasting isn’t just about predicting occupancy anymore—it’s about protecting margin through smarter tools and insights.

To do that, operators need to connect what’s coming with what’s happening. That means merging forward-looking demand data with actual cost and profit performance—and measuring success not only by RevPAR but by how much revenue flows through to the bottom line.

A growing number of operators are now embracing a more integrated approach to performance—Duetto‘s Revenue & Profit Operating System (RP ‑ OS). It’s a unified platform that brings together every part of the hotel revenue and operations – pricing, forecasting, reporting, group optimisation, loyalty, and profit insights – all under one roof.

Rather than managing revenue and cost in silos, RP‑OS aligns commercial and operational strategies using real-time data. These types of hotel profit forecasting tools help hotel teams see around corners, connect strategies, and make smarter, more actionable decisions across hotel departments.

It’s a shift from simply filling rooms to managing space, staffing, and services in a way that protects profitability in real time through hospitality margin control strategies.

My message has been around driving revenues and looking at the best ways hotels can look at opportunities to pull new levers and drive new revenue streams

, Grove explained. Labor will continue to be a challenge.

The challenges are clear: labour will remain volatile, energy is only temporarily softening, and food and beverage margins are now under 20% across the UK—closer to 15% in London. And while group and event business shows some promise later in the year, the slowdown in other ancillary revenues signals that operators can’t rely on top-line growth alone.

This is why smarter forecasting and tighter cost control are no longer “optimisation” tactics—they’re survival strategies.

For hotel executives, that means moving away from siloed reporting and adopting tools and frameworks that connect revenue strategy with operational reality. Those who can see both the future and the present in one view are in a stronger position to act before margin erosion sets in.

What Comes Next in Hotel Profitability

There’s no single fix—but there is a pattern. Markets growing more than 3.5%, operators who blend future demand signals with actual cost data, and teams who treat forecasting as a margin tool—not just a planning exercise—are the ones adapting fastest.

GOPPAR trends in 2025 show that profit ceilings aren’t inevitable. But seeing them early—and acting fast—is what will separate the hotels that hold the line from those who get left behind.

If you’re rethinking how to connect future demand with actual performance—and looking for better ways to manage cost pressures using hotel profit forecasting tools—reach out to www.hotstats.com You can also Email us at [email protected] Start a conversation

HotStats

HotStats – a Duetto business – is a global benchmarking company that offers specialized analysis of financial and operational information from hotels around the world. This provides hotel owners, operators, and investors with valuable insights into the financial performance of their properties against their competition – an invaluable resource for weighing options and evaluating investment opportunities. For a quick demo, email us at [email protected] Visit www.hotstats.com.