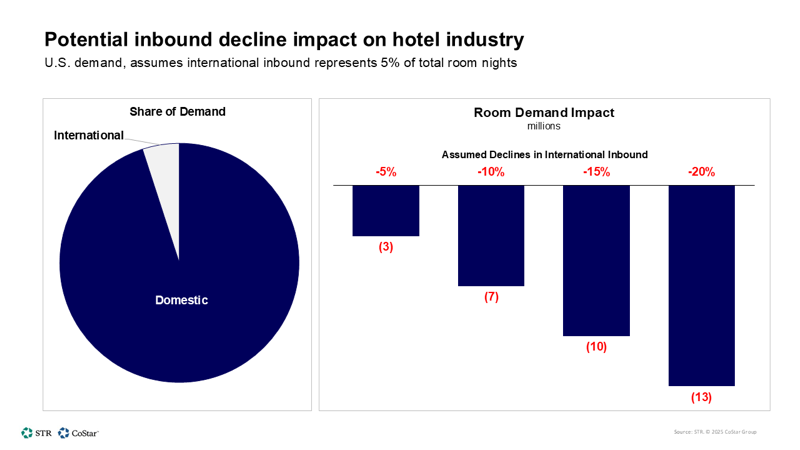

Recent projections by STR Inbound international arrivals in the United States could be on the decline. This decline could have an impact on the U.S. Hotel Industry, as it is estimated that 4-7% of hotel demand comes from international arrivals. A slight decline in demand could be minimal, but a more dramatic drop could have major repercussions. The performance of hotels is affected by a variety of factors including the geopolitical climate and natural disasters.

Analysis of the Impact

Tourism Economics states that international inbound arrivals are responsible for 4-7 percent of total U.S. Hotel demand. The industry could lose up to 3 million room-nights if international inbound fell by 5% during the year. But a steeper fall would be more significant, as a 1% drop in international inbound could reduce the demand for hotel rooms by 654,000 per year.

Recent Performance

Several major demand drivers impacted the industry in the first quarter 2025. The presidential inauguration was one of them, as well as the Super Bowl and College Football Playoff Championship. The Los Angeles wildfires, and the fall 2024 hurricanes played a part. RevPAR ended the first quarter of 2019 with a modest increase of 0.8%.

Future Bookings

Bookings in major U.S. cities for the next months are expected to remain relatively stable. The performance of individual markets varies. D.C. has seen an average decline of around 3 percentages points through June. San Diego, on the other hand, has seen an increase of around 6 percentages points.

Other Indicators

ADR growth is another factor to keep an eye on. Also, TSA screenings and unemployment claims are important. ADR growth was the primary factor driving RevPAR forecasts for this year. A slowdown in ADR could be a sign of market share discounting.

Looking Forward

Industry experts caution against overreaction, and emphasize that it is important to trust data and complete analysis. The NYU IHIF is releasing a revised STR forecast and Tourism Economics in early June.