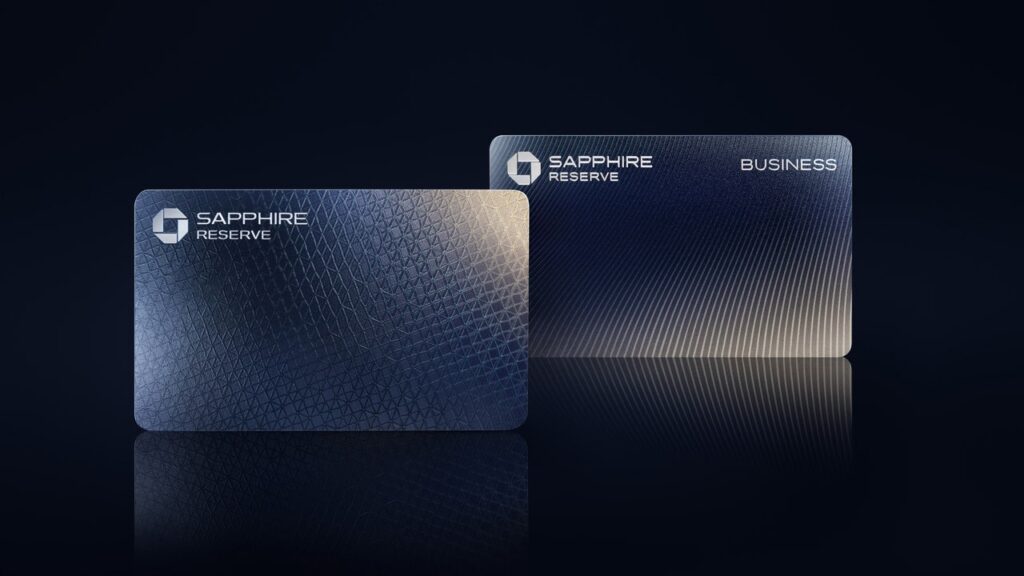

The most popular travel credit cards of all time is getting a major facelift—and a much higher annual fee. Chase Sapphire Reserve will have a new design and updated benefits in the near future, including new credit of nearly $1500 which can be used for travel, dining and lifestyle purchases. This is on top of its $795 annual fee.

The cardholder can earn eight Chase Ultimate Rewards Points per dollar on purchases made with the card. Chase Travel portalThe cardholders can redeem the points they have earned for travel by visiting the website. With a new feature, Points Boost, cardholders with the refreshed Chase Sapphire Reserve get “discounts”, when redeeming their points for premium flights and hotels.

The refreshed website is now available. Chase Sapphire Reserve Some cardholders will lose a few benefits they have enjoyed since the card was first introduced nearly ten year ago. Some of the most popular perks, such as its comprehensive benefits package, remain unchanged. travel insurance benefits You can also get a flexible $300 annual credit for travel. What you need to be aware of about the changes that will come into effect for the Chase Sapphire Reserve on June 23.

What is the Chase Sapphire Reserve new annual fee for?

On June 23, the Chase Sapphire Reserve will increase its annual fee to $795, up from $550. This is the most expensive premium travel rewards card we have seen to date. The Platinum Card® from American Express The current annual fee is $695.

You’ll need to pay an additional $75 per year if you want a card for an authorized user (like a spouse or child). Authorized users receive all of the benefits that you enjoy as a primary cardholder. airport lounge access privileges.

What are the new Chase Sapphire Reserve annual credits?

Chase Sapphire Reserve will receive new annual credits worth nearly $1500, which can be used to offset the increase in annual fee.

Most useful for travel is a new credit of up to $1,000 per year for those who qualify. hotel stays Booked through Chase Travel Portal worth up to $500 (2-night minimum requirement); Dining Credits at Restaurants that Partner with Chase Reserved by Sapphire Credits for purchasing tickets via StubHub and Viagogo, worth up $300 (activation is required). These benefits are divided into bi-annual credits. You can use 50% of your credit in the first part of the year and the rest in the second.

Cardholders will also receive up to $250 annually in Apple Music or Apple TV+ credit (one time activation is required) and up to $100 for Peloton purchases, such as a membership.

If you can maximize just two or three of these benefits each year—say, the $500 hotels credit and the $300 restaurants credit—you’ll essentially earn back the Sapphire Reserve’s new annual fee of $795. You should also keep in mind that these benefits are only available for certain purchases through Chase’s partners and you are only allowed to use up to 50% of the credit each year. Track your purchases to make sure you’re able to take advantage of the credit each time it becomes available.

What is the earning rate for the new Chase Sapphire Reserve card?

The new Chase Sapphire Reserve earns 8 points per $1 on all travel bookings through Chase Travel, 5 points per $1 on eligible Lyft rides and 4 points per Dollar (4x) for direct bookings with Chase. airlines Spending on eligible Peloton products will earn you 10 points per $1 on purchases of eligible equipment, while all other purchases will receive 1 point per $1.