The Manhattan market has been experiencing a protracted post-pandemic occupancy restoration, regardless of sturdy ADR good points. Though legislative and provide adjustments ought to bolster this restoration, latest geopolitical components and the tariffs and coverage adjustments enacted by the brand new federal administration are anticipated to have an effect on short-term lodge market tendencies. Our present demand forecast exhibits a full restoration past 2019 ranges by 2027/28.

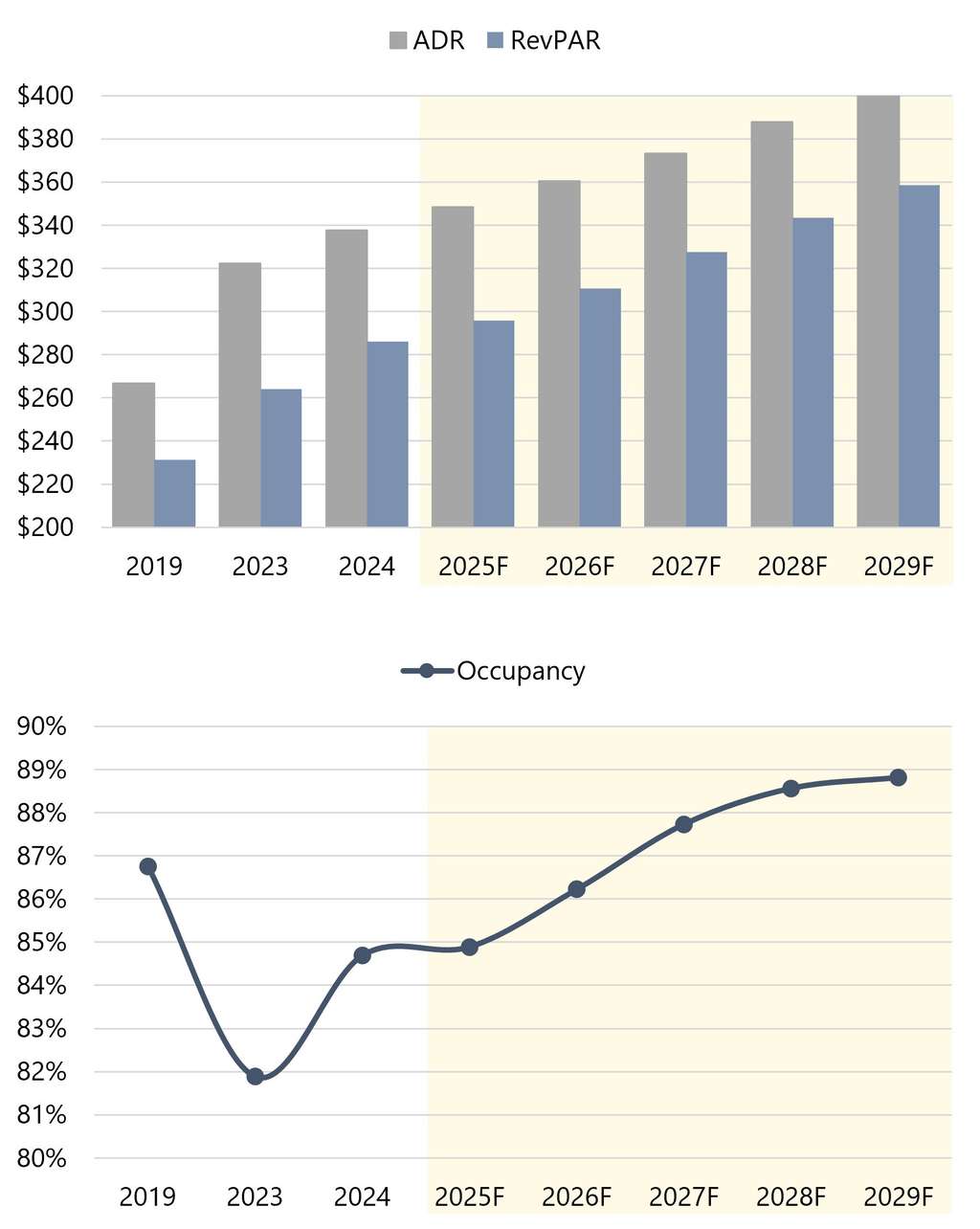

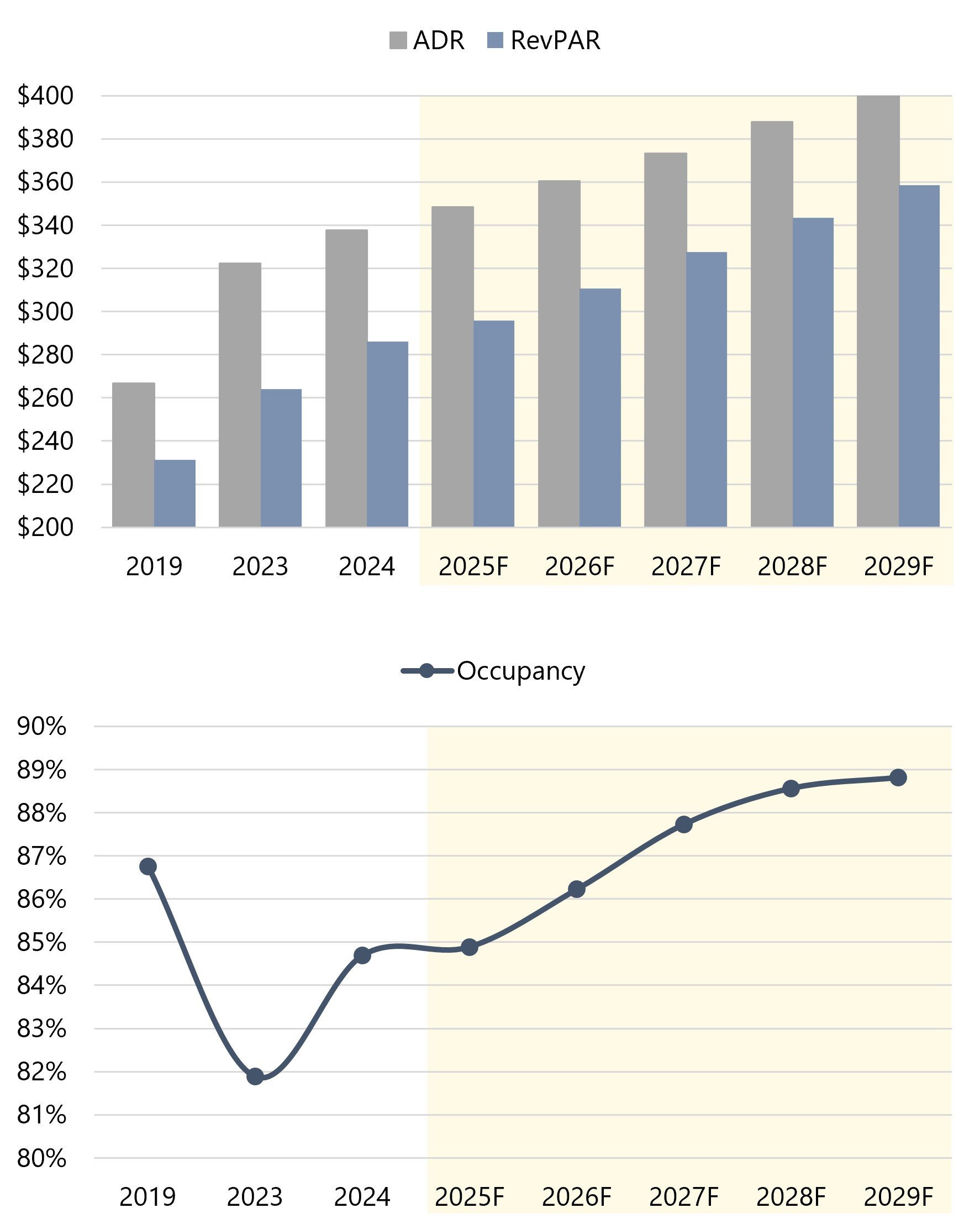

The Manhattan market remained resilient in the course of the decade ending 2019 however was severely affected by the COVID-19 pandemic. The final 4 years have been a interval of continued occupancy restoration for the market, coupled with sturdy good points in common day by day price (ADR) pushed partly by excessive inflationary ranges. In 2023, the market ADR surpassed the 2019 stage by over 20%. ADR then peaked in 2024, exceeding the 2019 stage by over 26%. Occupancy continued to lag in 2024, ending within the mid-80s. Nonetheless, substantial ADR will increase bolstered the market’s 2023 RevPAR roughly 14% above the 2019 stage and its 2024 RevPAR roughly 24% above the 2019 stage.

The complete market restoration would require the entire return of worldwide journey, assembly and group enterprise, and industrial demand. The present geopolitical components and not too long ago imposed tariffs, nevertheless, have created a powerful stage of uncertainty relating to worldwide visitation to the USA. The unpredictable timing and nature of coverage choices and the rhetoric of the brand new administration contribute to the uncertainty of inbound worldwide journey, making it troublesome to supply a near-term forecast.

In early Might 2025, New York City Tourism + Conventions revised its projection of 2025 visitation to 61.4 million, down from the February 2025 forecast of 64.4 million. Nonetheless, inflationary ranges might improve from the not too long ago imposed tariffs, which can not directly increase home journey. Some customers might think about less expensive home journeys to handle discretionary earnings, which might offset a portion of any loss in worldwide room-night demand. A resumed development of inflation will increase might also have an effect on ADR progress.

Resorts as Short-term Shelter Services

Most resorts that closed quickly in 2020 reopened following essentially the most important results of the pandemic. Nonetheless, some have completely closed, others are working as short-term shelters for unhoused people or migrants/asylum seekers, and nonetheless others have been or could also be transformed to alternate makes use of. Previous to the pandemic, a few of the outer-borough resorts have been already contracting guestrooms with the New York City Department of Homeless Services (NYC DHS) to supply short-term shelter amenities for residents experiencing homelessness. Extra lodging amenities have been quickly utilized as shelters throughout 2020 and 2021 to satisfy social-distance necessities in the course of the peak of the pandemic.

Intensifying the housing dilemma, an inflow of migrants and asylum seekers (a lot of whom have been transported straight from different states) started to reach in New York Metropolis within the second quarter of 2022; such influxes turned an everyday prevalence by means of mid-year 2024. Greater than 210,000 migrants and asylum seekers arrived within the metropolis throughout this era. A number of dozen resorts throughout the 5 boroughs have been utilized as short-term shelters as metropolis officers tried to handle the disaster surrounding unhoused residents and the inflow of migrants and asylum seekers.

Given the decreased arrivals of migrants and asylum seekers and the restricted funding, metropolis officers have been closing the short-term shelters in waves since mid-year 2024. Quite a few resorts have reopened to the general public following the shelter closures. Not less than a dozen extra lodging amenities are slated to shut as short-term shelters by the tip of June 2025, together with the Roosevelt Resort in Midtown Manhattan, which served as the primary consumption heart and Humanitarian Emergency Response and Aid Heart for migrants and asylum seekers. Whereas most of those properties are anticipated to reopen to the general public as resorts, the Roosevelt Resort is anticipated to be demolished to make room for a large-scale improvement. Moreover, lots of the resorts at the moment working as short-term shelters, in addition to people who have remained closed with unsure reopening dates, are older belongings which might be in truthful to good situation, and plenty of have important obsolescence drawbacks. As such, we anticipate that over 50% of these resorts have a excessive likelihood of both closing completely or being transformed to a different use over the following a number of years. In some circumstances, the usage of resorts to shelter New York Metropolis’s unhoused inhabitants might turn into a everlasting answer to the town’s reasonably priced housing disaster.

Native Regulation 18

Local Law 18, often called the Quick-Time period Rental Registration Regulation, was adopted on January 9, 2022, requiring all short-term-rental hosts to register with the Mayor’s Office of Special Enforcement (OSE). Native Regulation 18 prohibits reserving platforms (corresponding to Airbnb, Vrbo, and Hotels.com) from processing transactions for short-term leases that aren’t registered with the OSE. On September 5, 2023, the OSE commenced the preliminary section of Native Regulation 18 enforcement to make sure that short-term-rental hosts are utilizing the town’s verification system persistently and accurately. Given the tight restrictions, a big portion of the short-term leases in New York Metropolis usually are not permitted to function. Resorts have reportedly been absorbing a portion of this room-night demand. Resort homeowners and operators available in the market proceed to fastidiously observe lodge demand tendencies for adjustments that develop in response to Native Regulation 18; nevertheless, a while is required for these tendencies to evolve.

There was continued opposition to Native Regulation 18 from metropolis residents, because the short-term rental restrictions have had damaging monetary penalties for householders who depend on short-term leases for extra earnings. On November 13, 2024, just a few Metropolis Council members introduced Intro. 1107 that may grant some short-term-rental flexibility for homeowners of one- and two-family properties. The proposed Intro. 1107 has full help from the Restore Homeowners Autonomy & Rights group, which contains a number of hundred householders and has been pushing for adjustments to Native Regulation 18. An amended Intro. 1107-A was launched on February 3, 2025. Tenant advocates, lodge business members, and the Resort Trades Council oppose the proposed Intro. 1107 and don’t help the amended Intro. 1107-A. No remaining choice has been made but relating to the amended Intro. 1107-A.

Native Regulation 97

Local Law 97 was handed in April 2019 as a part of the Climate Mobilization Act, which requires that almost all buildings better than 25,000 gross sq. ft should meet new energy-efficiency and greenhouse gas-emissions requirements as of 2024, cut back emissions by 40% as of 2030, and cut back emissions by 100% as of 2050. Many property homeowners and operators have reported that their lodge buildings meet the 2024 and 2030 necessities.

Beginning on July 1, 2025, penalties might be issued for both non-compliance with the necessities or non-reporting. Thus, homeowners of older resorts should have in mind the price of both making the required upgrades or remitting penalty fines. Whereas Native Regulation 97 doesn’t straight have an effect on Manhattan guestroom stock, these potential prices, together with the related greater improvement prices and different bills (e.g., greater property and legal responsibility insurance coverage premiums), have to be thought-about by lodge builders, lodge possession entities, and lodge operators.

Protected Resorts Act (Invoice Int. 991)—Efficient Might 3, 2025

In July 2024, the New York City Council launched the proposed invoice Int. 991-2024, which is named the “Protected Resorts Act.” The proposed invoice underwent just a few revised variations between August and October 2024 following assessment and discussions between the Metropolis Council, Hotel and Gaming Trades Council, and Protect NYC Tourism Coalition. A remaining model of the proposed invoice was signed into regulation on November 4, 2024, and the Protected Resorts Act went into impact on Might 3, 2025.

The regulation contains quite a few service and security necessities, which many resorts already comply with as a part of their normal working procedures. The next are the primary new laws:

- All resorts in New York Metropolis are required to acquire a lodge license, which might be legitimate for a two-year time period, for the operation of the lodge. The lodge operator should get hold of a lodge license renewal each two years thereafter.

- All resorts in New York Metropolis (no matter guestroom rely) should preserve steady entrance desk protection throughout operational hours. As such, at the least one workers member should present entrance desk providers throughout in a single day durations.

- All resorts in New York Metropolis with 100 or extra guestrooms can’t subcontract “core lodge” positions and should straight make use of these workers members. “Core lodge” positions are outlined as entrance desk, housekeeping, and entrance service (e.g., home individual, bell individual, door individual).

- This requirement doesn’t apply to resorts with lower than 100 guestrooms.

- Subcontractor staffing contracts that have been executed previous to the regulation’s Might 3, 2025, efficient date might stay in impact if the contracts present for termination by a sure date.

- A lodge proprietor needn’t straight make use of core staff if the proprietor retains a single lodge operator to handle all lodge operations involving core staff, by which case the lodge operator have to be the direct employer of the core staff.

- All resorts in New York Metropolis with greater than 400 guestrooms (categorized as “giant resorts”) should have at the least one safety guard onsite throughout all working hours.

- No resorts in New York Metropolis, except airport resorts, might provide guestroom bookings for lower than 4 hours.

The lodge license software has been on-line since at the least April 2025, and a big portion of market resorts have reportedly submitted the license software. Resort market members are completely observing your complete course of as all the laws are applied.

NYC Citywide Resorts Textual content Modification

In December 2018, the Metropolis Council adopted a textual content modification to the M1 zoning district laws, making a requirement for a special-use allow for brand new lodge developments in M1 zoning districts. On December 9, 2021, the Metropolis Council adopted the Citywide Hotels Text Amendment, which extends the special-use allow requirement to all new lodge development tasks in all 5 boroughs. This primarily eradicated as-of-right lodge improvement in Manhattan.

The Citywide Resorts Textual content Modification additionally requires that lodge development commencing after December 9, 2021, use unionized development workforces. Resort homeowners and operators should then adhere to collective bargaining agreements for hourly workers within the operational departments (rooms, meals and beverage, and engineering/upkeep). Thus, lodge homeowners and operators should think about the upper prices related to these labor necessities. We be aware that meals and beverage operations leased to exterior operators are exempt from the unionized workforce requirement.

Though the event of limited- and select-service lodging amenities is predicted to be stifled by the NYC Citywide Resorts Textual content Modification, the potential stays for the event of upper-upscale and luxurious merchandise the place income era might offset the upper development and operational prices.

Expiration of Native Regulation 50 and New Housing Legal guidelines

Native Regulation 50 was enacted in 2015 to ban the conversion of resorts with greater than 150 guestrooms to alternate makes use of. Underneath Native Regulation 50, homeowners of enormous resorts might convert solely 20% of the guestroom stock to a different use, corresponding to micro residences and pupil housing; at the least 80% of the property’s guestroom stock was required to be retained for lodge use. Native Regulation 50 expired in June 2019; thus, some resorts might function with a decreased guestroom rely in an effort to extend operational efficiencies.

Moreover, the Housing Our Neighbors with Dignity Act, or HONDA (S5257C/A6593B), that was signed into New York State regulation in June 2021 permits financially distressed resorts and workplace buildings to be completely transformed to reasonably priced housing. Furthermore, the Hotel Conversion Bill (S4937C/A6262B) was enacted in June 2022, permitting residential resorts with completely different constructing laws (Class B resorts) positioned inside residential zoning districts or inside 400 ft of such districts to be transformed to everlasting residential models with their current certificates of occupancy.

Manhattan Market Forecast 2025–2029

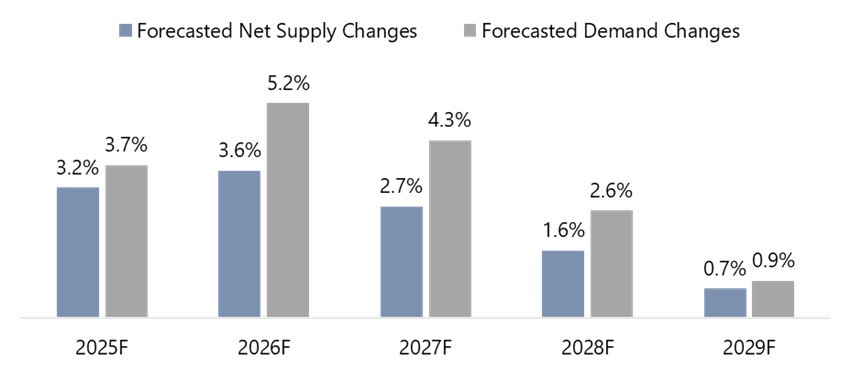

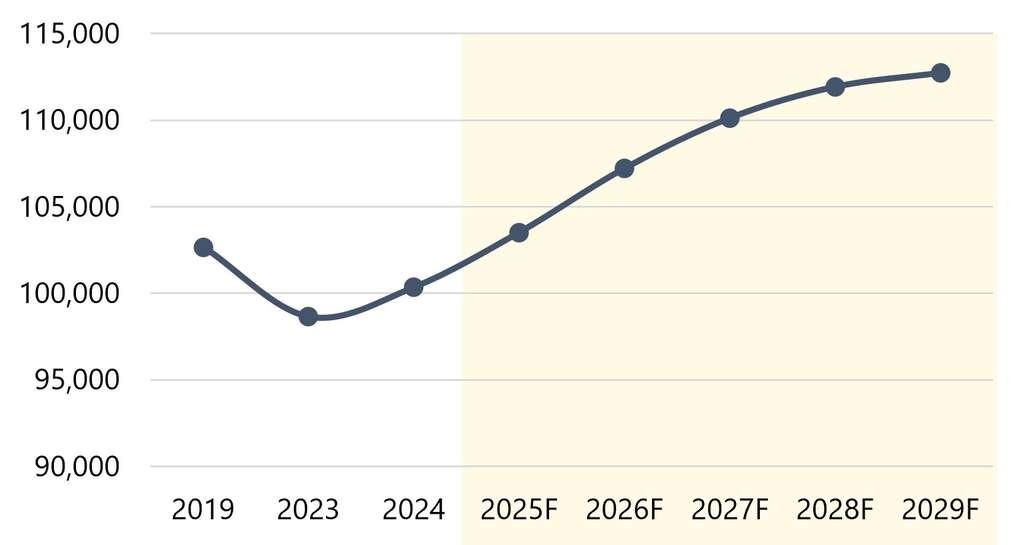

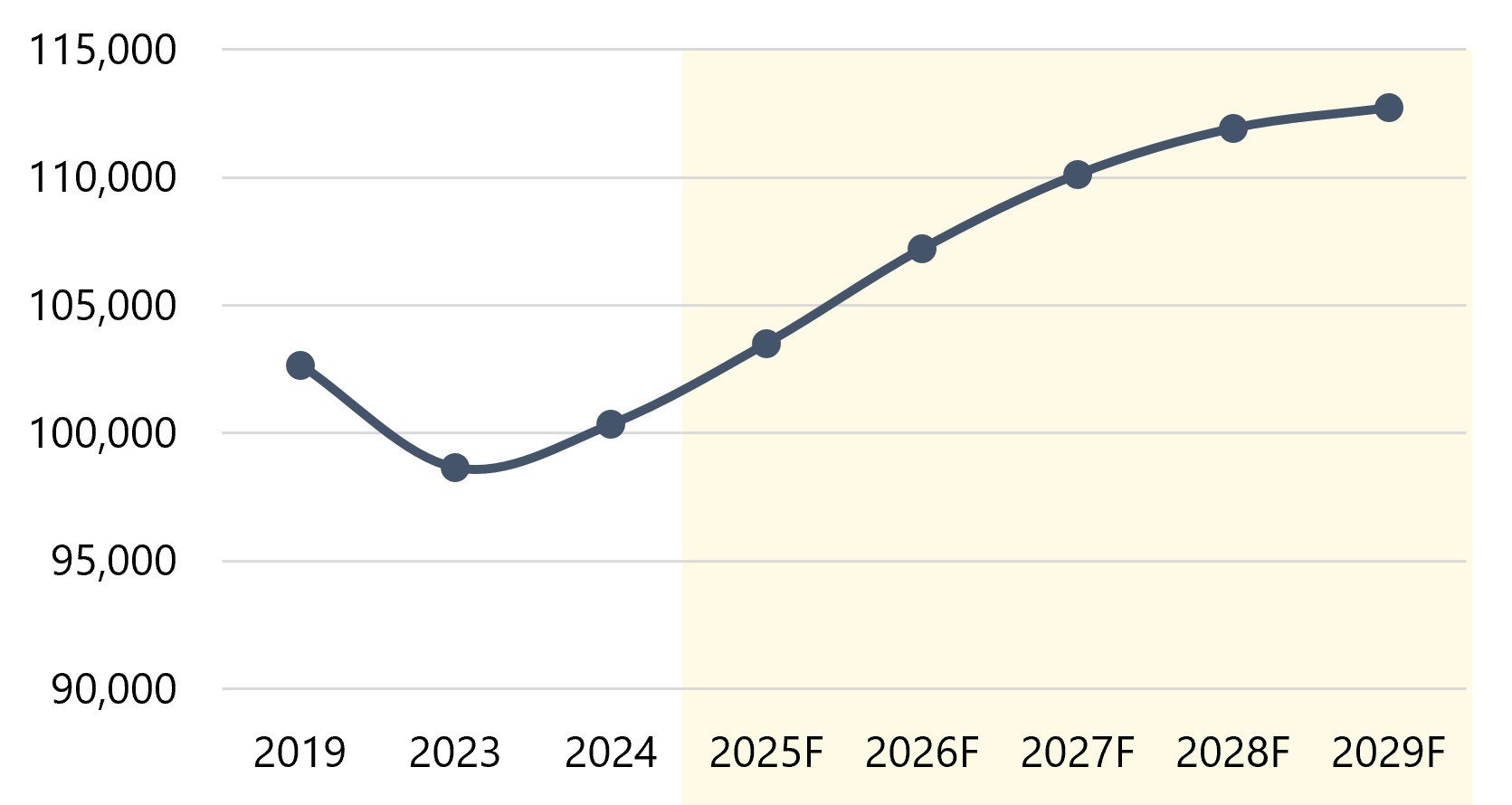

Based mostly on our evaluation of the historic knowledge, a assessment of the online new provide pipeline, the potential short-term impression of the present geopolitical components and imposed tariffs, and the long-term outlook for demand progress, we have now ready the next forecasts for the Manhattan lodging market by means of 2029.

MetLife Stadium has been awarded eight tournaments for the FIFA World Cup 2026, in addition to the World Cup remaining. MetLife Stadium is positioned in East Rutherford, New Jersey, roughly ten miles (by automobile) northwest of Manhattan. Given this location, the World Cup matches might be hosted collectively by New York Metropolis and New Jersey. The eight World Cup tournaments and the World Cup remaining are anticipated to considerably bolster leisure and tourism demand and ADR ranges for the native space. Manhattan is predicted to be significantly affected given the borough’s direct entry to/from northern New Jersey. The present geopolitical components and the brand new administration’s immigration insurance policies might have an effect on visitation for the matches in 2026; nevertheless, the extent of impression stays to be seen.

Strengthening demand and a constrained provide pipeline are anticipated to help continued ADR progress. Contributors to the anticipated demand progress embrace the sustained return of worldwide leisure vacationers, additional gradual return of enterprise journey, and stronger assembly and group exercise. Occupancy is anticipated to achieve the mid-to-high 80s by 2026/27, mirroring the market’s efficiency within the decade previous to the pandemic. We’ve got forecast occupancy to stabilize at 88.8% in 2029, modestly greater than the 2019 peak, given the restricted provide pipeline.

Conclusion

The Manhattan lodging market skilled extraordinary progress within the decade previous to 2020. Throughout this era, demand progress was roughly 57%, which outpaced the 52% improve in provide. Occupancy ranges have been firmly established within the higher 80s throughout this era. Nonetheless, the introduction of recent guestroom stock contributed to a decline in ADR from 2015 to 2017 and once more in 2019.

The COVID-19 pandemic altered the trajectory of Manhattan lodging efficiency and had extreme results available on the market starting in 2020. The market has been experiencing an accelerating restoration for the final three years, with progress primarily as a result of sturdy good points in common price. The present geopolitical components and the imposed tariffs and coverage adjustments of the brand new administration, nevertheless, might have an effect on room-night demand within the quick time period. The market is properly positioned for continued financial success over the long run, supported by a various base of employers, a strong tourism business, and an expanded conference heart, in addition to a number of new and deliberate larger-scale, mixed-use developments. Occupancy ranges ought to return to historic norms as international journey continues to strengthen and New York Metropolis stays a premier gateway vacation spot. Lastly, as the online new provide is absorbed by means of 2028 and the brand new provide pipeline contracts significantly, ADR will increase are anticipated to strengthen, supporting the forecasted RevPAR progress.

At HVS, we flip knowledge into highly effective insights that drive your success. Our distinctive methodology entails conducting major interviews inside native markets, capturing real-time insights and knowledge. This ensures a deep understanding of every market we function in, providing you with a definite aggressive edge. If you companion with HVS, you acquire entry to essentially the most present knowledge, unlocking the nuances of native dynamics and empowering you to make assured, strategic choices. For extra data on the Manhattan lodging market or for assist making knowledgeable funding choices that align along with your targets and danger tolerance, please contact your HVS New York Metropolis hospitality consultants, Roland de Milleret, MAI, at (516) 209-7305 or Patricia Shih at (404) 791-5509.