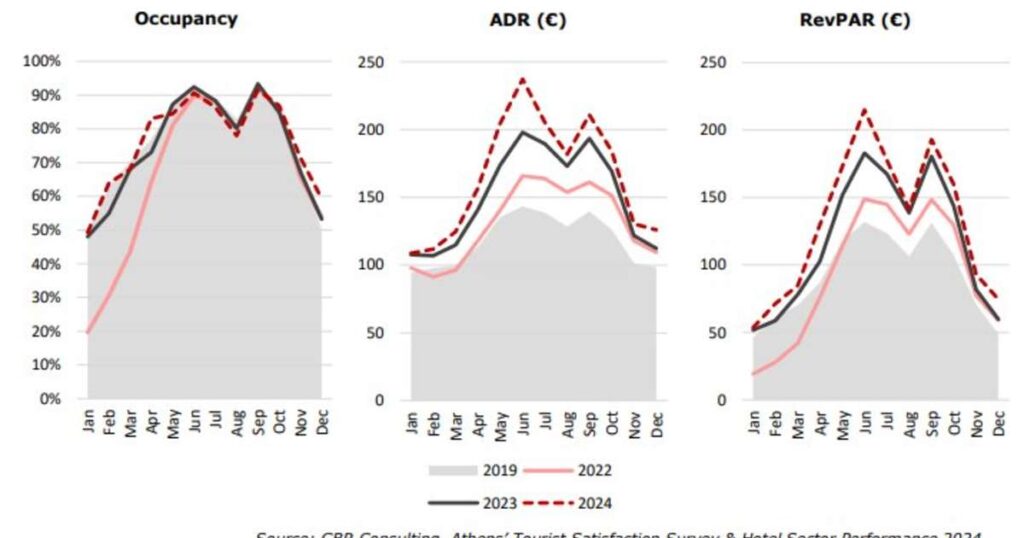

CBRE’s Hotel Investor Intention Survey 2025 ranked Greece 5th as the top investment destination for hotels, thanks to a strong tourism trend and an expanding luxury hotel segment. Greece registered 36.0 million international arrivals in 2024, up from 32.7 million in 2023, a growth of 9.8%, while travel receipts increased to € 20.6 billion in 2024 from € 19.7 billion in 2023 (+4.3%), excluding the cruise sector which contributed € 1.1 billion in 2024, an increase of 31.2% compared to 2023. The number of 5-star hotels and hotel rooms in Greece increased during the period 2019 – 2024 by 37% and 22% respectively and the 4-star sector by 14% and 8% respectively. According to data released in March 2025 by the Research Institute for Tourism indicated that the hotel sector generated an estimated total net revenue of € 11.5 billion in 2024 of which 40% by the 5-star sector and 39% by the 4- star segment. Compared to 2023, revenue at the 4-5-star segments increased by 9.9%, while the 1 – 3-star hotel showed a rise of 5.0%. The 3 – 5-star segments represent 56% of all hotels, 77% of all rooms and 92% of turnover. CBRE’s survey showed that Athens had risen to the 8th position in terms of city destination, reflecting increasing investor interest driven by strong tourism fundamentals as well as an expanding luxury hotel sector.

GBR Consulting It is the leading tourism and hospitality consultancy in Greece. Its experience includes market and financial feasibility studies as well as valuations and development plans for Hotels, Resorts, Spas, Marinas, Casinos & Gaming, Conference Centers & Arenas, Theme Parks, Golf Courses etc. GBR Consulting, the Greek branch of CB Richard Ellis (CBRE Atria), offers a service specialized in Tourism Properties Transactions. GBR Consulting has a database of financial data on over 1,000 hotels in Greece. It also has a datasharing agreement with STR Global – the world’s largest database for hotel operational data.