This sponsored content was developed in collaboration between Skift and a partner.

It’s 5:59 a.m. on a rainy Monday in Chicago. A corporate traveler scans their booking tool and clicks on “book” to lock in a hotel room at an Auckland upscale hotel. That single click unleashes the Global Distribution System (GDS): reservation messages, credit‑card authorizations, and once the guest checks out, a commission to the travel management company (TMC) that facilitated the sale.

You can see that the GDS agency model has been a reliable revenue engine for hospitality.

Roughly 200 million hotel bookings flow through the three big GDS networks Travelport, Sabre and Amadeus) are used by corporate travelers (Amadeus). Corporate travelGDS channels and, by extension,, remain critical to the hotel booking eco-system at a moment when hotel companies are clinging to stable, predictable revenue streams.

GDS Commissions in the Booking Universe: A One‑Slide Crash Course

Demand for hotels is split into two major macro-groups. Direct bookings flow through brand.com, voice/central‑reservation lines, and walk‑ins. Direct bookings are spread out across online travel agents (OTAs), wholesalers and group blocks. GDS is dominated by two commercial models:

- Agency / Post‑PayThe TMC is owed a commission by the hotel after the stay.

- Merchant / NetThe TMC pays the hotel a wholesale price and then sells the room at a higher rate to the travelers. This allows the TMC to make a profit on the markup.

According to Skift Research In 2024, the global gross bookings of hotels from these two models will represent about 25%. This article zeros in on the Agency/Post-Pay model because it generates commissionable revenue, or GDS Commission Share.

GDS Commission share: A global perspective

According to OnyxInsights data, hotels paid an estimated $2.1 billion in commissions to TMCs through the GDS networks in 2024. However, GDS commission share, which represents the share of total hotel commissions incurred by GDS bookings, is unevenly distributed. Understanding gaps can give players an edge in the hotel booking game.

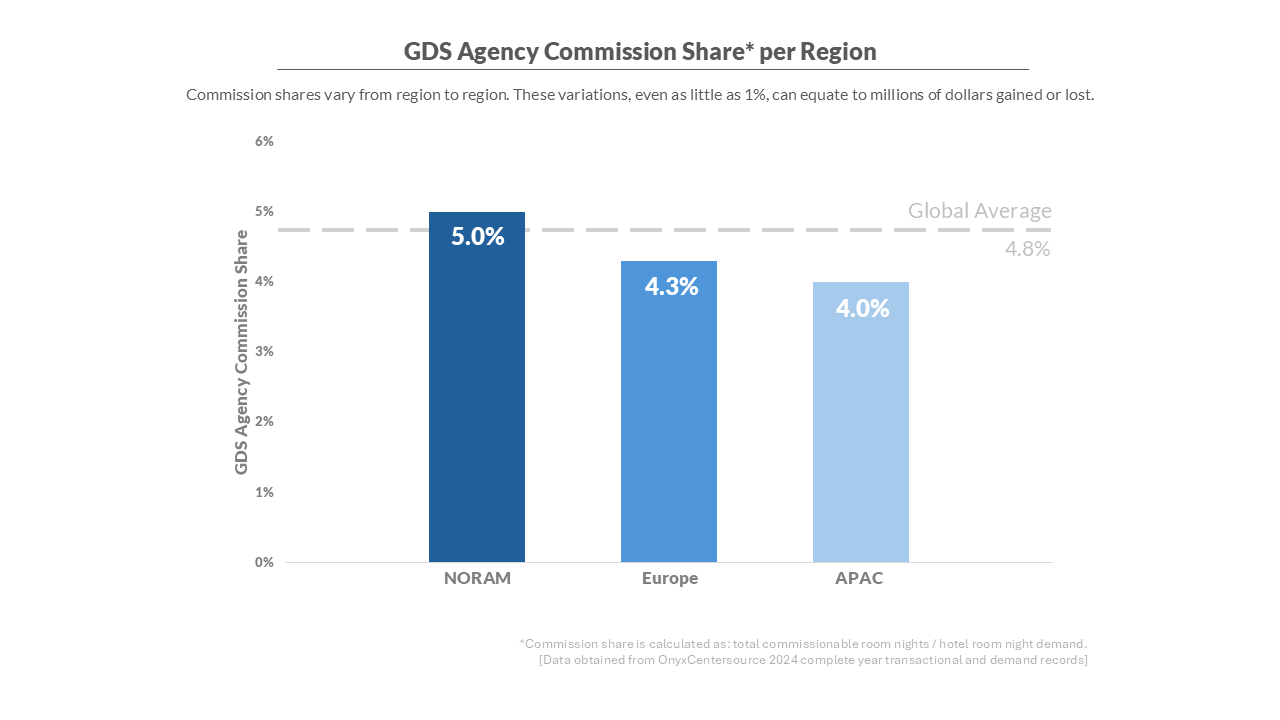

GDS Commissions by Region

- North America (5% GDS commission share) has spent decades wiring corporate travel programs into back‑office systems. TMCs, hotel CRS platforms, and payment providers all have deep links that keep bookings cheap and fast.

- Europe (4.3%) enjoys dense cross‑border business and stringent duty‑of‑care rules, pushing travelers into managed channels. Direct booking campaigns by hotel companies are limiting GDS growth.

- Asia‑Pacific (4% and climbing) currently lags but has significant momentum. Multinational companies are scaling hubs in Singapore, Sydney, and Bangalore; local TMCs are modernizing; and card adoption is broadening, together fueling the steepest year‑over‑year gains globally.

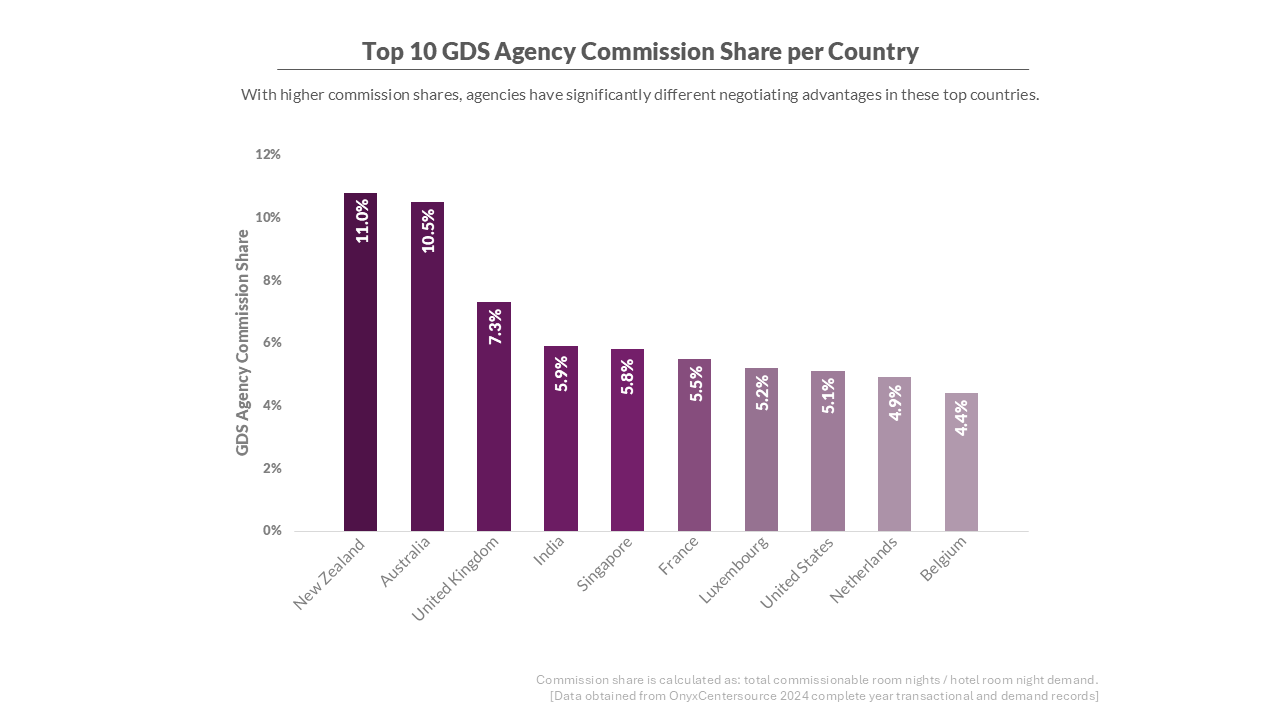

GDS commissions by country: which countries have the highest shares?

- New Zealand (11% GDS commission share) and Australia (10.5%) top the league table, powered by resource‑sector compliance, lengthy domestic flight sectors, and dominant regional TMCs.

- The United States (5.1%) tracks just above the global mean of 4.8%, representing the tug‑of‑war between enormous corporate demand and loyalty‑fueled direct‑booking campaigns.

- Belgium (4.4%) shows how mid‑size economies can under‑index when large corporations negotiate static, direct deals with preferred chains, sidestepping the GDS entirely.

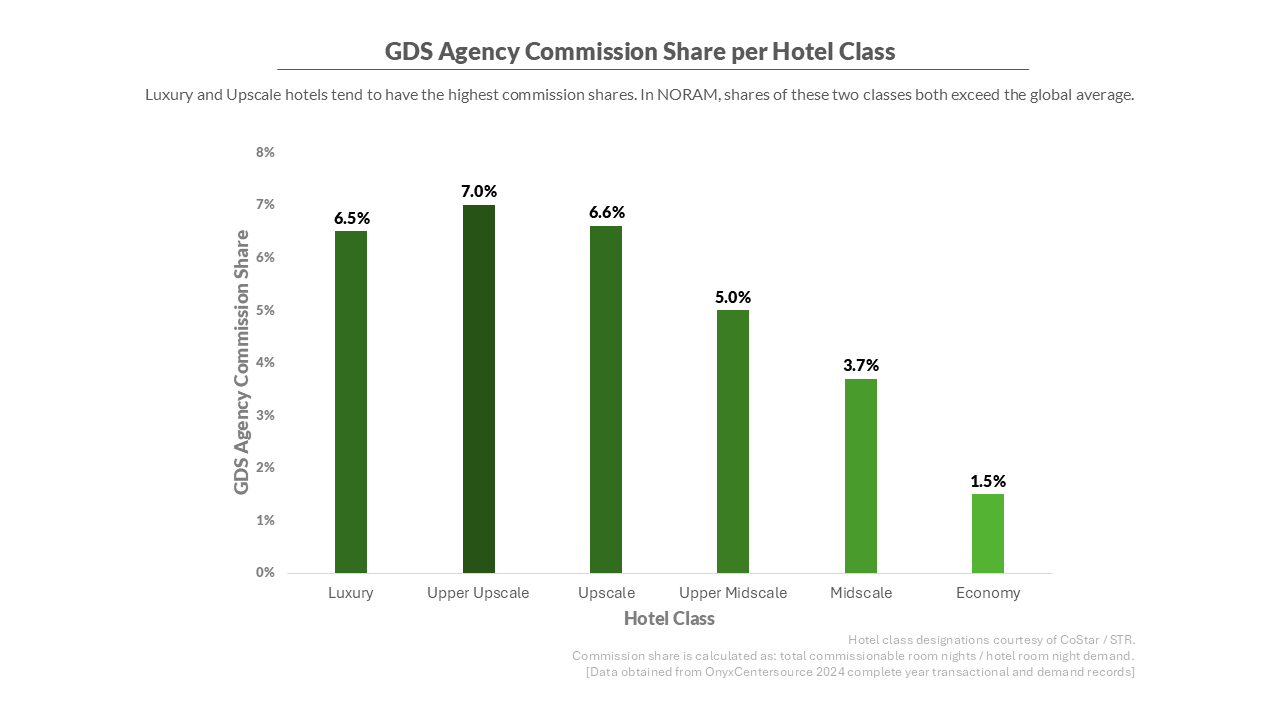

How Room Class Drives GDS Commission Share

- Luxury and upper‑upscale hotels capture 6% to 7% of stays via GDS because they sit at the epicenter of managed‑travel itineraries: meeting space, negotiated last‑room‑available clauses, and premium loyalty tiers.

- The GDS shares of commission for midscale and economy hotels are less than 3%. Their price‑sensitive guests flock to OTAs, metasearch sites, and air‑hotel bundles. Chain scale magnifies the gap: mega‑brands amortize connectivity costs and lock in global preferred suppliers, while independents shoulder higher fees or skip the channel altogether.

Why GDS Commission share Matters

Why is it important to have these small differences, when the GDS/agency commissions are only 5% of all global hotel commissions.

Skift Research says that hotels have been moving towards direct-heavy strategies ever since the internet age. They expect this trend to continue in the coming years. “Hotel Distribution Outlook 2024.”

Skift Research estimated that agency bookings would grow by 125% between now and 2030. Each percentage point of GDS commission represents millions of dollars. This is a lot of money for both hotels and travel agencies.

Part 2: GDS Commission implications at the Property Level

Region, country, and hotel class explain only part of the variance in GDS commission share. The next Data Snap, coming out in July, will zoom into the property level — branded vs. independents, location, hotel persona — and show how hotels are turning hidden white space into high‑margin bookings. Stay tuned.

“The Data Snap” The series is a regular article that gives a better picture of how the hotel booking industry has changed. It empowers both hotels and agents to make informed decisions, which will help them create productive relationships with their partners and increase revenue.

OnyxInsights gives hotels and TMCs a complete view of the landscape in order to better serve clients and partners. Onyx CenterSource handles over 100 millions transactions per year on behalf of 150,000 hotels and 200,000 agencies around the world, which amounts to nearly $2.1 billion. Visit onyxcentersource.com to learn more.

This content has been created by a collaborative effort. Onyx CenterSource Skift’s brand content studio. SkiftX.